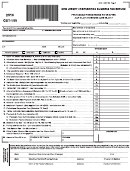

COMPLETE THE FOLLOWING: (Check off all applicable items)

(a) ___ General

(b) ___ Total Sales

(c) ___ Percentage of Sales

1. PRINCIPAL BUSINESS ACTIVITY

4. IF THE BUSINESS IS NOT SUBJECT TO THIS FEE, STATE THE REASON

FOR SUCH CLAIM.

(a) ____ MANUFACTURER (MAKER, FABRICATOR OR PROCESSOR)

(a) ____ THE BUSINESS IS A RETAILER WITH LESS THAN $500,000 IN

ANNUAL RETAIL SALES OF LITTER-GENERATING PRODUCTS.

(b) ____ WHOLESALER OR DISTRIBUTOR (MORE THAN 50% OF TOTAL

SALES ARE WHOLESALE)

(b) ____ THE BUSINESS IS A RESTAURANT WITH LESS THAN 10% IN

ANNUAL RETAIL SALES OF MEALS OR FOOD PREPARED FOR

(c) ____ RETAILER (MORE THAN 50% OF TOTAL SALES ARE RETAIL)

OFF-PREMISES CONSUMPTION, OR 50% OR MORE OF ITS

ACTIVITY IS SELLING MEALS OR FOOD PREPARED FOR ON-

(d) ____ NONE OF THE ABOVE. (IDENTIFY) ___________________

PREMISES CONSUMPTION.

__________________________________________________

(c) ____ THE BUSINESS DOES NOT SELL ANY LITTER-GENERATING

PRODUCTS

2. PRINCIPAL PRODUCT(s) SOLD _______________________________

(d) ____ OTHER (EXPLAIN) __________________________________

3. CHECK FEE COMPUTATION METHOD USED (See Instruction 4)

MAKE CHECK PAYABLE TO: STATE OF NJ - LITTER CONTROL FEE

MAIL RETURN WITH PAYMENT TO: DIVISION OF TAXATION, LITTER CONTROL FEE, REVENUE PROCESSING CENTER, PO BOX 274, TRENTON, NJ 08646-0274.

I SWEAR, VERIFY AND /OR AFFIRM THAT ALL INFORMATION ON THIS RETURN IS CORRECT. I AM AWARE THAT IF ANY OF THE FOREGOING

INFORMATION PROVIDED BY ME IS KNOWINGLY FALSE, I AM SUBJECT TO PUNISHMENT.

____________________ X ______________________________________________________________________________________________________________

(DATE)

(SIGNATURE OF DULY AUTHORIZED OFFICER OF FEE PAYER)

(TITLE)

______________________ X ______________________________________________________________________________________________________________________

(DATE)

(RETURN PREPARER’S SIGNATURE)

(ADDRESS)

(PREPARER’S I.D. NUMBER)

______________________________________________________________________________________________________________________________________________

(NAME OF RETURN PREPARER’S EMPLOYER)

(ADDRESS)

(EMPLOYER’S I.D. NUMBER)

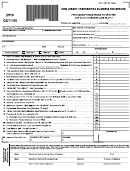

NOTE: For purposes of computing the fee using any of the three

a penalty may be imposed of $100 for each month or fraction

methods indicated, the business may, in lieu of segregating retail sales

thereof the return is delinquent.

2. LATE PAYMENT - 5% of the balance of fee due paid late may

from wholesale sales, compute the fee by applying the wholesale fee

be imposed.

rate (.0003) to the total gross receipts from all sales determined to be

B.

Interest Charge:

subject to the Litter Control Fee.

The annual interest rate is 3% above the average predominant

5.

ITEMIZED INSTRUCTIONS

prime rate. Interest is imposed each month or fraction thereof on

the unpaid balance of fee from the original due date to the date of

LINE 1 - GROSS RECEIPTS OF LITTER GENERATING PRODUCTS:

payment. At the end of each calendar year, any fee, penalties and

Enter the gross receipts (whole dollars only) from retail sales in column

interest remaining due will become part of the balance on which

A and the gross receipts from wholesale sales in column B of litter-

interest will be charged.

generating products sold within or into New Jersey during the period

covered by the return. Gross receipts must be reported on the accrual

NOTE: The average predominant prime rate is the rate as determined

basis and not as collections are made. Refer to instruction 2 regarding

by the Board of Governors of the Federal Reserve System, quoted by

sales subject to the fee.

commercial banks to large businesses on December 1st of the calendar

year immediately preceding the calendar year in which payment was

LINE 2 - DEDUCTIONS: Enter the gross receipts (whole dollars only)

due or as redetermined by the Director in accordance with N.J.S.A.

from sales of litter-generating products which fall into any of the

54:48-2.

following categories:

(a) A sale of a litter-generating product by a wholesaler or distributor to

LINE 7 - AMOUNT DUE: Add Line 5 plus Line 6 for column (A) and/or

another wholesaler or distributor (A wholesaler or distributor is a

column (B).

person primarily making wholesale sales rather than retail sales

and does not include a manufacturer);

LINE 8 - TOTAL AMOUNT DUE: Add Line 7, column (A) plus Line 7,

(b) A sale of a litter-generating product by a company to another

column (B). This is the amount which you must remit with your return.

company owned wholly by the same individuals or companies; and

(c)

A sale of a litter-generating product by a wholesaler or distributor

6.

FILING REQUIREMENTS

owned cooperatively by retailers to those retailers.

(a) Each business subject to the Litter Control Fee must file an annual

LINE 3 - BALANCE SUBJECT TO FEE: Subtract Line 2 from Line 1

fee return on or before March 15 of each year for the preceding

and enter on Line 3.

calendar year’s fee liability.

(b) The return must be signed by an officer of the fee payer authorized

LINE 4 - FEE RATE: Gross receipts from retail sales of litter-generating

to act to the effect that the statements contained therein are true.

products sold within or into New Jersey are subject to the fee at the rate

Return preparers who fail to sign the return or provide their

of 2.25/100 of 1% (.000225). Gross receipts from wholesale sales of

assigned tax ID# shall be liable for a $25 penalty for each such

litter-generating products sold within or into New Jersey are subject to

failure.

the fee at the rate of 3/100 of 1% (.0003).

(c)

All records and other supporting documents which are used in

completing this return must be retained and made available for

LINE 5 - AMOUNT OF FEE DUE: Multiply Line 3 by Line 4 in column

examination for at least 5 years following the filing of this return.

(A) and/or column (B) to compute the fee due.

7.

ELECTRONIC FUNDS TRANSFERS - The Division of Revenue and

LINE 6 - ADD: PENALTY AND INTEREST - Failure of any business to

Enterprise Services has established procedures to allow the remittance

file a Litter Control Fee return by the due date and/or failure to make

of tax payments through Electronic Funds Transfer (EFT). Taxpayers

remittance for the fee due by said date will subject the business to

with a prior year’s liability of $10,000 or more in any one tax are required

penalty and interest charges as follows:

to remit all tax payments using EFT.

If you have any questions

concerning the EFT program, call 609-292-9292, Option #6 or write to

A.

Penalty Charges:

N.J. Division of Revenue and Enterprise Services, EFT Section, PO Box

1. LATE FILING - 5% per month or fraction thereof of the

191, Trenton, NJ 08646-0191.

underpayment not to exceed 25% of such underpayment. Also,

1

1 2

2