Declaration Of Estimated Tax Form - 2017

ADVERTISEMENT

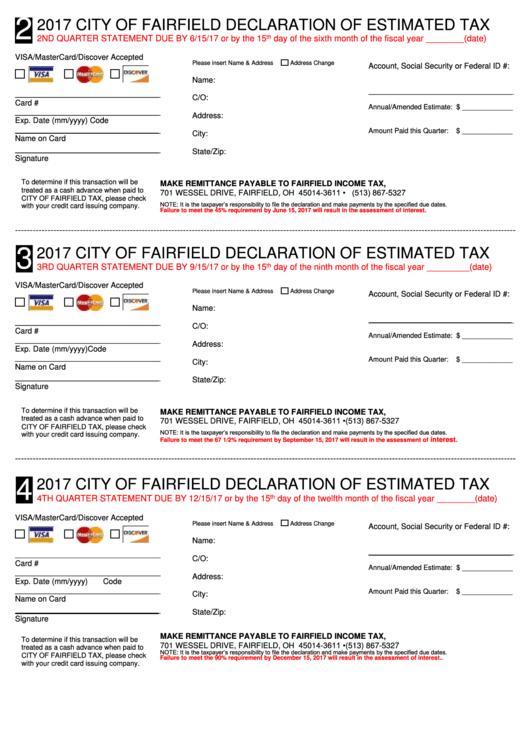

2

2017 CITY OF FAIRFIELD DECLARATION OF ESTIMATED TAX

2ND QUARTER STATEMENT DUE BY 6/15/17 or by the 15

th

day of the sixth month of the fiscal year ________(date)

VISA/MasterCard/Discover Accepted

Please insert Name & Address

Address Change

Account, Social Security or Federal ID #:

Name:

_________________________________

_________________________________

C/O:

Card #

Annual/Amended Estimate: $ _____________

_________________________________

Address:

Exp. Date (mm/yyyy)

Code

_________________________________

Amount Paid this Quarter:

$ _____________

City:

Name on Card

_________________________________

State/Zip:

Signature

To determine if this transaction will be

MAKE REMITTANCE PAYABLE TO FAIRFIELD INCOME TAX,

treated as a cash advance when paid to

701 WESSEL DRIVE, FAIRFIELD, OH 45014-3611 • (513) 867-5327

CITY OF FAIRFIELD TAX, please check

NOTE: It is the taxpayer’s responsibility to file the declaration and make payments by the specified due dates.

with your credit card issuing company.

Failure to meet the 45% requirement by June 15, 2017 will result in the assessment of interest.

----------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------

3

2017 CITY OF FAIRFIELD DECLARATION OF ESTIMATED TAX

th

3RD QUARTER STATEMENT DUE BY 9/15/17 or by the 15

day of the ninth month of the fiscal year _________(date)

VISA/MasterCard/Discover Accepted

Please insert Name & Address

Address Change

Account, Social Security or Federal ID #:

Name:

_________________________________

_________________________________

C/O:

Card #

Annual/Amended Estimate: $ _____________

_________________________________

Address:

Exp. Date (mm/yyyy)

Code

_________________________________

Amount Paid this Quarter:

$ _____________

City:

Name on Card

_________________________________

State/Zip:

Signature

To determine if this transaction will be

MAKE REMITTANCE PAYABLE TO FAIRFIELD INCOME TAX,

treated as a cash advance when paid to

701 WESSEL DRIVE, FAIRFIELD, OH 45014-3611 • (513) 867-5327

CITY OF FAIRFIELD TAX, please check

NOTE: It is the taxpayer’s responsibility to file the declaration and make payments by the specified due dates.

with your credit card issuing company.

interest.

Failure to meet the 67 1/2% requirement by September 15, 2017 will result in the assessment of

----------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------

2017 CITY OF FAIRFIELD DECLARATION OF ESTIMATED TAX

4

th

4TH QUARTER STATEMENT DUE BY 12/15/17 or by the 15

day of the twelfth month of the fiscal year ________(date)

VISA/MasterCard/Discover Accepted

Please insert Name & Address

Address Change

Account, Social Security or Federal ID #:

Name:

_________________________________

_________________________________

C/O:

Card #

Annual/Amended Estimate: $ _____________

_________________________________

Address:

Exp. Date (mm/yyyy)

Code

_________________________________

Amount Paid this Quarter:

$ _____________

City:

Name on Card

_________________________________

State/Zip:

Signature

MAKE REMITTANCE PAYABLE TO FAIRFIELD INCOME TAX,

To determine if this transaction will be

701 WESSEL DRIVE, FAIRFIELD, OH 45014-3611 • (513) 867-5327

treated as a cash advance when paid to

NOTE: It is the taxpayer’s responsibility to file the declaration and make payments by the specified due dates.

CITY OF FAIRFIELD TAX, please check

Failure to meet the 90% requirement by December 15, 2017 will result in the assessment of interest..

with your credit card issuing company.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1