632, Page 4

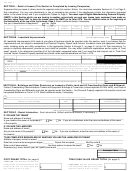

SECTION L - Detail of Leases (This Section is Completed by Leasing Companies)

Equipment that you lease to others should be reported under this section. Notice: You must also complete Sections A - F on Page 2.

See instructions. You may use attachments in lieu of completing this section if the attachments contain the information requested

below, in the same format, and if you complete the Tables on Page 2. You must report Eligible Manufacturing Personal Property

(EMPP) in this Section which you are leasing to another, unless both you and your lessee (your customer) have made an

election, using Form 5467, to have the lessee report the EMPP on its Form 5278. See the detailed notice at the beginning of

the Instructions, at the top of the first column, Page 5. Attach additional sheets, if necessary.

Are you a manufacturer of equipment?

Yes

No

Location of

Type of

Lease

Monthly

1st Year

Manufacturer

Original

Lease No.

Name & Address of Lessee

Equipment

Equipment

Period (Mo.)

Rental

in Service

Cost

Selling Price

Total Original Selling Price

SECTION M - Leasehold Improvements

All Leasehold Improvements (LHI) made at your place of business should be reported under this section, even if you believe that the

improvements are not subject to assessment as Personal Property. Report trade fixtures, foundation costs and equipment installation

costs, including wiring and utility connections, in the appropriate Section A through F, on page 2, not as LHI. See instructions. To

prevent a duplicate assessment, provide as much detail as possible. You may attach additional explanations and/or copies of "fixed

asset" records, if the attachment provides all of the information requested below and if you insert the total original cost in "Total Cost

Incurred" below. Personal Property reported here should not be reported elsewhere on Form L-4175.

STC

True Cash Value

Year Installed

Description (Describe in detail)

Original Cost

Multiplier

Assessor's Calculation

2016

Notice: 2016 installations must be reported above. Installations of LHI prior to 2016 are reported in this section, below this notice. The State Tax

Commission has directed that commencing in 2017 all Leasehold improvement installations in 2016, or later, must be valued as improvements made

to the leased real property. Trade fixtures and installation costs for equipment, must be reported on page 2, regardless of the date of installation.

Assessor: Do not assess 2016 installations as personal property except where the lease is a pre-1984 lease.

Total Cost Incurred (including 2016)

M1

M2

SECTION N - Buildings and Other Structures on Leased or Public Land and All Freestanding Signs and Billboards

Costs of Freestanding Communications Towers and Equipment Buildings at Tower sites (unless reported on Form 4452), and Costs of

Freestanding Signs and Billboards must also be reported under this Section. Any Personal Property reported in this section should not

be reported elsewhere on Form L-4175. Attach additional sheets, if necessary.

Check this box if you believe that these structures are already assessed as part of the real property.

Year Originally

Total Capitalized

True Cash Value

*

Address or Location of Building

Built

Cost

Assessor's Calculation

N1

N2

Total Capitalized Cost

SECTION O - Rental Information. See Instructions. (Attach additional sheets, if necessary.)

IF YOU ARE THE TENANT

Name and address of landlord __________________________________________________________________________________

Is your landlord the owner of the property?

Yes

No

If you are a sublessee, enter the name and address of the owner

of the property _______________________________________________________________________________________________

IF YOU ARE THE LANDLORD

Name and address of tenant ___________________________________________________________________________________

Are you the owner of the property?

Yes

No

If you are a sublessor, enter the name and address of the owner of

the property ________________________________________________________________________________________________

TO BE COMPLETED REGARDLESS OF WHETHER YOU ARE THE LANDLORD OR TENANT

Address of property rented or leased ____________________________________________________________________________

Date that current rental arrangement began:_________. Square feet occupied:_________ Monthly rental $____________________

Date current lease expires:________________. Are there options to renew the lease?

Yes

No

Expenses (e.g. taxes, electric, gas, etc.) paid by the tenant ___________________________________________________________

Assessor Value

O2

COST GRAND TOTAL (for page 4)

TRUE CASH VALUE GRAND TOTAL (for page 4)

TAXPAYER: Add Total Cost Incurred from

Section M and Total Capitalized Cost from

ASSESSOR: Add True Cash Value totals

Section N (M1 and N1). Enter grand total

from Sections M-O (M2-O2). Enter grand

$

$

here and carry to line 11a, page 1.

total here and carry to line 11b, page 1.

1

1 2

2 3

3 4

4