Declaration Of Estimated Tax - City Of Green Division Of Taxation

ADVERTISEMENT

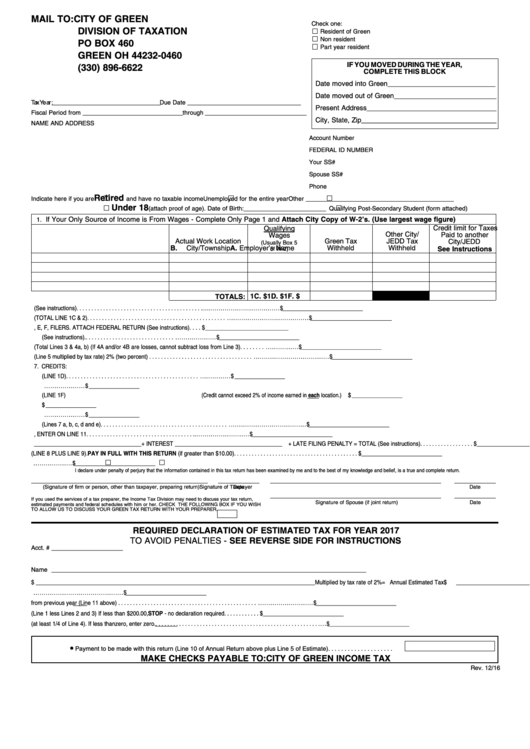

MAIL TO: CITY OF GREEN

Check one:

DIVISION OF TAXATION

Resident of Green

Non resident

PO BOX 460

Part year resident

GREEN OH 44232-0460

IF YOU MOVED DURING THE YEAR,

(330) 896-6622

COMPLETE THIS BLOCK

Date moved into Green _______________________________________

Date moved out of Green_____________________________________

Tax Year: _____________________________________________ Due Date _______________________________________________

Present Address_______________________________________________

Fiscal Period from _________________________________________ through __________________________________________

City, State, Zip _________________________________________________

NAME AND ADDRESS

Account Number

FEDERAL ID NUMBER

Your SS#

Spouse SS#

Phone

Retired

Indicate here if you are

and have no taxable income

Unemployed for the entire year

Other _____________________________________________________________

Under 18

(attach proof of age). Date of Birth: __________________________________

Qualifying Post-Secondary Student (form attached)

If Your Only Source of Income is From Wages - Complete Only Page 1 and Attach City Copy of W-2’s. (Use largest wage figure)

1.

Credit limit for Taxes

Qualifying

Other City/

Paid to another

Wages

Actual Work Location

Green Tax

JEDD Tax

City/JEDD

(Usually Box 5

A. Employer’s Name

B.

City/Township

C.

D.

Withheld

E.

Withheld

F.

See Instructions

of W-2)

TOTALS:

1C. $

1D. $

1F. $

2. OTHER TAXABLE INCOME (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

3. TOTAL INCOME (TOTAL LINE 1C & 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

4. A. NET PROFIT FROM BUSINESS FROM PAGE 2. ALSO NON-RESIDENT C, E, F, FILERS. ATTACH FEDERAL RETURN (See instructions). . . .

$

_____________________________________

B. GREEN RESIDENT INDIVIDUAL BUSINESS INCOME/LOSS. (See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

5. MUNICIPAL TAXABLE INCOME (Total Lines 3 & 4a, b) (If 4A and/or 4B are losses, cannot subtract loss from Line 3) . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

6. TAX DUE (Line 5 multiplied by tax rate) 2% (two percent) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

7. CREDITS:

A. CITY OF GREEN TAX WITHHELD (LINE 1D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _______________________

B. ESTIMATE PAYMENTS MADE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _______________________

C. CREDIT LIMIT FOR OTHER CITY/JEDD TAX PAID (LINE 1F) (Credit cannot exceed 2% of income earned in each location.)

$ _______________________

D. CREDIT FROM RESIDENT INDIVIDUAL BUSINESS INCOME WORKSHEET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _______________________

E. CREDIT FROM PRIOR YEAR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _______________________

F. TOTAL CREDITS (Lines 7 a, b, c, d and e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

8. BALANCE OF TAX DUE. IF OVERPAYMENT, ENTER ON LINE 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

9. LATE PAYMENT PENALTY_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ + INTEREST _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ + LATE FILING PENALTY = TOTAL (See instructions) . . . . . . . . . . . . . . . . . .

$

_____________________________________

10. BALANCE (LINE 8 PLUS LINE 9). PAY IN FULL WITH THIS RETURN (if greater than $10.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

11. OVERPAYMENT TO BE

REFUNDED OR

CREDITED TO NEXT YEAR. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

I declare under penalty of perjury that the information contained in this tax return has been examined by me and to the best of my knowledge and belief, is a true and complete return.

(Signature of firm or person, other than taxpayer, preparing return)

Date

Signature of Taxpayer

Date

If you used the services of a tax preparer, the Income Tax Division may need to discuss your tax return,

Signature of Spouse (if joint return)

Date

estimated payments and federal schedules with him or her. CHECK THE FOLLOWING BOX IF YOU WISH

TO ALLOW US TO DISCUSS YOUR GREEN TAX RETURN WITH YOUR PREPARER.

REQUIRED DECLARATION OF ESTIMATED TAX FOR YEAR 2017

TO AVOID PENALTIES - SEE REVERSE SIDE FOR INSTRUCTIONS

Acct. # _____________________________

Name ___________________________________________________________________________________________________________________________________

1. Annual estimated income $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Multiplied by tax rate of 2% = Annual Estimated Tax

$

_____________________________________

2. Credit for City or JEDD taxes withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

3. Overpayment Credit from previous year (Line 11 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

4. Annual Estimate After Credit Carry Forward and W/H (Line 1 less Lines 2 and 3) If less than $200.00, STOP - no declaration required . . . . . . . . . . . .

$

_____________________________________

5. First Quarter Payment (at least 1/4 of Line 4). If less than zero, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_____________________________________

•

Payment to be made with this return (Line 10 of Annual Return above plus Line 5 of Estimate) . . . . . . . . . . . . . . . . . . . .

MAKE CHECKS PAYABLE TO: CITY OF GREEN INCOME TAX

Rev. 12/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2