Reset Form

Print Form

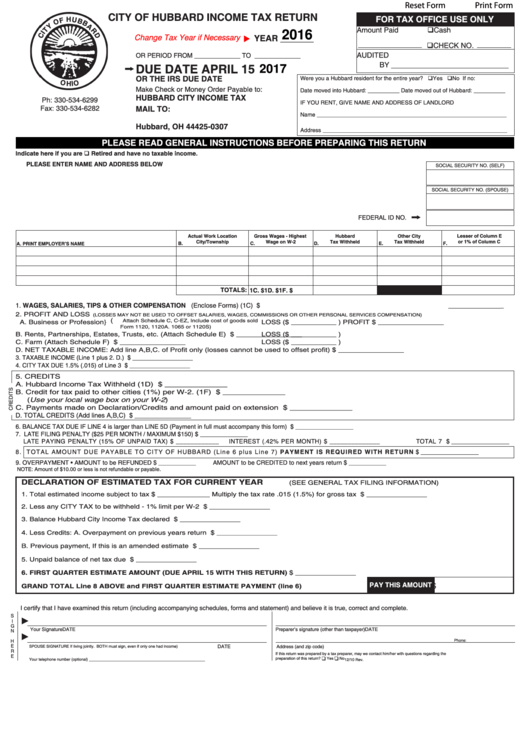

CITY OF HUBBARD INCOME TAX RETURN

FOR TAX OFFICE USE ONLY

Amount Paid

qCash

2016

YEAR _______

Change Tax Year if Necessary u

qCHECK NO.

AUDITED

OR PERIOD FROM _____________ TO _____________

BY

DUE DATE APRIL 15

2017

OR THE IRS DUE DATE

Were you a Hubbard resident for the entire year? qYes qNo If no:

Make Check or Money Order Payable to:

Date moved into Hubbard: __________ Date moved out of Hubbard: __________

HUBBARD CITY INCOME TAX

Ph: 330-534-6299

IF YOU RENT, GIVE NAME AND ADDRESS OF LANDLORD

Fax: 330-534-6282

MAIL TO:

Name ____________________________________________________________

P.O. Box 307

Hubbard, OH 44425-0307

Address __________________________________________________________

PLEASE READ GENERAL INSTRUCTIONS BEFORE PREPARING THIS RETURN

Indicate here if you are q Retired and have no taxable income.

PLEASE ENTER NAME AND ADDRESS BELOW

SOCIAL SECURITY NO. (SELF)

SOCIAL SECURITY NO. (SPOUSE)

FEDERAL ID NO.

Actual Work Location

Gross Wages - Highest

Hubbard

Other City

Lesser of Column E

City/Township

Wage on W-2

Tax Withheld

Tax Withheld

or 1% of Column C

A. PRINT EMPLOYER’S NAME

B.

C.

D.

E.

F.

TOTALS: 1C. $

1D. $

1F. $

1. WAGES, SALARIES, TIPS & OTHER COMPENSATION (Enclose Forms) (1C) ...................................................................................................... $ _______________

_

2. PROFIT AND LOSS

(LOSSES MAY NOT BE USED TO OFFSET SALARIES, WAGES, COMMISSIONS OR OTHER PERSONAL SERVICES COMPENSATION)

A. Business or Profession} (

LOSS ($ ___________ )

Attach Schedule C, C-EZ, Include cost of goods sold

PROFIT $ ________________

..............................

Form 1120, 1120A. 1065 or 1120S)

LOSS ($ ___________ )

B. Rents, Partnerships, Estates, Trusts, etc. (Attach Schedule E) ........

PROFIT $ ________________

LOSS ($ ___________ )

C. Farm (Attach Schedule F) .................................................................

PROFIT $ ________________

D. NET TAXABLE INCOME: Add line A,B,C. of Profit only (losses cannot be used to offset profit).............. $ ________________

3. TAXABLE INCOME (Line 1 plus 2. D.) ................................................................................................................................................................................................. $ __________________

4. CITY TAX DUE 1.5% (.015) of Line 3 ................................................................................................................................................................................................... $ __________________

5. CREDITS

A. Hubbard Income Tax Withheld (1D) .................................................................................... $ ______________

B. Credit for tax paid to other cities (1%) per W-2. (1F) ........................................................... $ ______________

(Use your local wage box on your W-2)

C. Payments made on Declaration/Credits and amount paid on extension ............................. $ ______________

D. TOTAL CREDITS (Add lines A,B,C) ...................................................................................................................................................................... $ ________________

6. BALANCE TAX DUE IF LINE 4 is larger than LINE 5D (Payment in full must accompany this form) .............................................................................................. $ _________________

7. LATE FILING PENALTY ($25 PER MONTH / MAXIMUM $150) $ ______________

TOTAL 7 $ _________________

LATE PAYING PENALTY (15% OF UNPAID TAX) $ ____________

INTEREST (.42% PER MONTH) $ ______________

8. T O TA L AM OU N T DUE PAYAB LE TO CITY OF HUBBARD (Line 6 plus Line 7) PAYMENT I S REQ UIRED WITH RETURN

$ _________________

9. OVERPAYMENT • AMOUNT to be REFUNDED $ ___________

AMOUNT to be CREDITED to next years return $ ___________

NOTE: Amount of $10.00 or less is not refundable or payable.

DECLARATION OF ESTIMATED TAX FOR CURRENT YEAR

(SEE GENERAL TAX FILING INFORMATION)

1. Total estimated income subject to tax $ _____________ Multiply the tax rate .015 (1.5%) for gross tax ...................................

$ _______________

2. Less any CITY TAX to be withheld - 1% limit per W-2 ................................................................................................................

$ _______________

3. Balance Hubbard City Income Tax declared ...............................................................................................................................

$ _______________

4. Less Credits: A. Overpayment on previous years return .............................................................................................................

$ _______________

B. Previous payment, If this is an amended estimate ............................................................................................

$ _______________

5. Unpaid balance of net tax due .....................................................................................................................................................

$ _______________

6. FIRST QUARTER ESTIMATE AMOUNT (DUE APRIL 15 WITH THIS RETURN) ....................................................................

$ _______________

PAY THIS AMOUNT

$

GRAND TOTAL Line 8 ABOVE and FIRST QUARTER ESTIMATE PAYMENT (line 6)

I certify that I have examined this return (including accompanying schedules, forms and statement) and believe it is true, correct and complete.

S

I

G

Your Signature

DATE

Preparer’s signature (other than taxpayer)

DATE

N

H

Phone:

E

SPOUSE SIGNATURE If living jointly. BOTH must sign, even if only one had income)

DATE

Address (and zip code)

R

If this return was prepared by a tax preparer, may we contact him/her with questions regarding the

E

preparation of this return?

q Yes

q No

Your telephone number (optional) _____________________________________________________

12/10 Rev.

1

1 2

2