Form W-1 - Monthly/quarterly Withholding Form

ADVERTISEMENT

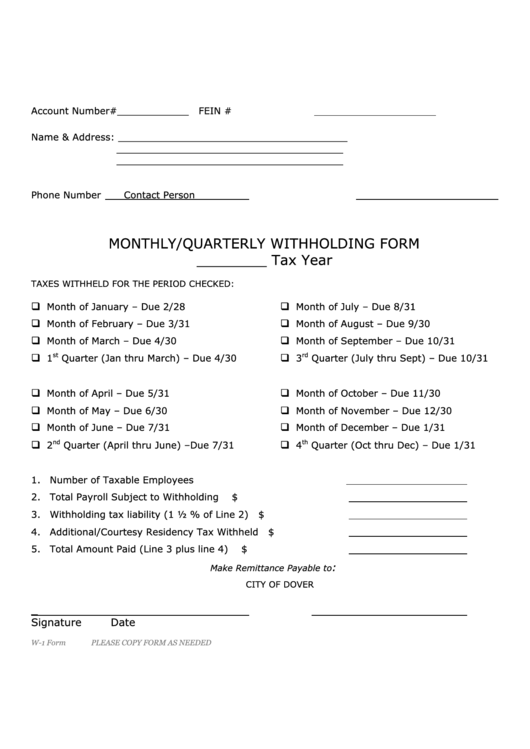

Account Number#____________

FEIN #

Name & Address: ______________________________________

______________________________________

______________________________________

Phone Number

Contact Person

MONTHLY/QUARTERLY WITHHOLDING FORM

________ Tax Year

TAXES WITHHELD FOR THE PERIOD CHECKED:

Month of January – Due 2/28

Month of July – Due 8/31

Month of February – Due 3/31

Month of August – Due 9/30

Month of March – Due 4/30

Month of September – Due 10/31

st

rd

1

Quarter (Jan thru March) – Due 4/30

3

Quarter (July thru Sept) – Due 10/31

Month of April – Due 5/31

Month of October – Due 11/30

Month of May – Due 6/30

Month of November – Due 12/30

Month of June – Due 7/31

Month of December – Due 1/31

nd

th

2

Quarter (April thru June) –Due 7/31

4

Quarter (Oct thru Dec) – Due 1/31

1. Number of Taxable Employees

2. Total Payroll Subject to Withholding

$

3. Withholding tax liability (1 ½ % of Line 2)

$

4. Additional/Courtesy Residency Tax Withheld

$

5. Total Amount Paid (Line 3 plus line 4)

$

:

Make Remittance Payable to

CITY OF DOVER

_

Signature

Date

W-1 Form

PLEASE COPY FORM AS NEEDED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1