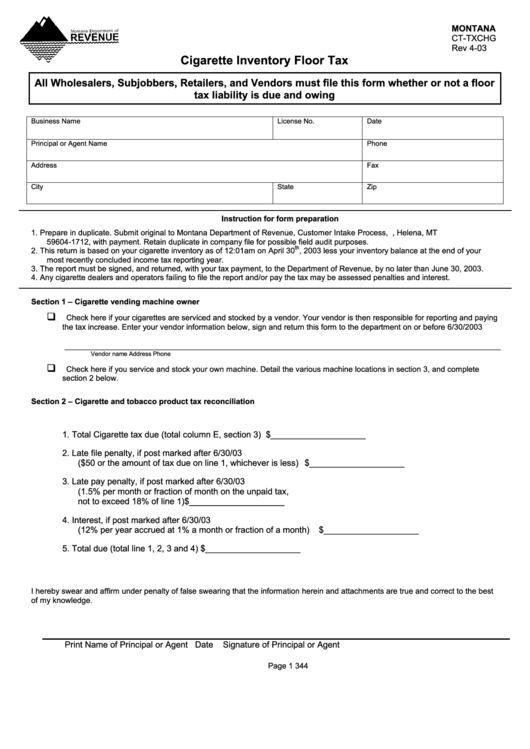

MONTANA

CT-TXCHG

Rev 4-03

Cigarette Inventory Floor Tax

All Wholesalers, Subjobbers, Retailers, and Vendors must file this form whether or not a floor

tax liability is due and owing

Business Name

License No.

Date

Principal or Agent Name

Phone

Address

Fax

City

State

Zip

Instruction for form preparation

1.

Prepare in duplicate. Submit original to Montana Department of Revenue, Customer Intake Process, P.O. Box 1712, Helena, MT

59604-1712, with payment. Retain duplicate in company file for possible field audit purposes.

th

2.

This return is based on your cigarette inventory as of 12:01am on April 30

, 2003 less your inventory balance at the end of your

most recently concluded income tax reporting year.

3.

The report must be signed, and returned, with your tax payment, to the Department of Revenue, by no later than June 30, 2003.

4.

Any cigarette dealers and operators failing to file the report and/or pay the tax may be assessed penalties and interest.

Section 1 – Cigarette vending machine owner

Check here if your cigarettes are serviced and stocked by a vendor. Your vendor is then responsible for reporting and paying

the tax increase. Enter your vendor information below, sign and return this form to the department on or before 6/30/2003

____________________________________________________________________________________________________

Vendor name

Address

Phone

Check here if you service and stock your own machine. Detail the various machine locations in section 3, and complete

section 2 below.

Section 2 – Cigarette and tobacco product tax reconciliation

1. Total Cigarette tax due (total column E, section 3) .................................................. $ ____________________

2. Late file penalty, if post marked after 6/30/03

($50 or the amount of tax due on line 1, whichever is less) ..................................... $ ____________________

3. Late pay penalty, if post marked after 6/30/03

(1.5% per month or fraction of month on the unpaid tax,

not to exceed 18% of line 1) .................................................................................... $ ____________________

4. Interest, if post marked after 6/30/03

(12% per year accrued at 1% a month or fraction of a month) ............................... $ ____________________

5. Total due (total line 1, 2, 3 and 4)............................................................................. $ ____________________

I hereby swear and affirm under penalty of false swearing that the information herein and attachments are true and correct to the best

of my knowledge.

Print Name of Principal or Agent

Date

Signature of Principal or Agent

Page 1

344

1

1 2

2