Declaration Of Estimated Pandora Income Tax Form - Village Of Pandora

ADVERTISEMENT

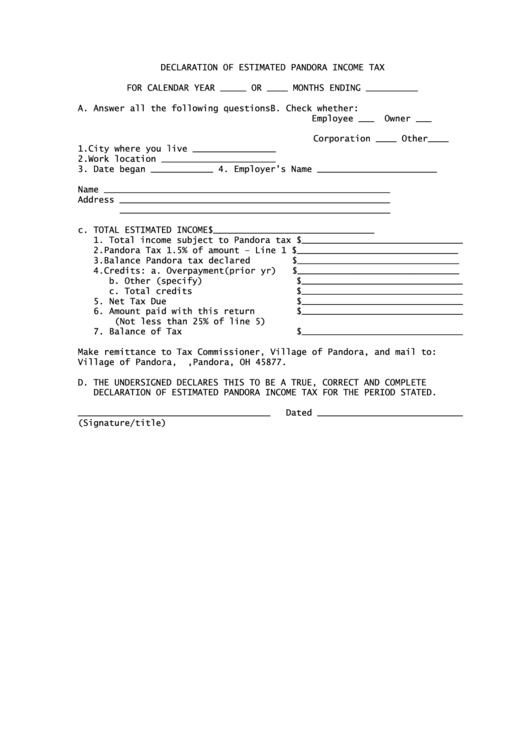

DECLARATION OF ESTIMATED PANDORA INCOME TAX

FOR CALENDAR YEAR _____ OR ____ MONTHS ENDING __________

A. Answer all the following questions

B. Check whether:

Employee ___

Owner ___

Corporation ____ Other____

1. City where you live ________________

2. Work location ______________________

3. Date began ____________ 4. Employer’s Name _______________________

Name _______________________________________________________

Address ____________________________________________________

____________________________________________________

c. TOTAL ESTIMATED INCOME

$_______________________________

1. Total income subject to Pandora tax $_______________________________

2. Pandora Tax 1.5% of amount – Line 1 $_______________________________

3. Balance Pandora tax declared

$_______________________________

4. Credits: a. Overpayment(prior yr)

$_______________________________

b. Other (specify)

$_______________________________

c. Total credits

$_______________________________

5. Net Tax Due

$_______________________________

6. Amount paid with this return

$_______________________________

(Not less than 25% of line 5)

7. Balance of Tax

$_______________________________

Make remittance to Tax Commissioner, Village of Pandora, and mail to:

Village of Pandora, P.O. Box 193, Pandora, OH 45877.

D. THE UNDERSIGNED DECLARES THIS TO BE A TRUE, CORRECT AND COMPLETE

DECLARATION OF ESTIMATED PANDORA INCOME TAX FOR THE PERIOD STATED.

_____________________________________

Dated ____________________________

(Signature/title)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1