Income Tax Return Form

ADVERTISEMENT

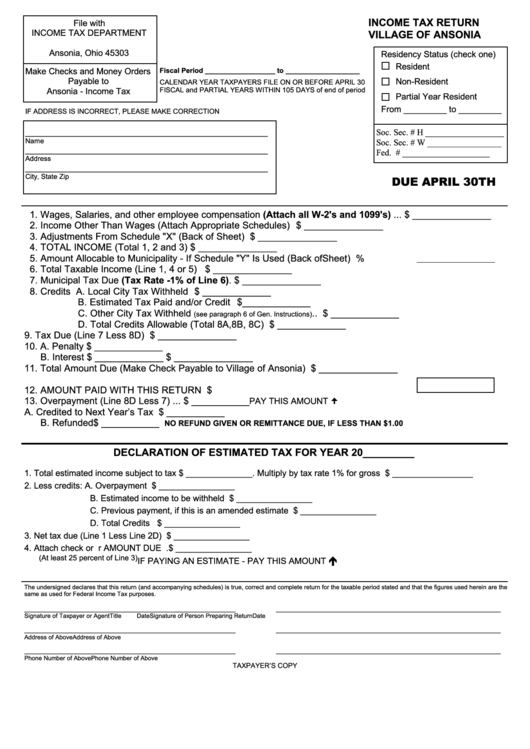

INCOME TAX RETURN

File with

INCOME TAX DEPARTMENT

VILLAGE OF ANSONIA

P.O. Box 607

Ansonia, Ohio 45303

Residency Status (check one)

Resident

Make Checks and Money Orders

Fiscal Period __________________ to ___________________

Payable to

Non-Resident

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 30

Ansonia - Income Tax

FISCAL and PARTIAL YEARS WITHIN 105 DAYS of end of period

Partial Year Resident

From _________ to _________

IF ADDRESS IS INCORRECT, PLEASE MAKE CORRECTION

___________________________________________________

Soc. Sec. # H __________________

Name

Soc. Sec. # W _________________

___________________________________________________

Fed. I.D. # ____________________

Address

___________________________________________________

City, State Zip

DUE APRIL 30TH

1. Wages, Salaries, and other employee compensation (Attach all W-2's and 1099's) ... $ _______________

2. Income Other Than Wages (Attach Appropriate Schedules) ......................................... $ _______________

3. Adjustments From Schedule "X" (Back of Sheet) .......................................................... $ _______________

4. TOTAL INCOME (Total 1, 2 and 3) ............................................................................... $ _______________

5. Amount Allocable to Municipality - If Schedule "Y" Is Used (Back of Sheet) .................

%

6. Total Taxable Income (Line 1, 4 or 5) ........................................................................... $ _______________

7. Municipal Tax Due (Tax Rate -1% of Line 6) ................................................................ $ _______________

8. Credits A. Local City Tax Withheld ............................................... $ _____________

B. Estimated Tax Paid and/or Credit ............................... $ _____________

C. Other City Tax Withheld

.. $ _____________

(see paragraph 6 of Gen. Instructions)

D. Total Credits Allowable (Total 8A,8B, 8C) .................. $ _____________

9. Tax Due (Line 7 Less 8D) ............................................................................................. $ _______________

10. A. Penalty $ _____________

B. Interest $ _____________ ........................................................................................ $ _______________

11. Total Amount Due (Make Check Payable to Village of Ansonia) ................................... $ _______________

12. AMOUNT PAID WITH THIS RETURN .......................................................................... $

13. Overpayment (Line 8D Less 7) ... $ ___________

PAY THIS AMOUNT

A. Credited to Next Year’s Tax .... $ ___________

B. Refunded ................................ $ ___________

NO REFUND GIVEN OR REMITTANCE DUE, IF LESS THAN $1.00

DECLARATION OF ESTIMATED TAX FOR YEAR 20_________

1. Total estimated income subject to tax $ ______________. Multiply by tax rate 1% for gross tax.....$ _________________

2. Less credits: A. Overpayment ....................................................................$ ________________

B. Estimated income to be withheld .....................................$ ________________

C. Previous payment, if this is an amended estimate ...........$ ________________

D. Total Credits ....................................................................$ ________________

3. Net tax due (Line 1 Less Line 2D) .................................................................................................. $ ________________

4. Attach check or M.O. for AMOUNT DUE ....................................................................................... $ ________________

(At least 25 percent of Line 3)

IF PAYING AN ESTIMATE - PAY THIS AMOUNT

The undersigned declares that this return (and accompanying schedules) is true, correct and complete return for the taxable period stated and that the figures used herein are the

same as used for Federal Income Tax purposes.

______________________________________________________________

__________________________________________________________________

Signature of Taxpayer or Agent

Title

Date

Signature of Person Preparing Return

Date

______________________________________________________________

__________________________________________________________________

Address of Above

Address of Above

______________________________________________________________

__________________________________________________________________

Phone Number of Above

Phone Number of Above

TAXPAYER’S COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2