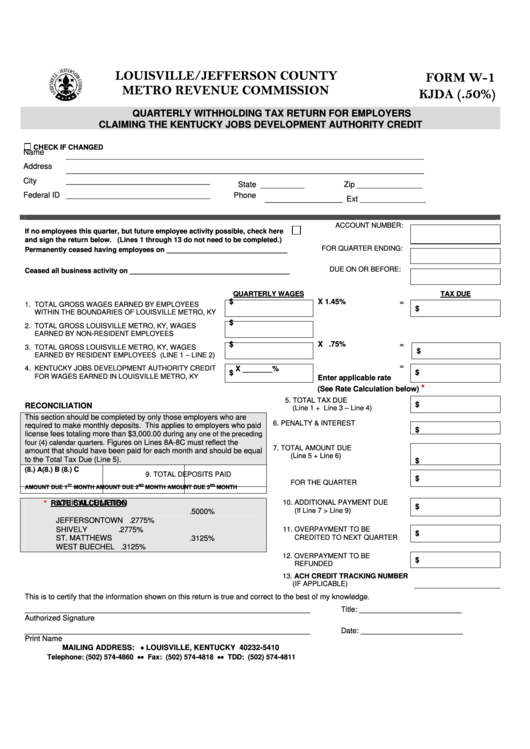

LOUISVILLE/JEFFERSON COUNTY

1

FORM W-

METRO REVENUE COMMISSION

.50

KJDA (

%)

QUARTERLY WITHHOLDING TAX RETURN FOR EMPLOYERS

CLAIMING THE KENTUCKY JOBS DEVELOPMENT AUTHORITY CREDIT

CHECK IF CHANGED

Name

__________________________________________________________________________________

Address

__________________________________________________________________________________

City

_________________________________

State __________

Zip _______________

Ext

Federal ID _________________________________

Phone

____________________

_________________

If no employees this quarter, but future employee activity possible, check here

ACCOUNT NUMBER:

and sign the return below. (Lines 1 through 13 do not need to be completed.)

Permanently ceased having employees on _______________________________

FOR QUARTER ENDING:

Ceased all business activity on _________________________________________

DUE ON OR BEFORE:

QUARTERLY WAGES

TAX DUE

1. TOTAL GROSS WAGES EARNED BY EMPLOYEES

=

$

X 1.45%

$

WITHIN THE BOUNDARIES OF LOUISVILLE METRO, KY

2. TOTAL GROSS LOUISVILLE METRO, KY, WAGES

$

EARNED BY NON-RESIDENT EMPLOYEES

3. TOTAL GROSS LOUISVILLE METRO, KY, WAGES

$

$

=

X .75%

EARNED BY RESIDENT EMPLOYEES (LINE 1 – LINE 2)

4. KENTUCKY JOBS DEVELOPMENT AUTHORITY CREDIT

X _______%

$

$

=

FOR WAGES EARNED IN LOUISVILLE METRO, KY

Enter applicable rate

*

(See Rate Calculation below)

5. TOTAL TAX DUE

$

RECONCILIATION

(Line 1 + Line 3 – Line 4)

This section should be completed by only those employers who are

required to make monthly deposits. This applies to employers who paid

6. PENALTY & INTEREST

$

license fees totaling more than $3,000.00 during

any one of the preceding

Figures on Lines 8A-8C must reflect the

four (4) calendar quarters.

7. TOTAL AMOUNT DUE

amount that should have been paid for each month and should be equal

(Line 5 + Line 6)

to the Total Tax Due (Line 5).

$

(8.) A

(8.) B

(8.) C

9. TOTAL DEPOSITS PAID

$

FOR THE QUARTER

ST

ND

RD

AMOUNT DUE 1

MONTH

AMOUNT DUE 2

MONTH

AMOUNT DUE 3

MONTH

10. ADDITIONAL PAYMENT DUE

*

RATE CALCULATION

$

(If Line 7 > Line 9)

LOUISVILLE METRO

.5000%

JEFFERSONTOWN

.2775%

SHIVELY

.2775%

11. OVERPAYMENT TO BE

$

CREDITED TO NEXT QUARTER

ST. MATTHEWS

.3125%

WEST BUECHEL

.3125%

12. OVERPAYMENT TO BE

$

REFUNDED

13. ACH CREDIT TRACKING NUMBER

(IF APPLICABLE)

This is to certify that the information shown on this return is true and correct to the best of my knowledge.

___________________________________________________________________

Title: ________________________

Authorized Signature

___________________________________________________________________

Date: ________________________

Print Name

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 • • Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1 2

2 3

3 4

4