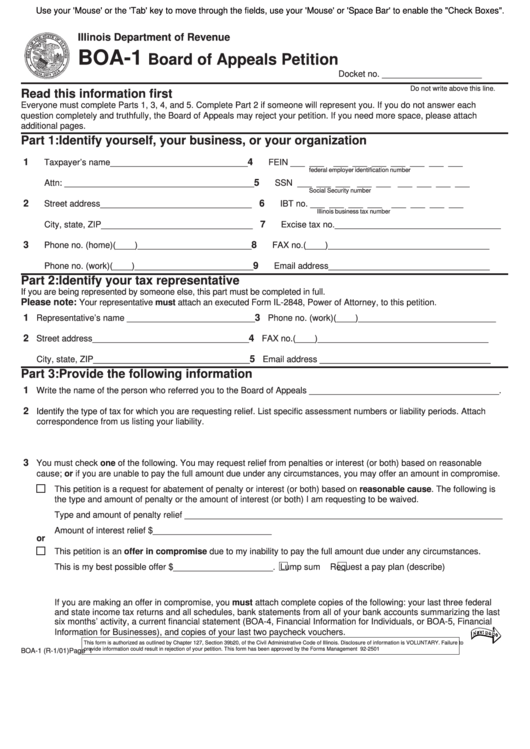

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

BOA-1

Board of Appeals Petition

Docket no. _____________________

Do not write above this line.

Read this information first

Everyone must complete Parts 1, 3, 4, and 5. Complete Part 2 if someone will represent you. If you do not answer each

question completely and truthfully, the Board of Appeals may reject your petition. If you need more space, please attach

additional pages.

Part 1: Identify yourself, your business, or your organization

1

4

Taxpayer’s name _____________________________

FEIN ___ ___

___ ___ ___ ___ ___ ___ ___

federal employer identification number

5

Attn: ________________________________________

SSN ___ ___ ___ ___ ___ ___ ___ ___ ___

Social Security number

2

_____________________________ 6

Street address

IBT no. ___ ___ ___ ___

___ ___ ___ ___

Illinois business tax number

_____________________________ 7

City, state, ZIP

Excise tax no.___________________________________

3

8

Phone no. (home) (____)________________________

FAX no. (____)__________________________________

9

Phone no. (work) (____)_________________________

Email address __________________________________

Part 2: Identify your tax representative

If you are being represented by someone else, this part must be completed in full.

Please note:

Your representative must attach an executed Form IL-2848, Power of Attorney, to this petition.

1

3

Representative’s name ___________________________

Phone no. (work)(____)_____________________________

2

4

Street address _________________________________

FAX no. (____)____________________________________

5

City, state, ZIP _________________________________

Email address ____________________________________

Part 3: Provide the following information

1

Write the name of the person who referred you to the Board of Appeals ________________________________________.

2

Identify the type of tax for which you are requesting relief. List specific assessment numbers or liability periods. Attach

correspondence from us listing your liability.

3

You must check one of the following. You may request relief from penalties or interest (or both) based on reasonable

cause; or if you are unable to pay the full amount due under any circumstances, you may offer an amount in compromise.

This petition is a request for abatement of penalty or interest (or both) based on reasonable cause. The following is

the type and amount of penalty or the amount of interest (or both) I am requesting to be waived.

Type and amount of penalty relief ___________________________________________________________________

Amount of interest relief $_________________________

or

This petition is an offer in compromise due to my inability to pay the full amount due under any circumstances.

This is my best possible offer $_____________________.

Lump sum

Request a pay plan (describe)

If you are making an offer in compromise, you must attach complete copies of the following: your last three federal

and state income tax returns and all schedules, bank statements from all of your bank accounts summarizing the last

six months’ activity, a current financial statement (BOA-4, Financial Information for Individuals, or BOA-5, Financial

Information for Businesses), and copies of your last two paycheck vouchers.

This form is authorized as outlined by Chapter 127, Section 39b20, of the Civil Administrative Code of Illinois. Disclosure of information is VOLUNTARY. Failure to

provide information could result in rejection of your petition. This form has been approved by the Forms Management Center.

IL-492-2501

BOA-1 (R-1/01)

Page 1

1

1 2

2 3

3 4

4