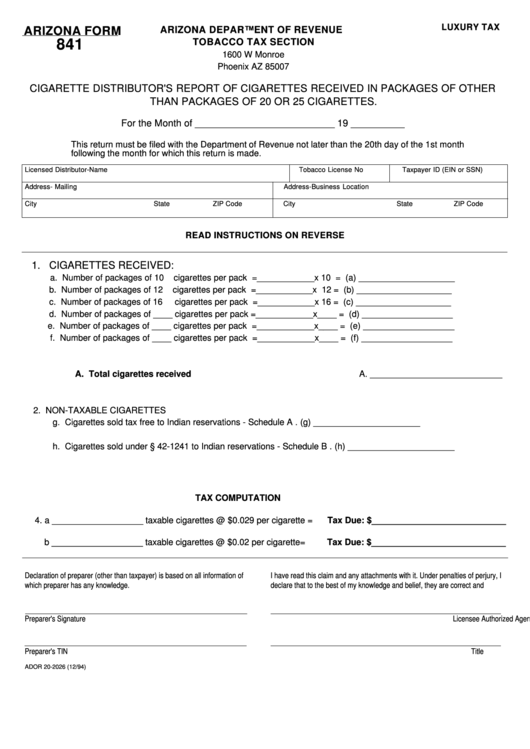

LUXURY TAX

ARIZONA FORM

ARIZONA DEPARTMENT OF REVENUE

841

TOBACCO TAX SECTION

1600 W Monroe

Phoenix AZ 85007

CIGARETTE DISTRIBUTOR'S REPORT OF CIGARETTES RECEIVED IN PACKAGES OF OTHER

THAN PACKAGES OF 20 OR 25 CIGARETTES.

For the Month of __________________________ 19 __________

This return must be filed with the Department of Revenue not later than the 20th day of the 1st month

following the month for which this return is made.

Licensed Distributor-Name

Tobacco License No

Taxpayer ID (EIN or SSN)

Address- Mailing

Address-Business Location

City

State

ZIP Code

City

State

ZIP Code

READ INSTRUCTIONS ON REVERSE

1. CIGARETTES RECEIVED:

a. Number of packages of 10

cigarettes per pack =____________x 10 = (a) ____________________

b. Number of packages of 12

cigarettes per pack =____________x 12 = (b) ____________________

c. Number of packages of 16

cigarettes per pack =____________x 16 = (c) ____________________

d. Number of packages of ____ cigarettes per pack =____________x____ = (d) ___________________

e. Number of packages of ____ cigarettes per pack =____________x____ = (e) ___________________

f. Number of packages of ____ cigarettes per pack =____________x____ = (f) ___________________

A. Total cigarettes received

A. ___________________________

2. NON-TAXABLE CIGARETTES

g. Cigarettes sold tax free to Indian reservations - Schedule A ................................... (g) ______________________

h. Cigarettes sold under § 42-1241 to Indian reservations - Schedule B ..................... (h) ______________________

TAX COMPUTATION

4. a ___________________ taxable cigarettes @ $0.029 per cigarette =

Tax Due: $____________________________

b ___________________ taxable cigarettes @ $0.02 per cigarette=

Tax Due: $____________________________

Declaration of preparer (other than taxpayer) is based on all information of

I have read this claim and any attachments with it. Under penalties of perjury, I

which preparer has any knowledge.

declare that to the best of my knowledge and belief, they are correct and

Preparer's Signature

Licensee Authorized Agent's Signature

Preparer's TIN

Title

ADOR 20-2026 (12/94)

1

1 2

2 3

3 4

4