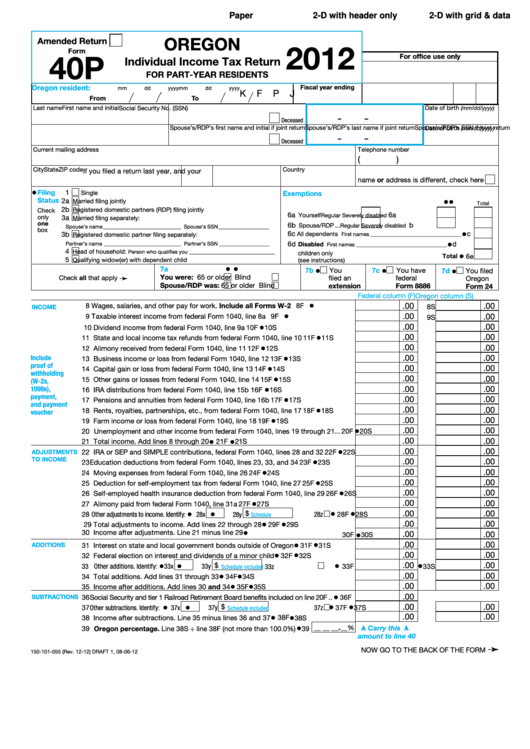

Form 40p - Oregon Individual Income Tax Return For Part-Year Residents - 2012

ADVERTISEMENT

1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

2

8

8

8

Paper

2-D with header only

2-D with grid & data

1

2

3

5

6 7 8 9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

4

82

3

3

2012

For office use only

Amended return

OREGON

4

4

Amended Return

2012

OREGON INDIVIDUAL INCOME TAX RETURN

Form

5

5

Form

40P

40P

For Part-Year Residents

For office use only

Individual Income Tax Return

6

Fiscal year ending

6

f r o m

X X / X X / X X X X

T o

X X / X X / X X X X

K

F

P

J

7

7

FOR PART-YEAR RESIDENTS

P S S N X X - X X X X

S S S N X X - X X X X

8

8

P l a S T N a m e X X X X X X X X X X X P f i r S T N a m e X X i

d o B

X X / X X / X X X X

d e C e a S e d

Oregon resident:

Fiscal year ending

mm

dd

yyyy

mm

dd

yyyy

9

9

K

F

P

J

S l a S T N a m e X X X X X X X X X X X S f i r S T N a m e X X i

d o B

X X / X X / X X X X

d e C e a S e d

From

To

10

10

e X T e N S i o N f i l e d

a d d r e S S 1 X X X X X X X X X X X X X X X X X X X X X X X X X X X

P H o N e

X X X - X X X - X X X X

Last name

First name and initial

Social Security No. (SSN)

Date of birth

(mm/dd/yyyy)

11

11

a d d r e S S 2 X X X X X X X X X X X X X X X X X X X X X X X X X X X

8 8 8 6

–

–

Deceased

12

12

Spouse’s/RDP’s last name if joint return

Spouse’s/RDP’s first name and initial if joint return

Spouse’s/RDP’s SSN if joint return

C i T Y X X X X X X X X X X X X X X X X X S T Z i P X X X X X X X

N e W N a m e / a d d r e S S

Date of birth

f o r m 2 4 f i l e d

(mm/dd/yyyy)

13

13

–

–

C o U N T r Y X X X X X X X X X X X X X X X

f o r C o m P U T e r U S e o N l Y

Deceased

14

14

f i l i N g S T a T U S :

X X X X X X X X X X X X X X X X X X X X X

Current mailing address

Telephone number

15

15

(

)

S P o U S e :

X X X X X X X X X X X X X X X S S N - X X - X X X X

16

16

City

State

ZIP code

Country

P a r T N e r :

X X X X X X X X X X X X X X X S S N - X X - X X X X

If you filed a return last year, and your

17

17

name or address is different, check here

q U a l i f Y i N g N a m e :

X X X X X X X X X X X X X X X X X X

18

18

•

PRINT 2-D BARCODE HERE

e X e m P T i o N S :

Filing

1

Single

Exemptions

19

19

Status

•

•

6 a S e l f :

2a

r e g U l a r

d i S a B l e d

X

Married filing jointly

Total

20

20

2b

Registered domestic partners (RDP) filing jointly

Check

6 B S P o U S e / r d P :

r e g U l a r

d i S a B l e d

X

6a

6a

21

Yourself ...........

Regular

...... Severely disabled

....

21

only

3a

Married filing separately:

6 C a l l d e P e N d e N T S :

X X X X X X X X X X X X X X

X X

one

6b

b

22

Spouse/RDP ...

22

Regular

...... Severely disabled

......

