Business Income Tax Return Form - 2016

ADVERTISEMENT

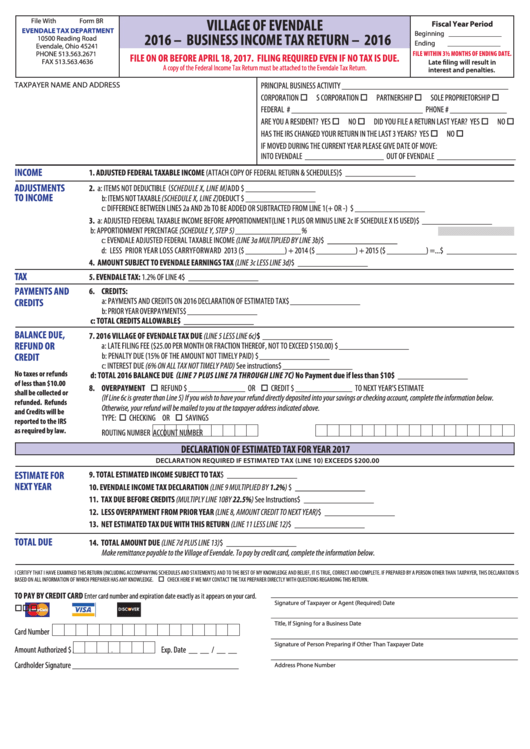

VILLAGE OF EVENDALE

File With

Form BR

Fiscal Year Period

EVENDALE TAX DEPARTMENT

Beginning _______________

2016 – BUSINESS INCOME TAX RETURN – 2016

10500 Reading Road

Ending

_______________

Evendale, Ohio 45241

FILE WITHIN 3½ MONTHS OF ENDING DATE.

PHONE 513.563.2671

FILE ON OR BEFORE APRIL 18, 2017. FILING REQUIRED EVEN IF NO TAX IS DUE.

FAX 513.563.4636

Late filing will result in

A copy of the Federal Income Tax Return must be attached to the Evendale Tax Return.

interest and penalties.

TAXPAYER NAME AND ADDRESS

PRINCIPAL BUSINESS ACTIVITY ______________________________________

CORPORATION S CORPORATION PARTNERSHIP SOLE PROPRIETORSHIP

FEDERAL I.D. # ______________________________ PHONE # _____________

ARE YOU A RESIDENT? YES NO DID YOU FILE A RETURN LAST YEAR? YES NO

HAS THE IRS CHANGED YOUR RETURN IN THE LAST 3 YEARS? YES NO

IF MOVED DURING THE CURRENT YEAR PLEASE GIVE DATE OF MOVE:

INTO EVENDALE __________________ OUT OF EVENDALE __________________

INCOME

1. ADJUSTED FEDERAL TAXABLE INCOME (ATTACH COPY OF FEDERAL RETURN & SCHEDULES) ....................................................... $ ________________

ADJUSTMENTS

2. a: ITEMS NOT DEDUCTIBLE (SCHEDULE X, LINE M) .................................................................... ADD $ ________________

TO INCOME

b: ITEMS NOT TAXABLE (SCHEDULE X, LINE Z) ......................................................................DEDUCT $ ________________

c: DIFFERENCE BETWEEN LINES 2a AND 2b TO BE ADDED OR SUBTRACTED FROM LINE 1 ................................................. (+ OR -) $ ________________

3. a: ADJUSTED FEDERAL TAXABLE INCOME BEFORE APPORTIONMENT(LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE X IS USED) ........ $ ________________

b: APPORTIONMENT PERCENTAGE (SCHEDULE Y, STEP 5) ...................................................................... _______________%

c: EVENDALE ADJUSTED FEDERAL TAXABLE INCOME (LINE 3a MULTIPLIED BY LINE 3b) .................................................................... $ ________________

d: LESS PRIOR YEAR LOSS CARRYFORWARD 2013 ($ _________) + 2014 ($ _________) + 2015 ($ _________) = ... $ ________________

