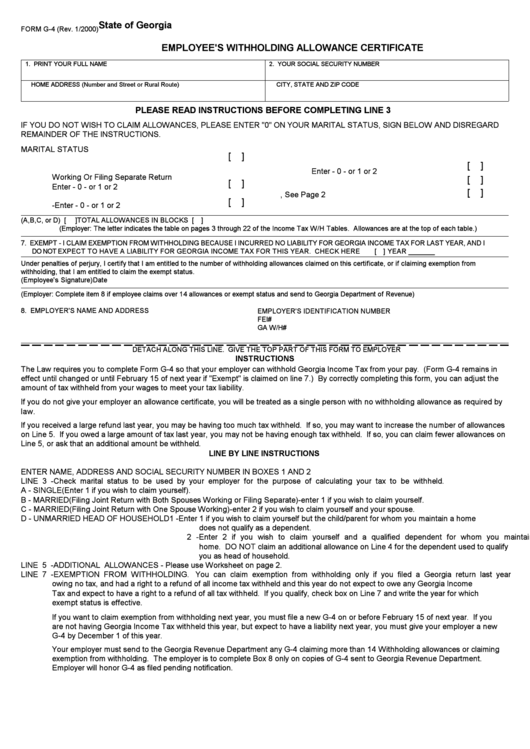

Form G-4 - Employee'S Withholding Allowance Certificate January 2000

ADVERTISEMENT

State of Georgia

FORM G-4 (Rev. 1/2000)

EMPLOYEE'S WITHHOLDING ALLOWANCE CERTIFICATE

1. PRINT YOUR FULL NAME

2. YOUR SOCIAL SECURITY NUMBER

HOME ADDRESS (Number and Street or Rural Route)

CITY, STATE AND ZIP CODE

PLEASE READ INSTRUCTIONS BEFORE COMPLETING LINE 3

IF YOU DO NOT WISH TO CLAIM ALLOWANCES, PLEASE ENTER "0" ON YOUR MARITAL STATUS, SIGN BELOW AND DISREGARD

REMAINDER OF THE INSTRUCTIONS.

MARITAL STATUS

[

]

3.

A. Single - enter - 0 - or 1

D. Unmarried Head of Household

[

]

B. Married Filing Joint Return Both Spouses

Enter - 0 - or 1 or 2

Working Or Filing Separate Return

[

]

[

]

4.

Dependents - Enter Number

Enter - 0 - or 1 or 2

[

]

5.

Additional Allowances, See Page 2

C. Married-Filing Joint Return One Spouse Working

[

]

-Enter - 0 - or 1 or 2

6.

LETTER USED (A,B,C, or D) [

]

TOTAL ALLOWANCES IN BLOCKS [ ]

(Employer: The letter indicates the table on pages 3 through 22 of the Income Tax W/H Tables. Allowances are at the top of each table.)

7. EXEMPT - I CLAIM EXEMPTION FROM WITHHOLDING BECAUSE I INCURRED NO LIABILITY FOR GEORGIA INCOME TAX FOR LAST YEAR, AND I

DO NOT EXPECT TO HAVE A LIABILITY FOR GEORGIA INCOME TAX FOR THIS YEAR. CHECK HERE

[

] YEAR _______

Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate, or if claiming exemption from

withholding, that I am entitled to claim the exempt status.

(Employee's Signature)

Date

(Employer: Complete item 8 if employee claims over 14 allowances or exempt status and send to Georgia Department of Revenue)

8. EMPLOYER'S NAME AND ADDRESS

EMPLOYER'S IDENTIFICATION NUMBER

FEI#

GA W/H#

DETACH ALONG THIS LINE. GIVE THE TOP PART OF THIS FORM TO EMPLOYER

INSTRUCTIONS

The Law requires you to complete Form G-4 so that your employer can withhold Georgia Income Tax from your pay. (Form G-4 remains in

effect until changed or until February 15 of next year if "Exempt" is claimed on line 7.) By correctly completing this form, you can adjust the

amount of tax withheld from your wages to meet your tax liability.

If you do not give your employer an allowance certificate, you will be treated as a single person with no withholding allowance as required by

law.

If you received a large refund last year, you may be having too much tax withheld. If so, you may want to increase the number of allowances

on Line 5. If you owed a large amount of tax last year, you may not be having enough tax withheld. If so, you can claim fewer allowances on

Line 5, or ask that an additional amount be withheld.

LINE BY LINE INSTRUCTIONS

ENTER NAME, ADDRESS AND SOCIAL SECURITY NUMBER IN BOXES 1 AND 2

LINE 3 - Check marital status to be used by your employer for the purpose of calculating your tax to be withheld.

A - SINGLE

(Enter 1 if you wish to claim yourself).

B - MARRIED

(Filing Joint Return with Both Spouses Working or Filing Separate)-enter 1 if you wish to claim yourself.

C - MARRIED

(Filing Joint Return with One Spouse Working)-enter 2 if you wish to claim yourself and your spouse.

D - UNMARRIED HEAD OF HOUSEHOLD

1 - Enter 1 if you wish to claim yourself but the child/parent for whom you maintain a home

does not qualify as a dependent.

2 - Enter 2 if you wish to claim yourself and a qualified dependent for whom you maintain a

home. DO NOT claim an additional allowance on Line 4 for the dependent used to qualify

you as head of household.

LINE 5 - ADDITIONAL ALLOWANCES - Please use Worksheet on page 2.

LINE 7 - EXEMPTION FROM WITHHOLDING. You can claim exemption from withholding only if you filed a Georgia return last year

owing no tax, and had a right to a refund of all income tax withheld and this year do not expect to owe any Georgia Income

Tax and expect to have a right to a refund of all tax withheld. If you qualify, check box on Line 7 and write the year for which

exempt status is effective.

If you want to claim exemption from withholding next year, you must file a new G-4 on or before February 15 of next year. If you

are not having Georgia Income Tax withheld this year, but expect to have a liability next year, you must give your employer a new

G-4 by December 1 of this year.

Your employer must send to the Georgia Revenue Department any G-4 claiming more than 14 Withholding allowances or claiming

exemption from withholding. The employer is to complete Box 8 only on copies of G-4 sent to Georgia Revenue Department.

Employer will honor G-4 as filed pending notification.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2