Form It-Tw - Teleworking Approval Form

ADVERTISEMENT

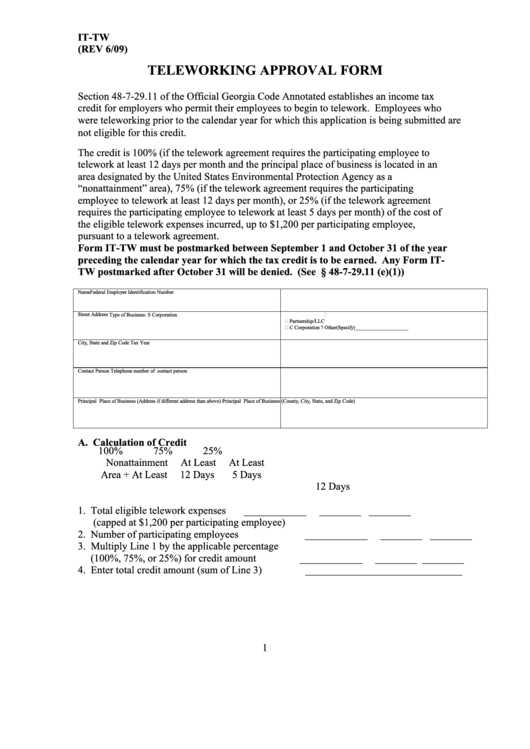

IT-TW

(REV 6/09)

TELEWORKING APPROVAL FORM

Section 48-7-29.11 of the Official Georgia Code Annotated establishes an income tax

credit for employers who permit their employees to begin to telework. Employees who

were teleworking prior to the calendar year for which this application is being submitted are

not eligible for this credit.

The credit is 100% (if the telework agreement requires the participating employee to

telework at least 12 days per month and the principal place of business is located in an

area designated by the United States Environmental Protection Agency as a

“nonattainment” area), 75% (if the telework agreement requires the participating

employee to telework at least 12 days per month), or 25% (if the telework agreement

requires the participating employee to telework at least 5 days per month) of the cost of

the eligible telework expenses incurred, up to $1,200 per participating employee,

pursuant to a telework agreement.

Form IT-TW must be postmarked between September 1 and October 31 of the year

preceding the calendar year for which the tax credit is to be earned. Any Form IT-

TW postmarked after October 31 will be denied. (See O.C.G.A. § 48-7-29.11 (e)(1))

Name

Federal Employer Identification Number

Street Address

Type of Business:

S Corporation

Partnership/LLC

C Corporation ? Other(Specify)____________________

City, State and Zip Code

Tax Year

Contact Person

Telephone number of contact person

Principal Place of Business (Address if different address than above)

Principal Place of Business (County, City, State, and Zip Code)

A. Calculation of Credit

100%

75%

25%

Nonattainment

At Least

At Least

Area + At Least

12 Days

5 Days

12 Days

1. Total eligible telework expenses

____________

________ ________

(capped at $1,200 per participating employee)

2. Number of participating employees

____________

________ ________

3. Multiply Line 1 by the applicable percentage

(100%, 75%, or 25%) for credit amount

____________

________ ________

4. Enter total credit amount (sum of Line 3)

______________________________

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3