Spouse’s name _____________________________ Spouse’s SSN ___________________

⁄

box

1

6 d d i S a B l e d C H i l d r e N o N l Y :

X X

Minimum

" white space

•

3b

8

Registered domestic partner filing separately:

6c

c

23

All dependents

23

First names __________________________________

X X X X X X X X X X X X X X X X X X X X X X X X X X X X X

around all four sides of barcode

Partner’s name _____________________________ Partner’s SSN ___________________

•

6d

d

24

Disabled

24

First names __________________________________

4

Head of household:

Person who qualifies you ________________________________

6 e T o T a l e X e m P T i o N S :

X X

children only

•

Total

6e

25

25

5

Qualifying widow(er) with dependent child

(see instructions)

7 a S e l f

:

6 5 o r o l d e r

B l i N d

•

•

26

26

•

•

•

7a

7b

You

7c

You have

7d

You filed

S P o U S e / r d P :

6 5 o r o l d e r

B l i N d

You were:

65 or older

Blind

27

Check all that apply

➛

filed an

federal

27

Oregon

Spouse/RDP was:

65 or older

Blind

extension

Form 8886

Form 24

28

28

Federal column (F)

Oregon column (S)

29

29

.00

•

.00

8 Wages, salaries, and other pay for work. Include all Forms W-2 ........................ 8F

8S

INCOME

30

30

•

.00

.00

9 Taxable interest income from federal Form 1040, line 8a ...................................... 9F

9S

31

31

.00

•

.00

10 Dividend income from federal Form 1040, line 9a ................................................. 10F

10S

32

32

.00

•

.00

11 State and local income tax refunds from federal Form 1040, line 10 .................... 11F

11S

33

33

•

.00

.00

12 Alimony received from federal Form 1040, line 11 ................................................ 12F

12S

34

34

.00

•

.00

Include

13 Business income or loss from federal Form 1040, line 12 ..................................... 13F

13S

35

35

proof of

.00

•

.00

14 Capital gain or loss from federal Form 1040, line 13 ............................................. 14F

14S

36

36

withholding

.00

•

.00

15 Other gains or losses from federal Form 1040, line 14 .......................................... 15F

15S

(W-2s,

37

37

.00

•

.00

1099s),

16 IRA distributions from federal Form 1040, line 15b ............................................... 16F

16S

38

38

payment,

•

.00

.00

17 Pensions and annuities from federal Form 1040, line 16b ..................................... 17F

17S

39

39

and payment

.00

•

.00

18 Rents, royalties, partnerships, etc., from federal Form 1040, line 17 .................... 18F

18S

voucher

40

40

.00

•

.00

19 Farm income or loss from federal Form 1040, line 18 ........................................... 19F

19S

41

41

•

.00

.00

20 Unemployment and other income from federal Form 1040, lines 19 through 21 ... 20F

20S

42

42

•

.00

•

.00

21 Total income. Add lines 8 through 20 .................................................................

21F

21S

43

43

.00

•

.00

22 IRA or SEP and SIMPLE contributions, federal Form 1040, lines 28 and 32 ......... 22F

22S

ADJUSTMENTS

44

44

TO INCOME

.00

•

.00

23 Education deductions from federal Form 1040, lines 23, 33, and 34 .................... 23F

23S

45

45

.00

•

.00

24 Moving expenses from federal Form 1040, line 26 ................................................ 24F

24S

46

46

•

.00

.00

25 Deduction for self-employment tax from federal Form 1040, line 27 .................... 25F

25S

47

47

.00

•

.00

26 Self-employed health insurance deduction from federal Form 1040, line 29 ........ 26F

26S

48

48

.00

•

.00

27 Alimony paid from federal Form 1040, line 31a ..................................................... 27F

27S

49

49

•

•

•

•

.00

.00

28y $

28 Other adjustments to income. Identify:

28x

28z

28F

28S

Schedule

50

50

•

.00

•

.00

29 Total adjustments to income. Add lines 22 through 28 ......................................

29F

29S

51

51

•

.00

•

.00

30 Income after adjustments. Line 21 minus line 29 ...............................................

30F

30S

52

52

•

•

.00

.00

ADDITIONS

31 Interest on state and local government bonds outside of Oregon .....................

31F

31S

53

53

•

•

.00

.00

32 Federal election on interest and dividends of a minor child ...............................

32F

32S

54

54

•

•

•

•

.00

.00

33y $

33 Other additions. Identify:

33x

33z

......

33F

33S

Schedule included

55

55

•

.00

•

.00

34 Total additions. Add lines 31 through 33 ............................................................

34F

34S

56

56

•

.00

•

.00

35 Income after additions. Add lines 30 and 34 ......................................................

35F

35S

57

57

•

.00

SUBTRACTIONS

36 Social Security and tier 1 Railroad Retirement Board benefits included on line 20F ..

36F

58

58

•

•

•

•

.00

.00

37y $

37 Other subtractions. Identify:

37x

37z

37F

37S

Schedule included

59

59

.00

.00

•

•

38F

38 Income after subtractions. Line 35 minus lines 36 and 37 .................................

38S

60

60

•

.

__ __ __

__ %

Carry this

39 Oregon percentage. Line 38S ÷ line 38F (not more than 100.0%)

39

61

61

amount to line 40

62

62

➛

NOW GO TO THE BACK OF THE FORM

63

63

150-101-055-2 (Rev. 12-12) DRAFT 1, 08-06-12

150-101-055 (Rev. 12-12) DRAFT 1, 08-06-12

64

64

65

65

8

8

8

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

1

2

3

5

6 7 8 9

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

0

4

82

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2