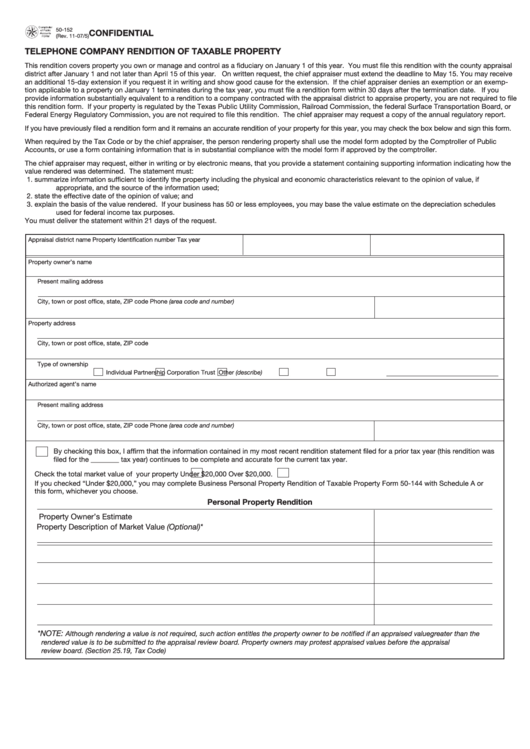

50-152

CONFIDENTIAL

(Rev. 11-07/5)

TELEPHONE COMPANY RENDITION OF TAXABLE PROPERTY

This rendition covers property you own or manage and control as a fiduciary on January 1 of this year. You must file this rendition with the county appraisal

district after January 1 and not later than April 15 of this year. On written request, the chief appraiser must extend the deadline to May 15. You may receive

an additional 15-day extension if you request it in writing and show good cause for the extension. If the chief appraiser denies an exemption or an exemp-

tion applicable to a property on January 1 terminates during the tax year, you must file a rendition form within 30 days after the termination date. If you

provide information substantially equivalent to a rendition to a company contracted with the appraisal district to appraise property, you are not required to file

this rendition form. If your property is regulated by the Texas Public Utility Commission, Railroad Commission, the federal Surface Transportation Board, or

Federal Energy Regulatory Commission, you are not required to file this rendition. The chief appraiser may request a copy of the annual regulatory report.

If you have previously filed a rendition form and it remains an accurate rendition of your property for this year, you may check the box below and sign this form.

When required by the Tax Code or by the chief appraiser, the person rendering property shall use the model form adopted by the Comptroller of Public

Accounts, or use a form containing information that is in substantial compliance with the model form if approved by the comptroller.

The chief appraiser may request, either in writing or by electronic means, that you provide a statement containing supporting information indicating how the

value rendered was determined. The statement must:

1.

summarize information sufficient to identify the property including the physical and economic characteristics relevant to the opinion of value, if

appropriate, and the source of the information used;

2.

state the effective date of the opinion of value; and

3.

explain the basis of the value rendered. If your business has 50 or less employees, you may base the value estimate on the depreciation schedules

used for federal income tax purposes.

You must deliver the statement within 21 days of the request.

Appraisal district name

Property Identification number

Tax year

Property owner’s name

Present mailing address

City, town or post office, state, ZIP code

Phone (area code and number)

Property address

City, town or post office, state, ZIP code

Type of ownership

Individual

Partnership

Corporation

Trust

Other (describe)

Authorized agent’s name

Present mailing address

City, town or post office, state, ZIP code

Phone (area code and number)

By checking this box, I affirm that the information contained in my most recent rendition statement filed for a prior tax year (this rendition was

filed for the ________ tax year) continues to be complete and accurate for the current tax year.

Check the total market value of your property

Under $20,000

Over $20,000.

If you checked “Under $20,000,” you may complete Business Personal Property Rendition of Taxable Property Form 50-144 with Schedule A or

this form, whichever you choose.

Personal Property Rendition

Property Owner’s Estimate

Property Description

of Market Value (Optional)*

*NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised valuegreater than the

rendered value is to be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal

review board. (Section 25.19, Tax Code)

1

1 2

2