Declaration Of Estimated Tax - City Of Green Division Of Taxation Page 2

ADVERTISEMENT

Ohio House Bill 5 mandated extensive changes to Ohio Revised Code Section 718 (Ohio municipal income tax law) beginning with tax

year 2016. The amended version of ORC 718 can be found at

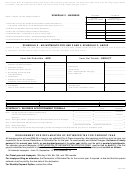

SCHEDULE C - BUSINESS

COLUMN A

COLUMN B

NOTE - If Column A is used, disregard Column B

OR

ACTUAL —

ALLOCATED —

TAXABLE TO GREEN

TAXABLE TO GREEN

$

$

1. Net Profit or Loss per your Federal Income Tax Return (attach Federal Return) . . . . . . . . . . . . . . . . . . . . . . .

(1120 Line 28; 1120S Sch K Line 18; 1065 Analysis of Net Income (Loss) Line 1)

2. Add items not deductible under Tax Ordinance (Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Deduct items not taxable under Tax Ordinance (Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Adjusted Net Profit - If using column A, enter on Line 4A Page 1

$

5. Business Apportionment Formula - Average Percentage (Schedule Y). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Apportioned Net Profits - Multiply Line 4B by Line 5 - Enter on Line 4A Page 1 . . . . . . . . . . . . . . . . . . . . . . .

$

SCHEDULE X - ADJUSTMENTS FOR LINE 2 AND 3, SCHEDULE C, ABOVE

Applies to 1120, 1120S and 1065 filers. Excluding Schedule C, E, and F filers, taxable income shall be computed as if the taxpayer is a

C corporation. Include Federal return to support your income calculation. See ORC 718.01.

Items Not Deductible - ADD

Items Not Taxable - DEDUCT

a. Withdrawal by proprietor or partners, if

$

included in any expense accounts. . . . . . . . . . . .

___________________________________

$

h. Capital Gains . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___________________________________

b. Payments to partners. . . . . . . . . . . . . . . . . . . . . .

___________________________________

i. Interest Income . . . . . . . . . . . . . . . . . . . . . . . . . .

___________________________________

c. All income taxes paid or accrued . . . . . . . . . . . .

___________________________________

j. Other - attach explanation citing legal

d. Net operating loss carry-forward,

basis for deduction. . . . . . . . . . . . . . . . . . . . . . . .

___________________________________

from Federal Return. . . . . . . . . . . . . . . . . . . . . . .

___________________________________

e. Capital losses . . . . . . . . . . . . . . . . . . . . . . . . . . .

___________________________________

f. Expenses incurred in the production of

non-taxable income (at least 5% of line 2) . . . . .

___________________________________

g. Total Additions

2. Total Deductions

(enter on Line 2, Schedule C above). . . . . . . . . .

$

(enter on Line 3, Schedule C, above) . . . . . . . . .

$

Were there any employees that you leased, during the year covered by this return? ______ YES

______ NO If YES, how many?

NAME OF LEASING COMPANY

MAILING ADDRESS, CONTACT, TELEPHONE NUMBER

FEDERAL EIN

Located

Located in

SCHEDULE Y - BUSINESS APPORTIONMENT FORMULA

Everywhere

Green

Percentage

$ ___________________________

$ ___________________________

xxxxxxxxx

Step 1. Average original cost of real and tangible property . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________________

$ ___________________________

xxxxxxxxx

Gross annual rentals multiplied by 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________________

$ ___________________________

________________ %

Total Step 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________________

$ ___________________________

________________ %

Step 2. Total wages, salaries, commissions and other compensation paid to all employees. . . .

$ ___________________________

$ ___________________________

________________ %

Step. 3 Gross receipts from sales and work or services performed . . . . . . . . . . . . . . . . . . . . . . .

xxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxx

________________ %

Step 4. Total of percentages

Step 5. Average percentage (Divide total percentages by number of percentages used.) Enter here and carry to Line 5 - Schedule C, above.

. . .

________________ %

REQUIREMENT FOR DECLARATION OF ESTIMATED TAX FOR CURRENT YEAR

All taxpayers who will owe $200.00 or more in non-withheld City of Green income tax, after applying credit from prior tax year, are

required to file an Annual Declaration of Estimated Tax for the year. To avoid penalty and interest charges, the lower of ninety

percent of the current year liability or one hundred percent of the prior year liability must be paid in quarterly installments.

For calendar year-end taxpayers, a DECLARATION OF ESTIMATED TAX FOR THE YEAR must be filed by April 15. (The first

quarter estimated tax payment is due at this time.) The remaining estimates will be billed quarterly and are due as follows:

All calendar taxpayers - June 15, September 15, and December 15.

For Fiscal year end taxpayers: 15th day of 4th, 6th, 9th, and 12th months.

For taxpayers filing an extension, the Declaration of Estimated Tax for the current year, if required, is due and the first quarter

estimate must be paid by the due date of the declaration.

For Monthly Payment Option, contact this office.

Rev. 12/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2