Fayette Income Tax Form - Village Of Fayette

ADVERTISEMENT

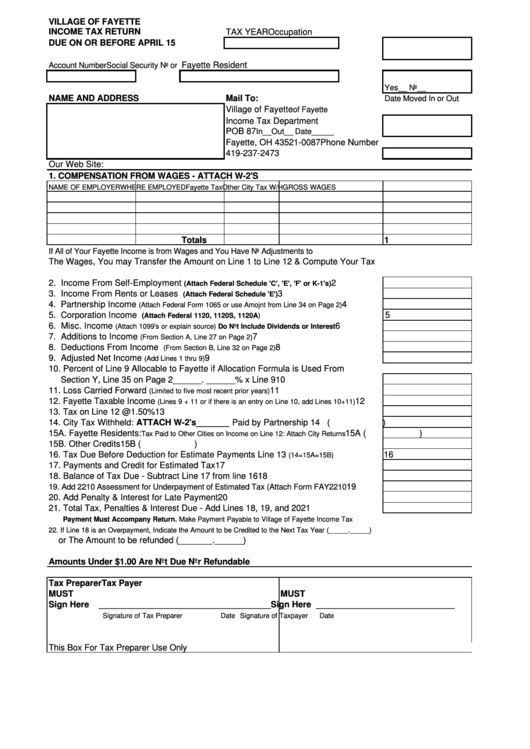

VILLAGE OF FAYETTE

INCOME TAX RETURN

TAX YEAR

Occupation

DUE ON OR BEFORE APRIL 15

Fayette Resident

Account Number

Social Security No or E.I.D. No

Yes__ No__

NAME AND ADDRESS

Mail To:

Date Moved In or Out

Village of Fayette

of Fayette

Income Tax Department

POB 87

In__Out__ Date_____

Fayette, OH 43521-0087

Phone Number

419-237-2473

Our Web Site:

1. COMPENSATION FROM WAGES - ATTACH W-2'S

NAME OF EMPLOYER

WHERE EMPLOYED

Fayette Tax

Other City Tax W/H

GROSS WAGES

Totals

1

If All of Your Fayette Income is from Wages and You Have No Adjustments to

The Wages, You may Transfer the Amount on Line 1 to Line 12 & Compute Your Tax

2. Income From Self-Employment

2

(Attach Federal Schedule 'C', 'E', 'F' or K-1's)

3. Income From Rents or Leases

3

(Attach Federal Schedule 'E')

4. Partnership Income

4

(Attach Federal Form 1065 or use Amojnt from Line 34 on Page 2)

5. Corporation Income

5

(Attach Federal 1120, 1120S, 1120A)

6. Misc. Income

6

(Attach 1099's or explain source) Do Not Include Dividends or Interest

7. Additions to Income

7

(From Section A, Line 27 on Page 2)

8. Deductions From Income

8

(From Section B, Line 32 on Page 2)

9. Adjusted Net Income

9

(Add Lines 1 thru 9)

10. Percent of Line 9 Allocable to Fayette if Allocation Formula is Used From

Section Y, Line 35 on Page 2______. ______% x Line 9

10

11. Loss Carried Forward

11

(Limited to five most recent prior years)

12. Fayette Taxable Income

12

(Lines 9 + 11 or if there is an entry on Line 10, add Lines 10+11)

13. Tax on Line 12 @1.50%

13

14. City Tax Withheld: ATTACH W-2's_______ Paid by Partnership

14 (

)

15A. Fayette Residents:

15A (

)

Tax Paid to Other Cities on Income on Line 12: Attach City Returns

15B. Other Credits

15B (

)

16. Tax Due Before Deduction for Estimate Payments Line 13

16

(14=15A=15B)

17. Payments and Credit for Estimated Tax

17

18. Balance of Tax Due - Subtract Line 17 from line 16

18

19

19. Add 2210 Assessment for Underpayment of Estimated Tax (Attach Form FAY2210

20. Add Penalty & Interest for Late Payment

20

21. Total Tax, Penalties & Interest Due - Add Lines 18, 19, and 20

21

Payment Must Accompany Return. Make Payment Payable to Village of Fayette Income Tax

22. If Line 18 is an Overpayment, Indicate the Amount to be Credited to the Next Tax Year (_____._____)

or The Amount to be refunded (_______.______)

Amounts Under $1.00 Are Not Due Nor Refundable

Tax Preparer

Tax Payer

MUST

MUST

Sign Here

____________________________________ Sign Here _____________________________

Signature of Tax Preparer

Date

Signature of Taxpayer

Date

This Box For Tax Preparer Use Only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2