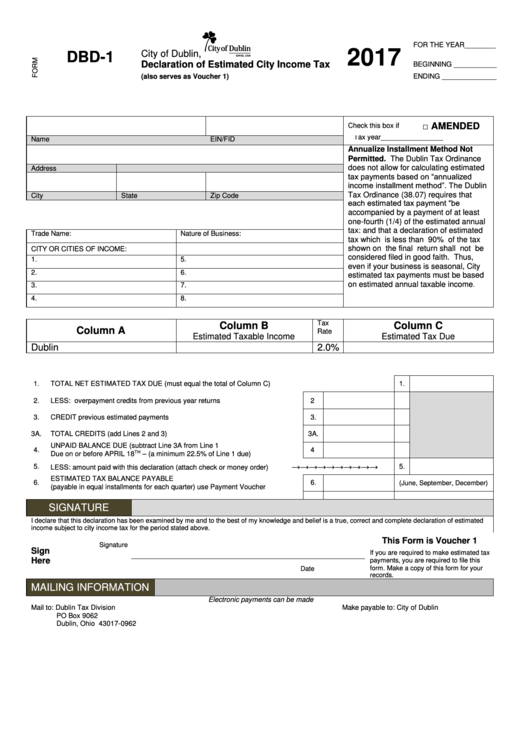

FOR THE YEAR________

2017

City of Dublin,

DBD-1

Declaration of Estimated City Income Tax

BEGINNING ___________

(also serves as Voucher 1)

ENDING ______________

□ AMENDED

Check this box if

Name

EIN/FID

Tax year________________

Annualize Installment Method Not

Permitted. The Dublin Tax Ordinance

does not allow for calculating estimated

Address

tax payments based on “annualized

income installment method”. The Dublin

Tax Ordinance (38.07) requires that

City

State

Zip Code

each

estimated

tax

payment

“be

accompanied by a payment of at least

one-fourth (1/4) of the estimated annual

tax: and that a declaration of estimated

Trade Name:

Nature of Business:

tax which is less than 90% of the tax

shown on the final return shall not be

CITY OR CITIES OF INCOME:

considered filed in good faith.

Thus,

1.

5.

even if your business is seasonal, City

2.

6.

estimated tax payments must be based

on estimated annual taxable income

.

3.

7.

4.

8.

Tax

Column B

Column C

Column A

Rate

Estimated Taxable Income

Estimated Tax Due

Dublin

2.0%

1.

TOTAL NET ESTIMATED TAX DUE (must equal the total of Column C)

1.

2.

LESS: overpayment credits from previous year returns

2

3.

CREDIT previous estimated payments

3.

3A.

TOTAL CREDITS (add Lines 2 and 3)

3A.

UNPAID BALANCE DUE (subtract Line 3A from Line 1

4.

4

– (a minimum 22.5% of Line 1 due)

TH

Due on or before APRIL 18

→→→→→→→→→→

5.

5.

LESS: amount paid with this declaration (attach check or money order)

ESTIMATED TAX BALANCE PAYABLE

6.

6.

(June, September, December)

(payable in equal installments for each quarter) use Payment Voucher

SIGNATURE

I declare that this declaration has been examined by me and to the best of my knowledge and belief is a true, correct and complete declaration of estimated

income subject to city income tax for the period stated above.

This Form is Voucher 1

Signature

Sign

If you are required to make estimated tax

Here

payments, you are required to file this

form. Make a copy of this form for your

Date

records.

MAILING INFORMATION

Electronic payments can be made

Mail to: Dublin Tax Division

Make payable to: City of Dublin

PO Box 9062

Dublin, Ohio 43017-0962

1

1