Form Ptab-1-A - Residential Appeal

ADVERTISEMENT

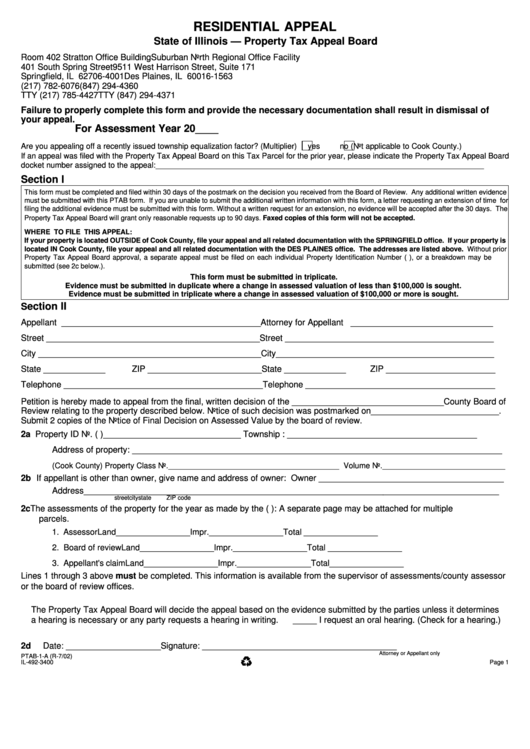

RESIDENTIAL APPEAL

State of Illinois — Property Tax Appeal Board

Room 402 Stratton Office Building

Suburban North Regional Office Facility

401 South Spring Street

9511 West Harrison Street, Suite 171

Springfield, IL 62706-4001

Des Plaines, IL 60016-1563

(217) 782-6076

(847) 294-4360

TTY (217) 785-4427

TTY (847) 294-4371

Failure to properly complete this form and provide the necessary documentation shall result in dismissal of

your appeal.

For Assessment Year 20____

Are you appealing off a recently issued township equalization factor? (Multiplier)

yes

no (Not applicable to Cook County.)

If an appeal was filed with the Property Tax Appeal Board on this Tax Parcel for the prior year, please indicate the Property Tax Appeal Board

docket number assigned to the appeal:___________________________________________________________________________

Section I

This form must be completed and filed within 30 days of the postmark on the decision you received from the Board of Review. Any additional written evidence

must be submitted with this PTAB form. If you are unable to submit the additional written information with this form, a letter requesting an extension of time for

filing the additional evidence must be submitted with this form. Without a written request for an extension, no evidence will be accepted after the 30 days. The

Property Tax Appeal Board will grant only reasonable requests up to 90 days. Faxed copies of this form will not be accepted.

WHERE TO FILE THIS APPEAL:

If your property is located OUTSIDE of Cook County, file your appeal and all related documentation with the SPRINGFIELD office. If your property is

located IN Cook County, file your appeal and all related documentation with the DES PLAINES office. The addresses are listed above. Without prior

Property Tax Appeal Board approval, a separate appeal must be filed on each individual Property Identification Number (P .I.N.), or a breakdown may be

submitted (see 2c below.).

This form must be submitted in triplicate.

Evidence must be submitted in duplicate where a change in assessed valuation of less than $100,000 is sought.

Evidence must be submitted in triplicate where a change in assessed valuation of $100,000 or more is sought.

ection II

S

Appellant __________________________________________ Attorney for Appellant ______________________________

Street _____________________________________________ Street ____________________________________________

City _______________________________________________ City______________________________________________

State _____________

ZIP ________________________ State _____________

ZIP _______________________

Telephone __________________________________________ Telephone ________________________________________

Petition is hereby made to appeal from the final, written decision of the ________________________________County Board of

Review relating to the property described below. Notice of such decision was postmarked on___________________________.

Submit 2 copies of the Notice of Final Decision on Assessed Value by the board of review.

2a Property ID No. (P .I.N.)_____________________________ Township : ________________________________________

Address of property: ______________________________________________________________________________

(Cook County) Property Class No._______________________________________ Volume No.____________________________

2b If appellant is other than owner, give name and address of owner: Owner _______________________________________

Address_______________________________________________________________________________________

street

city

state

ZIP code

2c The assessments of the property for the year as made by the (P .I.N. only): A separate page may be attached for multiple

parcels.

1. Assessor

Land________________Impr.________________ Total ________________

2. Board of review

Land________________Impr.________________ Total ________________

3. Appellant's claim

Land________________Impr.________________ Total________________

Lines 1 through 3 above must be completed. This information is available from the supervisor of assessments/county assessor

or the board of review offices.

The Property Tax Appeal Board will decide the appeal based on the evidence submitted by the parties unless it determines

a hearing is necessary or any party requests a hearing in writing.

_____ I request an oral hearing. (Check for a hearing.)

2d

Date: ____________________

Signature: _________________________________________

Attorney or Appellant only

PTAB-1-A (R-7/02)

IL-492-3400

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4