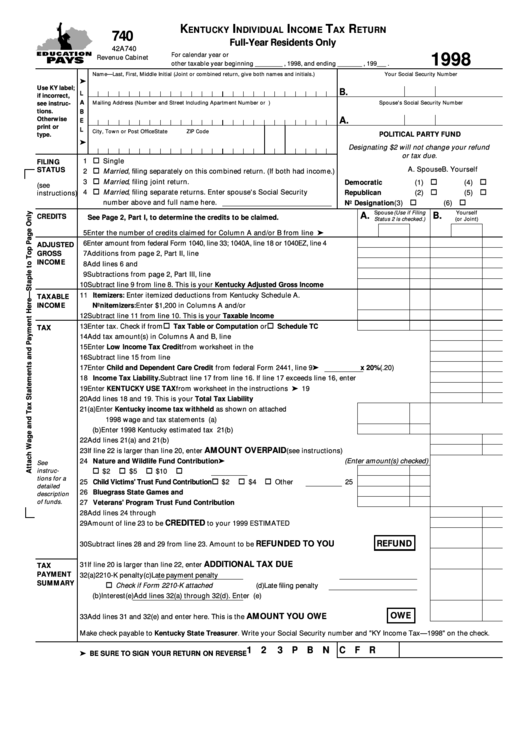

K

I

I

T

R

ENTUCKY

NDIVIDUAL

NCOME

AX

ETURN

740

Full-Year Residents Only

42A740

For calendar year or

1998

Revenue Cabinet

other taxable year beginning _________ , 1998, and ending ________ , 199___ .

Name—Last, First, Middle Initial (Joint or combined return, give both names and initials.)

Your Social Security Number

Use KY label;

B.

L

if incorrect,

A

Mailing Address (Number and Street Including Apartment Number or P.O. Box)

Spouse's Social Security Number

see instruc-

tions.

B

Otherwise

A.

E

print or

L

City, Town or Post Office

State

ZIP Code

POLITICAL PARTY FUND

type.

Designating $2 will not change your refund

or tax due.

1

Single

FILING

A. Spouse

B. Yourself

STATUS

2

Married , filing separately on this combined return. (If both had income.)

3

Married , filing joint return.

Democratic

(1)

(4)

(see

4

Married , filing separate returns. Enter spouse's Social Security

Republican

(2)

(5)

instructions)

number above and full name here.

No Designation

(3)

(6)

Spouse (Use if Filing

Yourself

A.

B.

CREDITS

See Page 2, Part I, to determine the credits to be claimed.

Status 2 is checked.)

(or Joint)

5 Enter the number of credits claimed for Column A and/or B from line 37 ........

6 Enter amount from federal Form 1040, line 33; 1040A, line 18 or 1040EZ, line 4 .....

6

ADJUSTED

GROSS

7 Additions from page 2, Part II, line 41 ...................................................................

7

INCOME

8 Add lines 6 and 7 .....................................................................................................

8

9 Subtractions from page 2, Part III, line 49 .............................................................

9

10 Subtract line 9 from line 8. This is your Kentucky Adjusted Gross Income ....... 10

11 Itemizers: Enter itemized deductions from Kentucky Schedule A.

TAXABLE

INCOME

Nonitemizers: Enter $1,200 in Columns A and/or B ............................................. 11

12 Subtract line 11 from line 10. This is your Taxable Income ................................. 12

13 Enter tax. Check if from

Tax Table or Computation or

Schedule TC ........ 13

TAX

14 Add tax amount(s) in Columns A and B, line 13 ......................................................................................... 14

15 Enter Low Income Tax Credit from worksheet in the instructions ............................................................ 15

16 Subtract line 15 from line 14 ................................................................................................ ........................ 16

17 Enter Child and Dependent Care Credit from federal Form 2441, line 9

x 20% (.20) ...... 17

18 Income Tax Liability. Subtract line 17 from line 16. If line 17 exceeds line 16, enter zero ...................... 18

19 Enter KENTUCKY USE TAX from worksheet in the instructions ............................................................

19

20 Add lines 18 and 19. This is your Total Tax Liability .................................................................................. 20

21 (a) Enter Kentucky income tax withheld as shown on attached

1998 wage and tax statements .................................................................... 21(a)

(b) Enter 1998 Kentucky estimated tax payments .......................................... 21(b)

22 Add lines 21(a) and 21(b) .............................................................................................................................. 22

AMOUNT OVERPAID

23 If line 22 is larger than line 20, enter

(see instructions) .................................. 23

24 Nature and Wildlife Fund Contribution

(Enter amount(s) checked)

See

instruc-

$2

$5

$10

Other

................................................ 24

tions for a

25 Child Victims' Trust Fund Contribution

$2

$4

Other

25

detailed

26 Bluegrass State Games and U.S. Olympic Committee Fund Contribution ....... 26

description

of funds.

27 Veterans' Program Trust Fund Contribution ........................................................ 27

28 Add lines 24 through 27 ................................................................................................................................ 28

CREDITED

29 Amount of line 23 to be

to your 1999 ESTIMATED TAX ....................................................... 29

REFUNDED TO YOU

REFUND

30 Subtract lines 28 and 29 from line 23. Amount to be

...............

30

ADDITIONAL TAX DUE

31 If line 20 is larger than line 22, enter

............................................................. 31

TAX

PAYMENT

32 (a) 2210-K penalty

(c) Late payment penalty

SUMMARY

Check if Form 2210-K attached

(d) Late filing penalty

(b) Interest

(e) Add lines 32(a) through 32(d). Enter here ... 32(e)

OWE

AMOUNT YOU OWE

33 Add lines 31 and 32(e) and enter here. This is the

........................

33

Make check payable to Kentucky State Treasurer. Write your Social Security number and "KY Income Tax—1998" on the check.

1

2

3

P B N C F R

BE SURE TO SIGN YOUR RETURN ON REVERSE

1

1 2

2