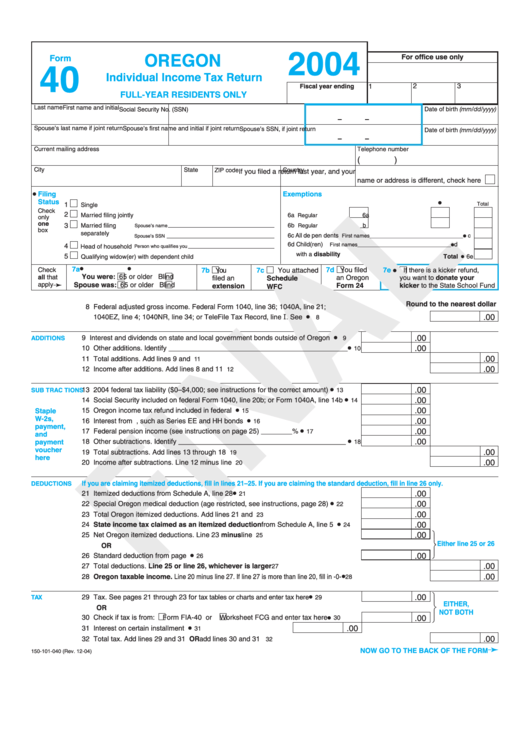

Form 40 - 2004 Individual Income Tax Return Full-Year Residents Only

ADVERTISEMENT

2004

OREGON

Form

For office use only

40

Individual Income Tax Return

Fiscal year ending

2

3

1

FULL-YEAR RESIDENTS ONLY

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

–

–

Spouse’s last name if joint return

Spouse’s first name and initial if joint return

Date of birth (mm/dd/yyyy)

Spouse’s SSN, if joint return

–

–

Current mailing address

Telephone number

(

)

City

State

Country

ZIP code

If you filed a return last year, and your

name or address is different, check here

•

Filing

Exemptions

Status

•

Total

1

Single

Check

2

Married filing jointly

6a Yourself......

6a

Regular

........ Severely disabled

.........

only

one

3

Married filing

6b Spouse ......

Regular

........ Severely disabled

...........

b

Spouse’s name

box

separately

•

6c All de pen dents

c

Spouse’s SSN

First names ________________________________

4

•

Head of household

6d Child(ren)

d

Person who qualifies you

First names ________________________________

with a disability

•

5

Total

Qualifying widow(er) with dependent child

6e

•

•

7a

7d

•

Check

7b

7c

You filed

7e

You

You attached

If there is a kicker refund,

You were:

all that

65 or older

Blind

you want to donate your

filed an

Schedule

an Oregon

➛

apply

Spouse was:

65 or older

Blind

Form 24

kicker to the State School Fund

extension

WFC

Round to the nearest dollar

8 Federal adjusted gross income. Federal Form 1040, line 36; 1040A, line 21;

1040EZ, line 4; 1040NR, line 34; or TeleFile Tax Record, line I. See instructions .......................................

•

.00

8

•

.00

9 Interest and dividends on state and local government bonds outside of Oregon .....

ADDITIONS

9

•

.00

10 Other additions. Identify ______________________________________________

10

.00

11 Total additions. Add lines 9 and 10.................................................................................................................

11

.00

12 Income after additions. Add lines 8 and 11 ....................................................................................................

12

•

.00

13 2004 federal tax liability ($0–$4,000; see instructions for the correct amount) .........

SUB TRAC TIONS

13

•

.00

14 Social Security included on federal Form 1040, line 20b; or Form 1040A, line 14b

14

•

.00

Staple

15 Oregon income tax refund included in federal income..............................................

15

W-2s,

•

.00

16 Interest from U.S. government, such as Series EE and HH bonds ..........................

16

payment,

•

.00

17 Federal pension income (see instructions on page 25) ________% ........................

17

and

•

.00

payment

18 Other subtractions. Identify ___________________________________________

18

voucher

.00

19 Total subtractions. Add lines 13 through 18 ...................................................................................................

19

here

.00

20 Income after subtractions. Line 12 minus line 19...........................................................................................

20

If you are claiming itemized deductions, fill in lines 21–25. If you are claiming the standard deduction, fill in line 26 only.

DEDUCTIONS

•

.00

21 Itemized deductions from Schedule A, line 28 ..........................................................

21

•

.00

22 Special Oregon medical deduction (age restricted, see instructions, page 28) ........

22

.00

23 Total Oregon itemized deductions. Add lines 21 and 22 .............................................

23

•

.00

24 State income tax claimed as an itemized deduction from Schedule A, line 5 .....

24

25 Net Oregon itemized deductions. Line 23 minus line 24 ............................................

.00

25

Either line 25 or 26

OR

•

.00

26 Standard deduction from page 28.............................................................................

26

27 Total deductions. Line 25 or line 26, whichever is larger ...........................................................................

.00

27

•

28 Oregon taxable income. Line 20 minus line 27. If line 27 is more than line 20, fill in -0- .....................................

.00

28

•

.00

TAX

29 Tax. See pages 21 through 23 for t ax tables or charts and enter tax here .................

29

EITHER,

OR

NOT BOTH

•

30 Check if tax is from:

Form FIA-40 or

Worksheet FCG and enter tax here ....

.00

30

•

.00

31 Interest on certain installment sales......................................

31

32 Total tax. Add lines 29 and 31 OR add lines 30 and 31 .......................................................OREGON TAX

.00

32

➛

NOW GO TO THE BACK OF THE FORM

150-101-040 (Rev. 12-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2