Income Tax Return Form

ADVERTISEMENT

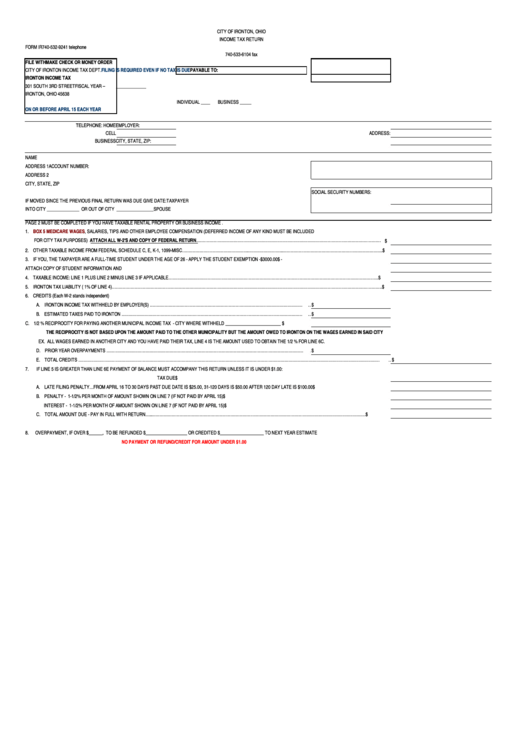

CITY OF IRONTON, OHIO

INCOME TAX RETURN

FORM IR

740-532-9241 telephone

740-533-6104 fax

FILE WITH

MAKE CHECK OR MONEY ORDER

CITY OF IRONTON INCOME TAX DEPT.

FILING IS REQUIRED EVEN IF NO TAX IS DUE

PAYABLE TO:

P.O. BOX 704

CALENDAR YEAR -- _____________

IRONTON INCOME TAX

301 SOUTH 3RD STREET

FISCAL YEAR --

_____________

IRONTON, OHIO 45638

INDIVIDUAL ____

BUSINESS _____

ON OR BEFORE APRIL 15 EACH YEAR

TELEPHONE: HOME

EMPLOYER:

CELL

ADDRESS:

BUSINESS

CITY, STATE, ZIP:

NAME

ADDRESS 1

ACCOUNT NUMBER:

ADDRESS 2

CITY, STATE, ZIP

SOCIAL SECURITY NUMBERS:

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE GIVE DATE:

TAXPAYER

INTO CITY ______________ OR OUT OF CITY ________________

SPOUSE

PAGE 2 MUST BE COMPLETED IF YOU HAVE TAXABLE RENTAL PROPERTY OR BUSINESS INCOME.

1.

BOX 5 MEDICARE

WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (DEFERRED INCOME OF ANY KIND MUST BE INCLUDED

FOR CITY TAX PURPOSES) ATTACH ALL W-2'S AND COPY OF FEDERAL RETURN………………………………………………………………………………………………………………………… $

2. OTHER TAXABLE INCOME FROM FEDERAL SCHEDULE C, E, K-1, 1099-MISC…………………………………………..……………………...……………………………………………………………….. $

3. IF YOU, THE TAXPAYER ARE A FULL-TIME STUDENT UNDER THE AGE OF 26 - APPLY THE STUDENT EXEMPTION -$3000.00

$ -

ATTACH COPY OF STUDENT INFORMATION AND I.D. FOR THE STUDENT EXEMPTION

4. TAXABLE INCOME: LINE 1 PLUS LINE 2 MINUS LINE 3 IF APPLICABLE………………………………………………………………………………………………………………………………………….

$

5. IRONTON TAX LIABILITY ( 1% OF LINE 4)…………………………………………………………………………………………………………………………………………………………………………………. $

6. CREDITS (Each W-2 stands independent)

A. IRONTON INCOME TAX WITHHELD BY EMPLOYER(S) ………………………………………………………………………………………………………$

B. ESTIMATED TAXES PAID TO IRONTON …………………………………………………………………………………………………………………………$

C. 1/2 % RECIPROCITY FOR PAYING ANOTHER MUNICIPAL INCOME TAX - CITY WHERE WITHHELD ________________________...........

$

THE RECIPROCITY IS NOT BASED UPON THE AMOUNT PAID TO THE OTHER MUNICIPALITY BUT THE AMOUNT OWED TO IRONTON ON THE WAGES EARNED IN SAID CITY

EX. ALL WAGES EARNED IN ANOTHER CITY AND YOU HAVE PAID THEIR TAX, LINE 4 IS THE AMOUNT USED TO OBTAIN THE 1/2 % FOR LINE 6C.

D. PRIOR YEAR OVERPAYMENTS …………………………………………………………………………………………………………………………………… $

E. TOTAL CREDITS ………………………………………………………………………………………………………………………………………………………………………………………………………… $

7.

IF LINE 5 IS GREATER THAN LINE 6E PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN UNLESS IT IS UNDER $1.00:

TAX DUE

$

A. LATE FILING PENALTY…FROM APRIL 16 TO 30 DAYS PAST DUE DATE IS $25.00, 31-120 DAYS IS $50.00 AFTER 120 DAY LATE IS $100.00

$

B. PENALTY - 1-1/2% PER MONTH OF AMOUNT SHOWN ON LINE 7 (IF NOT PAID BY APRIL 15)

$

INTEREST - 1-1/2% PER MONTH OF AMOUNT SHOWN ON LINE 7 (IF NOT PAID BY APRIL 15)

$

C. TOTAL AMOUNT DUE - PAY IN FULL WITH RETURN…...……………………………………………………………………………………………………………………………………………

$

8.

OVERPAYMENT, IF OVER $______, TO BE REFUNDED $__________________ OR CREDITED $___________________ TO NEXT YEAR ESTIMATE

NO PAYMENT OR REFUND/CREDIT FOR AMOUNT UNDER $1.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2