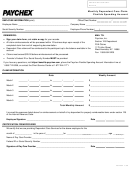

Flexible Spending Account Claim Form Dependent Care Page 2

ADVERTISEMENT

Flexible Spending Account

Claim Form ~ Dependent Care

OSR 5-344 (Rev 1-4-2010)

How to File this FSA Claim Form

1. Attach a copy of your itemized bill from the provider with the following information:

a. Name and address of the provider

b. Social Security number or federal tax identification number of the provider

c. Detailed statement of services rendered, with dates of services

2. Mail the completed FSA Claim Form, along with a copy of the provider’s itemized bill, to the address

listed below or you may email a pdf of forms and attachments to .

3. Keep copies of all claims submitted. We will not return documentation mailed with this claim form.

4. You must submit all FSA claims by the last day of the specified run-off period of the following year for

expenses incurred during the plan year. Check with your company’s Human Resources department for

the exact date your run-off period ends. Any money remaining in your account after the end of the plan

year will be forfeited under Internal Revenue Service (IRS) guidelines.

Dependent Care Reimbursement

Expenses to provide care for your eligible dependents may qualify for reimbursement. Eligible

dependents include children under age 13, a disabled child, a disabled spouse, or a disabled parent for

whom you are entitled to a personal tax exemption as a dependent.

To be eligible, you must be working while your dependents receive care. Also, if you are married, your

spouse must be:

- A wage earner, or

- A full-time student for at least five months during the year, or

- Disabled and unable to provide for his or her own care.

Expenses eligible for reimbursement are those incurred to enable you to be gainfully employed, and

include covered charges by:

- Licensed nursery schools and day care centers.

- Individuals (other than your dependents under age 19) who provide care for your children in or

outside your home, or for your disabled spouse or dependent parent in your home.

- Housekeepers, maids or cooks in your home, to include their food and lodging in your home, as

long as their services are performed for the benefit of your eligible dependent(s).

Under IRS regulations, the reimbursement when aggregated with all other dependent care

reimbursement during the same year may not exceed the lesser of the following limits:

1) $5,000

2) $2,500 if you are married and your spouse files a separate tax return

3) If you are single, your taxable compensation

4) If married, the lesser of your earned income or your spouse’s earned income for the year

IRS regulations limit the amount of reimbursement expenses for dependent care to the lower of the

annual earned income of you or your spouse. If your spouse is disabled or a full-time student, this

limitation assumes that your spouse earns $200 per month (one dependent) or $400 per month (two or

more dependents). Under IRS regulations, qualified individuals can receive a tax credit for some

dependent care costs. You may claim this credit on your personal tax return. You cannot claim the tax

credit for any dependent care costs reimbursed from the FSA, since FSA funds are pre-tax withholdings.

How to Contact Us

Mailing

FSA Administration

address:

BlueCross BlueShield of South Carolina

Fax:

(803) 264-6423

P.O. Box 100237

Phone: toll-free 1-800-300-5248

Columbia, SC 29202

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2