Subcontractor'S Statement Regarding Workers Compensation, Pay-Roll Tax And Remuneration Form

ADVERTISEMENT

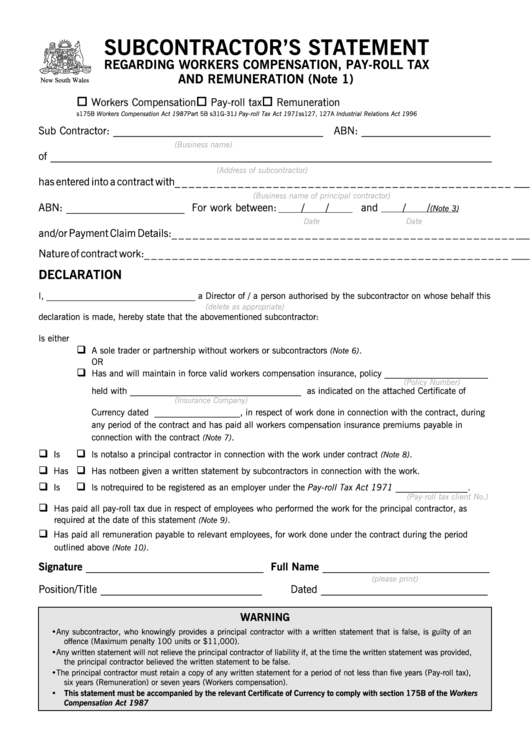

SUBCONTRACTOR’S STATEMENT

REGARDING WORKERS COMPENSATION, PAY-ROLL TAX

AND REMUNERATION (Note 1)

New South Wales

Workers Compensation

Pay-roll tax

Remuneration

s175B Workers Compensation Act 1987

Part 5B s31G-31J Pay-roll Tax Act 1971

ss127, 127A Industrial Relations Act 1996

Sub Contractor: _______________________________________ ABN: ________________________

(Business name)

of __________________________________________________________________________________

(Address of subcontractor)

has entered into a contract with_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Note 2)

(Business name of principal contractor)

ABN: ______________________ For work between:

/

/

and

/

/

(Note 3)

Date

Date

and/or Payment Claim Details: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Note 4)

Nature of contract work: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Note 5)

DECLARATION

I, _________________________________ a Director of / a person authorised by the subcontractor on whose behalf this

(delete as appropriate)

declaration is made, hereby state that the abovementioned subcontractor:

Is either

A sole trader or partnership without workers or subcontractors

.

(Note 6)

OR

Has and will maintain in force valid workers compensation insurance, policy _______________________

(Policy Number)

held with ______________________________________ as indicated on the attached Certificate of

(Insurance Company)

Currency dated ___________________, in respect of work done in connection with the contract, during

any period of the contract and has paid all workers compensation insurance premiums payable in

connection with the contract

.

(Note 7)

Is

Is not

also a principal contractor in connection with the work under contract

.

(Note 8)

Has

Has not

been given a written statement by subcontractors in connection with the work.

Is

Is not

required to be registered as an employer under the Pay-roll Tax Act 1971 ________________.

(Pay-roll tax client No.)

Has paid all pay-roll tax due in respect of employees who performed the work for the principal contractor, as

required at the date of this statement

.

(Note 9)

Has paid all remuneration payable to relevant employees, for work done under the contract during the period

outlined above

.

(Note 10)

Signature _________________________________ Full Name _______________________________

(please print)

Position/Title ______________________________

Dated _______________________________

WARNING

• Any subcontractor, who knowingly provides a principal contractor with a written statement that is false, is guilty of an

offence (Maximum penalty 100 units or $11,000).

• Any written statement will not relieve the principal contractor of liability if, at the time the written statement was provided,

the principal contractor believed the written statement to be false.

• The principal contractor must retain a copy of any written statement for a period of not less than five years (Pay-roll tax),

six years (Remuneration) or seven years (Workers compensation).

• This statement must be accompanied by the relevant Certificate of Currency to comply with section 175B of the Workers

Compensation Act 1987

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2