4. AMOUNT SUBJECT TO EVENDALE EARNINGS TAX (LINE 3c LESS LINE 3d) .................................................................................... $ ________________

TAX

5. EVENDALE TAX: 1.2% OF LINE 4 .................................................................................................................................................... $ ________________

PAYMENTS AND

6. CREDITS:

a: PAYMENTS AND CREDITS ON 2016 DECLARATION OF ESTIMATED TAX .............................................. $ ________________

CREDITS

b: PRIOR YEAR OVERPAYMENTS .......................................................................................................... $ ________________

c: TOTAL CREDITS ALLOWABLE ...........................................................................................................................$ ________________

BALANCE DUE,

7. 2016 VILLAGE OF EVENDALE TAX DUE (LINE 5 LESS LINE 6c) .......................................................................................$ ________________

REFUND OR

a: LATE FILING FEE ($25.00 PER MONTH OR FRACTION THEREOF, NOT TO EXCEED $150.00) ................. $ ________________

b: PENALTY DUE (15% OF THE AMOUNT NOT TIMELY PAID) ................................................................ $ ________________

CREDIT

c: INTEREST DUE (6% ON ALL TAX NOT TIMELY PAID) See instructions ................................................. $ ________________

No taxes or refunds

d: TOTAL 2016 BALANCE DUE (LINE 7 PLUS LINE 7A THROUGH LINE 7C) No Payment due if less than $10 .................$ ________________

of less than $10.00

8. OVERPAYMENT REFUND $ _____________ OR CREDIT $ _____________ TO NEXT YEAR’S ESTIMATE

shall be collected or

(If Line 6c is greater than Line 5) If you wish to have your refund directly deposited into your savings or checking account, complete the information below.

refunded. Refunds

Otherwise, your refund will be mailed to you at the taxpayer address indicated above.

and Credits will be

TYPE: CHECKING OR SAVINGS

reported to the IRS

as required by law.

ROUTING NUMBER

ACCOUNT NUMBER

DECLARATION OF ESTIMATED TAX FOR YEAR 2017

DECLARATION REQUIRED IF ESTIMATED TAX (LINE 10) EXCEEDS $200.00

ESTIMATE FOR

9. TOTAL ESTIMATED INCOME SUBJECT TO TAX .............................................................................................................................. $ ________________

NEXT YEAR

10. EVENDALE INCOME TAX DECLARATION (LINE 9 MULTIPLIED BY 1.2%) ........................................................................................ $ ________________

11. TAX DUE BEFORE CREDITS (MULTIPLY LINE 10 BY 22.5%) See Instructions .................................................................................. $ ________________

12. LESS OVERPAYMENT FROM PRIOR YEAR (LINE 8, AMOUNT CREDIT TO NEXT YEAR) ...................................................................... $ ________________

13. NET ESTIMATED TAX DUE WITH THIS RETURN (LINE 11 LESS LINE 12) ........................................................................................ $ ________________

TOTAL DUE

14. TOTAL AMOUNT DUE (LINE 7d PLUS LINE 13) ................................................................................................................................. $ ________________

Make remittance payable to the Village of Evendale. To pay by credit card, complete the information below.

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THIS DECLARATION IS

BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

CHECK HERE IF WE MAY CONTACT THE TAX PREPARER DIRECTLY WITH QUESTIONS REGARDING THIS RETURN.

TO PAY BY CREDIT CARD

______________________________________________________________________

Enter card number and expiration date exactly as it appears on your card.

Signature of Taxpayer or Agent (Required)

Date

______________________________________________________________________

Title, If Signing for a Business

Date

Card Number

______________________________________________________________________

Signature of Person Preparing if Other Than Taxpayer

Date

Amount Authorized $

Exp. Date __ __ / __ __

,

.

______________________________________________________________________

Cardholder Signature ______________________________________

Address

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2