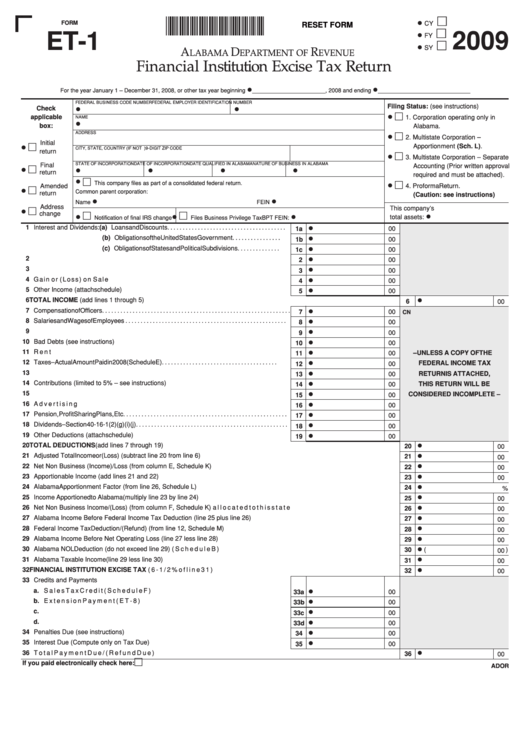

090001E1

• CY

FORM

RESET FORM

2009

ET-1

• FY

• SY

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Financial Institution Excise Tax Return

•

•

For the year January 1 – December 31, 2008, or other tax year beginning

_______________________, 2008 and ending

_____________________________

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Filing Status: (see instructions)

Check

•

•

•

applicable

1. Corporation operating only in

NAME

•

box:

Alabama.

ADDRESS

•

2. Multistate Corporation –

Initial

Apportionment (Sch. L).

•

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

return

•

3. Multistate Corporation – Separate

Final

STATE OF INCORPORATION

DATE OF INCORPORATION

DATE QUALIFIED IN ALABAMA

NATURE OF BUSINESS IN ALABAMA

Accounting (Prior written approval

•

•

•

•

•

return

required and must be attached).

•

This company files as part of a consolidated federal return.

•

Amended

4. Proforma Return.

•

Common parent corporation:

return

(Caution: see instructions)

•

•

Name

FEIN

Address

This company’s

•

change

total assets: •

•

•

•

Notification of final IRS change

Files Business Privilege Tax BPT FEIN:

1 Interest and Dividends: (a) Loans and Discounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

1a

00

(b) Obligations of the United States Government. . . . . . . . . . . . . . . .

•

1b

00

(c) Obligations of States and Political Subdivisions. . . . . . . . . . . . . .

•

1c

00

2 Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

2

00

3 Rental Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

3

00

4 Gain or (Loss) on Sale of Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

4

00

5 Other Income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

5

00

•

6 TOTAL INCOME (add lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Compensation of Officers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

7

00

CN

8 Salaries and Wages of Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

8

00

9 Repairs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

9

00

10 Bad Debts (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

10

00

11 Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

– UNLESS A COPY OF THE

11

00

12 Taxes – Actual Amount Paid in 2008 (Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

FEDERAL INCOME TAX

12

00

13 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

RETURN IS ATTACHED,

13

00

14 Contributions (limited to 5% – see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

THIS RETURN WILL BE

14

00

15 Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

CONSIDERED INCOMPLETE –

15

00

16 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

16

00

17 Pension, Profit Sharing Plans, Etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

17

00

18 Dividends – Section 40-16-1(2)(g)(i)(j). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

18

00

19 Other Deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

19

00

•

20 TOTAL DEDUCTIONS (add lines 7 through 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

•

21 Adjusted Total Income or (Loss) (subtract line 20 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

•

22 Net Non Business (Income)/Loss (from column E, Schedule K) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

•

23 Apportionable Income (add lines 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

•

24 Alabama Apportionment Factor (from line 26, Schedule L). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

%

•

25 Income Apportioned to Alabama (multiply line 23 by line 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

•

26 Net Non Business Income/(Loss) (from column F, Schedule K) allocated to this state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

•

27 Alabama Income Before Federal Income Tax Deduction (line 25 plus line 26). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

•

28 Federal Income Tax Deduction/(Refund) (from line 12, Schedule M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

•

29 Alabama Income Before Net Operating Loss (line 27 less line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

00

•

30 Alabama NOL Deduction (do not exceed line 29) (Schedule B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

(

)

00

•

31 Alabama Taxable Income (line 29 less line 30). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

00

•

32 FINANCIAL INSTITUTION EXCISE TAX (6-1/2% of line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

00

33 Credits and Payments

a. Sales Tax Credit (Schedule F). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

33a

00

b. Extension Payment (ET-8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

33b

00

c. Additional Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

33c

00

d. Total Credits and Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

33d

00

34 Penalties Due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

34

00

35 Interest Due (Compute only on Tax Due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

35

00

•

36 Total Payment Due/(Refund Due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

00

ADOR

If you paid electronically check here:

1

1 2

2 3

3 4

4