DUALTT-AONM-YRXY-MOHJ-EUJY

A

D

R

LABAMA

EPARTMENT OF

EVENUE

I

C

T

D

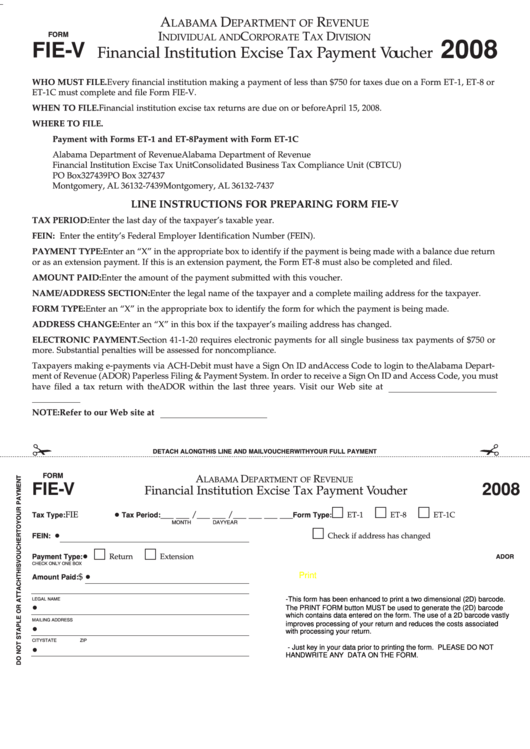

FORM

NDIVIDUAL AND

ORPORATE

AX

IVISION

2008

FIE-V

Financial Institution Excise Tax Payment Voucher

WHO MUST FILE. Every financial institution making a payment of less than $750 for taxes due on a Form ET-1, ET-8 or

ET-1C must complete and file Form FIE-V.

WHEN TO FILE. Financial institution excise tax returns are due on or before April 15, 2008.

WHERE TO FILE.

Payment with Forms ET-1 and ET-8

Payment with Form ET-1C

Alabama Department of Revenue

Alabama Department of Revenue

Financial Institution Excise Tax Unit

Consolidated Business Tax Compliance Unit (CBTCU)

PO Box 327439

PO Box 327437

Montgomery, AL 36132-7439

Montgomery, AL 36132-7437

LINE INSTRUCTIONS FOR PREPARING FORM FIE-V

TAX PERIOD: Enter the last day of the taxpayer’s taxable year.

FEIN: Enter the entity’s Federal Employer Identification Number (FEIN).

PAYMENT TYPE: Enter an “X” in the appropriate box to identify if the payment is being made with a balance due return

or as an extension payment. If this is an extension payment, the Form ET-8 must also be completed and filed.

AMOUNT PAID: Enter the amount of the payment submitted with this voucher.

NAME/ADDRESS SECTION: Enter the legal name of the taxpayer and a complete mailing address for the taxpayer.

FORM TYPE: Enter an “X” in the appropriate box to identify the form for which the payment is being made.

ADDRESS CHANGE: Enter an “X” in this box if the taxpayer’s mailing address has changed.

ELECTRONIC PAYMENT. Section 41-1-20 requires electronic payments for all single business tax payments of $750 or

more. Substantial penalties will be assessed for noncompliance.

Taxpayers making e-payments via ACH-Debit must have a Sign On ID and Access Code to login to the Alabama Depart-

ment of Revenue (ADOR) Paperless Filing & Payment System. In order to receive a Sign On ID and Access Code, you must

have filed a tax return with the ADOR within the last three years. Visit our Web site at

eservice.htm for additional information.

NOTE: Refer to our Web site at for tax payment and form preparation requirements.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FIE-V

2008

Financial Institution Excise Tax Payment Voucher

•

Tax Type: FIE

Tax Period: ___ ___ /___ ___ /___ ___ ___ ___

Form Type:

ET-1

ET-8

ET-1C

MONTH

DAY

YEAR

•

FEIN:

Check if address has changed

•

Payment Type:

Return

Extension

ADOR

CHECK ONLY ONE BOX

Print

Reset

•

Amount Paid: $

-This form has been enhanced to print a two dimensional (2D) barcode.

LEGAL NAME

•

The PRINT FORM button MUST be used to generate the (2D) barcode

which contains data entered on the form. The use of a 2D barcode vastly

MAILING ADDRESS

improves processing of your return and reduces the costs associated

•

with processing your return.

CITY

STATE

ZIP

- Just key in your data prior to printing the form. PLEASE DO NOT

•

HANDWRITE ANY DATA ON THE FORM.

1

1