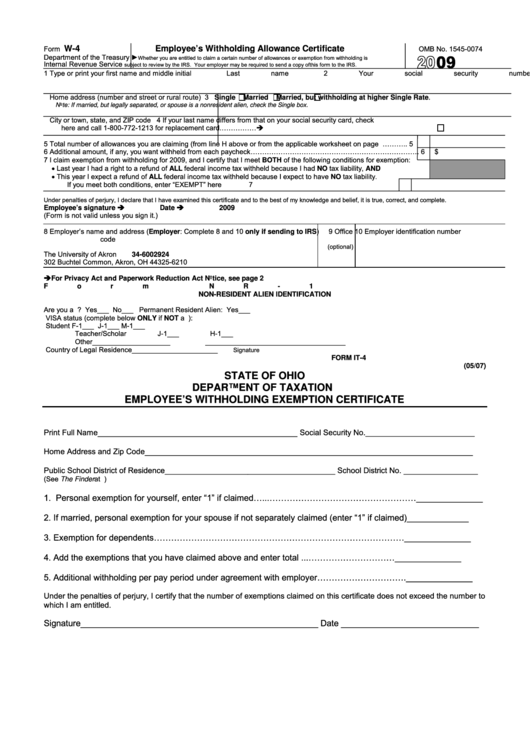

Form W-4 - Employee'S Withholding Allowance Certificate - 2009, Ohio Form It-4 - Employee'S Withholding Exemption Certificate

ADVERTISEMENT

Form

W-4

Employee’s Withholding Allowance Certificate

OMB No. 1545-0074

Department of the Treasury

►

Whether you are entitled to claim a certain number of allowances or exemption from withholding is

Internal Revenue Service

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

1 Type or print your first name and middle initial

Last name

2 Your social security number

Home address (number and street or rural route)

3

Single

Married

Married, but withholding at higher Single Rate.

Note: If married, but legally separated, or spouse is a nonresident alien, check the Single box.

City or town, state, and ZIP code

4 If your last name differs from that on your social security card, check

here and call 1-800-772-1213 for replacement card.……………

5 Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2.......……….. 5

6 Additional amount, if any, you want withheld from each paycheck………………………………………………………………. 6

$

7 I claim exemption from withholding for 2009, and I certify that I meet BOTH of the following conditions for exemption:

•

Last year I had a right to a refund of ALL federal income tax withheld because I had NO tax liability, AND

•

This year I expect a refund of ALL federal income tax withheld because I expect to have NO tax liability.

If you meet both conditions, enter “EXEMPT” here

7

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

Date

2009

(Form is not valid unless you sign it.)

8 Employer’s name and address (Employer: Complete 8 and 10 only if sending to IRS)

9 Office 10 Employer identification number

code

(optional)

The University of Akron

34-6002924

302 Buchtel Common, Akron, OH 44325-6210

For Privacy Act and Paperwork Reduction Act Notice, see page 2

Form NR-1

NON-RESIDENT ALIEN IDENTIFICATION

Are you a U.S. citizen? Yes___ No___

Permanent Resident Alien: Yes___

VISA status (complete below ONLY if NOT a U.S. citizen):

Student F-1___ J-1___ M-1___

Teacher/Scholar J-1___ H-1___

Other____________________

____________________________________

Country of Legal Residence______________________

Signature

FORM IT-4

(05/07)

STATE OF OHIO

DEPARTMENT OF TAXATION

EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE

__________________________________________

Print Full Name

Social Security No._________________________

_____________________________________________________________________

Home Address and Zip Code

Public School District of Residence_______________________________________ School District No. _________________

(See The Finder at tax.ohio.gov.)

1. Personal exemption for yourself, enter “1” if claimed…...……………………………………………______________

2. If married, personal exemption for your spouse if not separately claimed (enter “1” if claimed)_____________

3. Exemption for dependents……………………………………………………………………………______________

4. Add the exemptions that you have claimed above and enter total ...…………………………______________

5. Additional withholding per pay period under agreement with employer………………………….______________

Under the penalties of perjury, I certify that the number of exemptions claimed on this certificate does not exceed the number to

which I am entitled.

Signature__________________________________________________ Date _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1