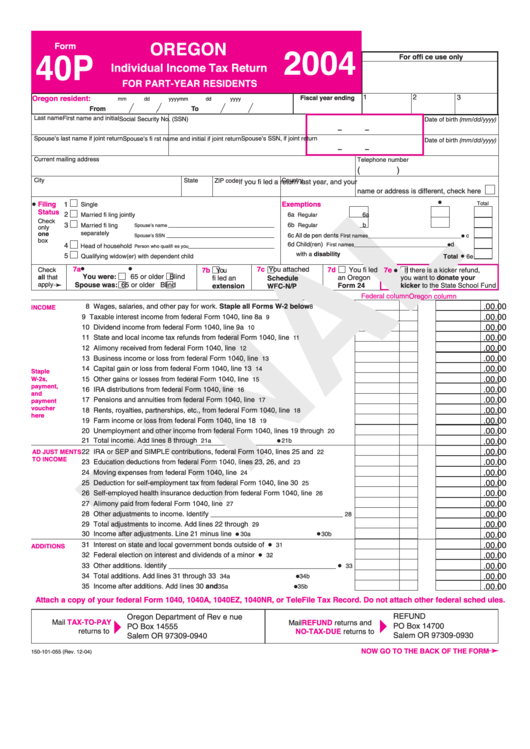

Form 40p - 2004 Individual Income Tax Return For Part-Year Residents

ADVERTISEMENT

OREGON

Form

2004

40P

For offi ce use only

Individual Income Tax Return

FOR PART-YEAR RESIDENTS

1

2

3

Oregon resident:

Fiscal year ending

mm

dd

yyyy

mm

dd

yyyy

To

From

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

–

–

Spouse’s last name if joint return

Spouse’s SSN, if joint return

Spouse’s fi rst name and initial if joint return

Date of birth (mm/dd/yyyy)

–

–

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you fi led a return last year, and your

name or address is different, check here

•

•

Filing

Exemptions

Total

1

Single

Status

2

Married fi ling jointly

6a Yourself......

Regular

........ Severely disabled

.........

6a

Check

3

Married fi ling

6b Spouse ......

b

Regular

........ Severely disabled

...........

Spouse’s name

only

separately

one

•

6c All de pen dents

First names ________________________________

c

Spouse’s SSN

box

4

•

Head of household

6d Child(ren)

d

Person who qualifi es you

First names ________________________________

with a disability

•

5

Qualifying widow(er) with dependent child

Total

6e

•

•

7a

7d

•

Check

7b

7c

You fi led

7e

You

You attached

If there is a kicker refund,

You were:

all that

65 or older

Blind

Schedule

you want to donate your

fi led an

an Oregon

➛

apply

Spouse was:

65 or older

Blind

Form 24

kicker to the State School Fund

extension

WFC-N/P

Federal column

Oregon column

8 Wages, salaries, and other pay for work. Staple all Forms W-2 below ................

.00

.00

8

INCOME

.00

.00

9 Taxable interest income from federal Form 1040, line 8a ......................................

9

.00

.00

10 Dividend income from federal Form 1040, line 9a ..................................................

10

.00

.00

11 State and local income tax refunds from federal Form 1040, line 10......................

11

.00

.00

12 Alimony received from federal Form 1040, line 11 ..................................................

12

.00

.00

13 Business income or loss from federal Form 1040, line 12 ......................................

13

.00

.00

14 Capital gain or loss from federal Form 1040, line 13 ..............................................

14

Staple

W-2s,

.00

.00

15 Other gains or losses from federal Form 1040, line 14 ...........................................

15

payment,

16 IRA distributions from federal Form 1040, line 15b .................................................

.00

.00

16

and

.00

.00

17 Pensions and annuities from federal Form 1040, line 16b......................................

17

payment

voucher

.00

.00

18 Rents, royalties, partnerships, etc., from federal Form 1040, line 17......................

18

here

19 Farm income or loss from federal Form 1040, line 18 ............................................

.00

.00

19

.00

.00

20 Unemployment and other income from federal Form 1040, lines 19 through 21 ....

20

•

21 Total income. Add lines 8 through 20 ......................................................................

.00

.00

21a

21b

.00

.00

AD JUST MENTS

22 IRA or SEP and SIMPLE contributions, federal Form 1040, lines 25 and 32..........

22

TO INCOME

.00

.00

23 Education deductions from federal Form 1040, lines 23, 26, and 27......................

23

.00

.00

24 Moving expenses from federal Form 1040, line 29 .................................................

24

.00

.00

25 Deduction for self-employment tax from federal Form 1040, line 30 ......................

25

26 Self-employed health insurance deduction from federal Form 1040, line 31 ..........

.00

.00

26

.00

.00

27 Alimony paid from federal Form 1040, line 34a.......................................................

27

.00

.00

28 Other adjustments to income. Identify __________________________________

28

29 Total adjustments to income. Add lines 22 through 28 ............................................

.00

.00

29

•

•

30 Income after adjustments. Line 21 minus line 29..................................................

.00

.00

30a

30b

•

.00

.00

31 Interest on state and local government bonds outside of Oregon.........................

31

ADDITIONS

•

.00

.00

32 Federal election on interest and dividends of a minor child ..................................

32

•

.00

.00

33 Other additions. Identify ___________________________________________

33

•

.00

.00

34 Total additions. Add lines 31 through 33 .................................................................

34a

34b

•

35 Income after additions. Add lines 30 and 34...........................................................

.00

.00

35a

35b

Attach a copy of your federal Form 1040, 1040A, 1040EZ, 1040NR, or TeleFile Tax Record. Do not attach other federal sched ules.

REFUND

Oregon Department of Rev e nue

4

4

TAX-TO-PAY

Mail

Mail

REFUND

returns and

PO Box 14700

PO Box 14555

returns to

NO-TAX-DUE

returns to

Salem OR 97309-0930

Salem OR 97309-0940

➛

NOW GO TO THE BACK OF THE FORM

150-101-055 (Rev. 12-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2