Village Of Byesville Income Tax Return Form - 2016

ADVERTISEMENT

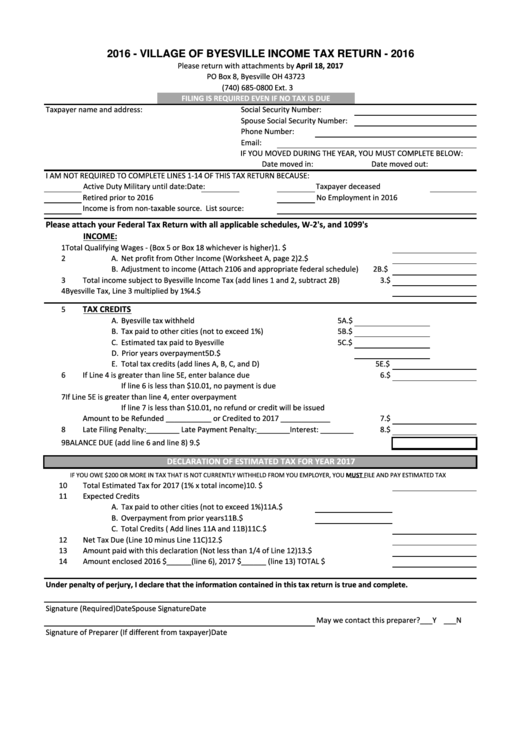

2016 - VILLAGE OF BYESVILLE INCOME TAX RETURN - 2016

Please return with attachments by April 18, 2017

PO Box 8, Byesville OH 43723

(740) 685-0800 Ext. 3

FILING IS REQUIRED EVEN IF NO TAX IS DUE

Taxpayer name and address:

Social Security Number:

Spouse Social Security Number:

Phone Number:

Email:

IF YOU MOVED DURING THE YEAR, YOU MUST COMPLETE BELOW:

Date moved in:

Date moved out:

I AM NOT REQUIRED TO COMPLETE LINES 1-14 OF THIS TAX RETURN BECAUSE:

Active Duty Military until date:

Taxpayer deceased

Date:

Retired prior to 2016

No Employment in 2016

Income is from non-taxable source. List source:

Please attach your Federal Tax Return with all applicable schedules, W-2's, and 1099's

INCOME:

1

Total Qualifying Wages - (Box 5 or Box 18 whichever is higher)

1. $

2

A. Net profit from Other Income (Worksheet A, page 2)

2.$

B. Adjustment to income (Attach 2106 and appropriate federal schedule)

2B.$

3

Total income subject to Byesville Income Tax (add lines 1 and 2, subtract 2B)

3.$

4

Byesville Tax, Line 3 multiplied by 1%

4.$

TAX CREDITS

5

A.

Byesville tax withheld

5A.$

B.

Tax paid to other cities (not to exceed 1%)

5B.$

C.

Estimated tax paid to Byesville

5C.$

D. Prior years overpayment

5D.$

E.

Total tax credits (add lines A, B, C, and D)

5E.$

6

If Line 4 is greater than line 5E, enter balance due

6.$

If line 6 is less than $10.01, no payment is due

7

If Line 5E is greater than line 4, enter overpayment

If line 7 is less than $10.01, no refund or credit will be issued

Amount to be Refunded ___________ or Credited to 2017 ____________

7.$

8

Late Filing Penalty:________ Late Payment Penalty:________Interest: ________

8.$

9

BALANCE DUE (add line 6 and line 8)

9.$

DECLARATION OF ESTIMATED TAX FOR YEAR 2017

IF YOU OWE $200 OR MORE IN TAX THAT IS NOT CURRENTLY WITHHELD FROM YOU EMPLOYER, YOU MUST FILE AND PAY ESTIMATED TAX

10

Total Estimated Tax for 2017 (1% x total income)

10. $

11

Expected Credits

A. Tax paid to other cities (not to exceed 1%)

11A.$

B. Overpayment from prior years

11B.$

C. Total Credits ( Add lines 11A and 11B)

11C.$

12

Net Tax Due (Line 10 minus Line 11C)

12.$

13

Amount paid with this declaration (Not less than 1/4 of Line 12)

13.$

14

Amount enclosed 2016 $______(line 6), 2017 $______ (line 13)

TOTAL $

Under penalty of perjury, I declare that the information contained in this tax return is true and complete.

Signature (Required)

Date

Spouse Signature

Date

May we contact this preparer?

___Y ___N

Signature of Preparer (If different from taxpayer)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3