50-152 (Rev. 11-07/5) (Back)

Real Property Rendition

Property Owner’s Estimate

Property Description

of Market Value (Optional)*

NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value

greater than the rendered value is to be submitted to the appraisal review board. Property owners may protest appraised

values before the appraisal review board. (Section 25.19, Tax Code)

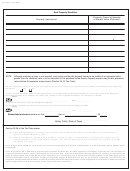

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated entity of the prop-

erty owner?

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your

knowledge and belief. If you checked “Yes” above, sign and date on the first signature line below. No notarization is required.

Signature

_________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

Signature

__________________________________________________________________ Date _________________

Subscribed and sworn before me this ____________day of ____________________________, 20______.

__________________________________________________________

Notary Public, State of Texas

Section 22.26 of the Tax Code states:

(a)

Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is

required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has

been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must sign

the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10,

Penal Code.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to

10 percent of the total taxes due on the property for the current year. If the court determines that you filed a false rendition or report with the

intent to commit fraud or to evade the tax or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser any

altered or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an

inspection, investigation determination, or other proceeding before the appraisal district, the chief appraiser must impose an additional penalty

equal to 50 percent of the total taxes due on the property for the current year.

1

1 2

2