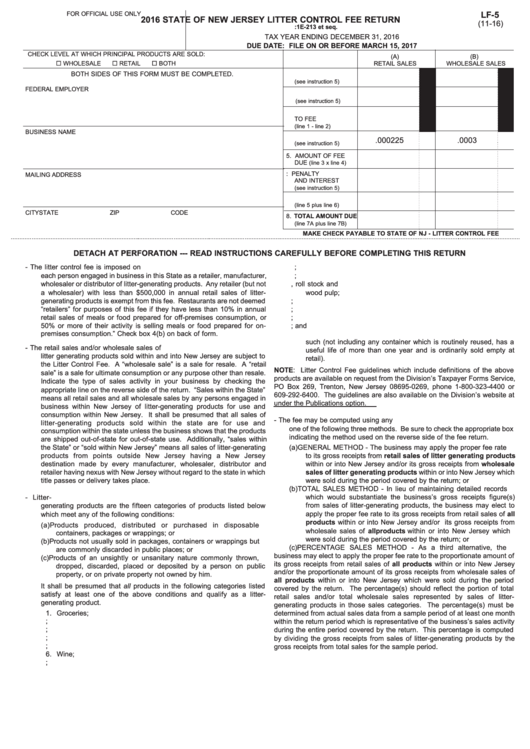

FOR OFFICIAL USE ONLY

LF-5

2016 STATE OF NEW JERSEY LITTER CONTROL FEE RETURN

(11-16)

N.J.S.A. 13:1E-213 et seq.

TAX YEAR ENDING DECEMBER 31, 2016

DUE DATE: FILE ON OR BEFORE MARCH 15, 2017

CHECK LEVEL AT WHICH PRINCIPAL PRODUCTS ARE SOLD:

(A)

(B)

¨ WHOLESALE

¨ RETAIL

¨ BOTH

RETAIL SALES

WHOLESALE SALES

BOTH SIDES OF THIS FORM MUST BE COMPLETED.

1. GROSS RECEIPTS

(see instruction 5)

FEDERAL EMPLOYER I.D.NUMBER_____________________________________________

2. LESS DEDUCTIONS

(see instruction 5)

3. BALANCE SUBJECT

TO FEE

(line 1 - line 2)

BUSINESS NAME

4. FEE RATE

.000225

.0003

(see instruction 5)

5. AMOUNT OF FEE

DUE

(line 3 x line 4)

6. ADD: PENALTY

MAILING ADDRESS

AND INTEREST

(see instruction 5)

7. AMOUNT DUE

(line 5 plus line 6)

CITY

STATE

ZIP CODE

8. TOTAL AMOUNT DUE

(line 7A plus line 7B)

MAKE CHECK PAYABLE TO STATE OF NJ - LITTER CONTROL FEE

DETACH AT PERFORATION --- READ INSTRUCTIONS CAREFULLY BEFORE COMPLETING THIS RETURN

1.

WHO IS SUBJECT TO THE FEE - The litter control fee is imposed on

8. Cigarettes and tobacco products;

each person engaged in business in this State as a retailer, manufacturer,

9. Cleaning agents and toiletries;

wholesaler or distributor of litter-generating products. Any retailer (but not

10. Paper products and household paper except books, roll stock and

a wholesaler) with less than $500,000 in annual retail sales of litter-

wood pulp;

generating products is exempt from this fee. Restaurants are not deemed

11. Newsprint and magazine paper stock;

“retailers” for purposes of this fee if they have less than 10% in annual

12. Motor vehicle tires;

retail sales of meals or food prepared for off-premises consumption, or

13. Glass containers sold as such;

50% or more of their activity is selling meals or food prepared for on-

14. Metal containers sold as such; and

premises consumption.” Check box 4(b) on back of form.

15. Plastic or fiber containers made of synthetic material and sold as

such (not including any container which is routinely reused, has a

2.

SALES SUBJECT TO FEE - The retail sales and/or wholesale sales of

useful life of more than one year and is ordinarily sold empty at

litter generating products sold within and into New Jersey are subject to

retail).

the Litter Control Fee. A “wholesale sale” is a sale for resale. A “retail

NOTE: Litter Control Fee guidelines which include definitions of the above

sale” is a sale for ultimate consumption or any purpose other than resale.

products are available on request from the Division’s Taxpayer Forms Service,

Indicate the type of sales activity in your business by checking the

PO Box 269, Trenton, New Jersey 08695-0269, phone 1-800-323-4400 or

appropriate line on the reverse side of the return. “Sales within the State”

609-292-6400. The guidelines are also available on the Division’s website at

means all retail sales and all wholesale sales by any persons engaged in

under the Publications option.

business within New Jersey of litter-generating products for use and

consumption within New Jersey. It shall be presumed that all sales of

4.

FEE COMPUTATION METHODS - The fee may be computed using any

litter-generating products sold within the state are for use and

one of the following three methods. Be sure to check the appropriate box

consumption within the state unless the business shows that the products

indicating the method used on the reverse side of the fee return.

are shipped out-of-state for out-of-state use. Additionally, “sales within

the State” or “sold within New Jersey” means all sales of litter-generating

(a) GENERAL METHOD - The business may apply the proper fee rate

products from points outside New Jersey having a New Jersey

to its gross receipts from retail sales of litter generating products

destination made by every manufacturer, wholesaler, distributor and

within or into New Jersey and/or its gross receipts from wholesale

sales of litter generating products within or into New Jersey which

retailer having nexus with New Jersey without regard to the state in which

title passes or delivery takes place.

were sold during the period covered by the return; or

(b) TOTAL SALES METHOD - In lieu of maintaining detailed records

3.

LITTER-GENERATING PRODUCTS SUBJECT TO FEE - Litter-

which would substantiate the business’s gross receipts figure(s)

generating products are the fifteen categories of products listed below

from sales of litter-generating products, the business may elect to

which meet any of the following conditions:

apply the proper fee rate to its gross receipts from retail sales of all

products within or into New Jersey and/or its gross receipts from

(a) Products produced, distributed or purchased in disposable

wholesale sales of all products within or into New Jersey which

containers, packages or wrappings; or

were sold during the period covered by the return; or

(b) Products not usually sold in packages, containers or wrappings but

(c)

PERCENTAGE SALES METHOD - As a third alternative, the

are commonly discarded in public places; or

business may elect to apply the proper fee rate to the proportionate amount of

(c) Products of an unsightly or unsanitary nature commonly thrown,

its gross receipts from retail sales of all products within or into New Jersey

dropped, discarded, placed or deposited by a person on public

and/or the proportionate amount of its gross receipts from wholesale sales of

property, or on private property not owned by him.

all products within or into New Jersey which were sold during the period

It shall be presumed that all products in the following categories listed

covered by the return. The percentage(s) should reflect the portion of total

satisfy at least one of the above conditions and qualify as a litter-

retail sales and/or total wholesale sales represented by sales of litter-

generating product.

generating products in those sales categories. The percentage(s) must be

1. Groceries;

determined from actual sales data from a sample period of at least one month

2. Nondrug drugstore sundry products;

within the return period which is representative of the business’s sales activity

3. Food for human or pet consumption;

during the entire period covered by the return. This percentage is computed

4. Soft drinks and carbonated waters;

by dividing the gross receipts from sales of litter-generating products by the

5. Beer and other malt beverages;

gross receipts from total sales for the sample period.

6. Wine;

7. Distilled spirits;

1

1 2

2