Instructions For Use General Sales & Use Tax Form

ADVERTISEMENT

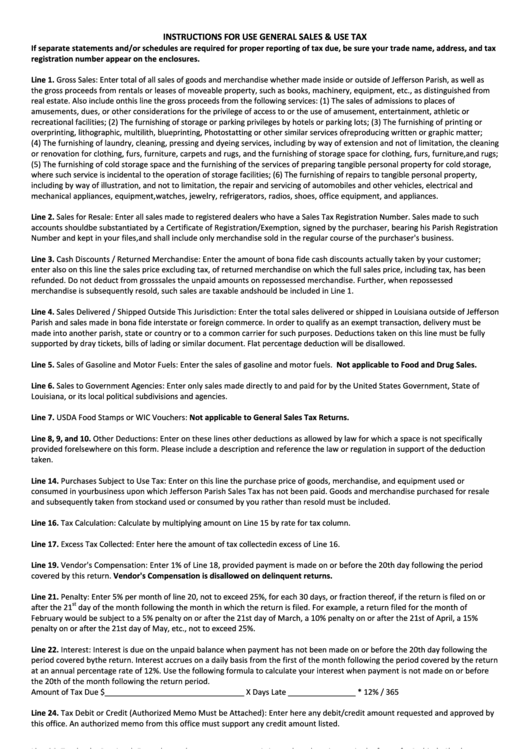

INSTRUCTIONS FOR USE GENERAL SALES & USE TAX

If separate statements and/or schedules are required for proper reporting of tax due, be sure your trade name, address, and tax

registration number appear on the enclosures.

Line 1. Gross Sales: Enter total of all sales of goods and merchandise whether made inside or outside of Jefferson Parish, as well as

the gross proceeds from rentals or leases of moveable property, such as books, machinery, equipment, etc., as distinguished from

real estate. Also include on this line the gross proceeds from the following services: (1) The sales of admissions to places of

amusements, dues, or other considerations for the privilege of access to or the use of amusement, entertainment, athletic or

recreational facilities; (2) The furnishing of storage or parking privileges by hotels or parking lots; (3) The furnishing of printing or

overprinting, lithographic, multilith, blueprinting, Photostatting or other similar services of reproducing written or graphic matter;

(4) The furnishing of laundry, cleaning, pressing and dyeing services, including by way of extension and not of limitation, the cleaning

or renovation for clothing, furs, furniture, carpets and rugs, and the furnishing of storage space for clothing, furs, furniture, and rugs;

(5) The furnishing of cold storage space and the furnishing of the services of preparing tangible personal property for cold storage,

where such service is incidental to the operation of storage facilities; (6) The furnishing of repairs to tangible personal property,

including by way of illustration, and not to limitation, the repair and servicing of automobiles and other vehicles, electrical and

mechanical appliances, equipment, watches, jewelry, refrigerators, radios, shoes, office equipment, and appliances.

Line 2. Sales for Resale: Enter all sales made to registered dealers who have a Sales Tax Registration Number. Sales made to such

accounts should be substantiated by a Certificate of Registration/Exemption, signed by the purchaser, bearing his Parish Registration

Number and kept in your files, and shall include only merchandise sold in the regular course of the purchaser's business.

Line 3. Cash Discounts / Returned Merchandise: Enter the amount of bona fide cash discounts actually taken by your customer;

enter also on this line the sales price excluding tax, of returned merchandise on which the full sales price, including tax, has been

refunded. Do not deduct from gross sales the unpaid amounts on repossessed merchandise. Further, when repossessed

merchandise is subsequently resold, such sales are taxable and should be included in Line 1.

Line 4. Sales Delivered / Shipped Outside This Jurisdiction: Enter the total sales delivered or shipped in Louisiana outside of Jefferson

Parish and sales made in bona fide interstate or foreign commerce. In order to qualify as an exempt transaction, delivery must be

made into another parish, state or country or to a common carrier for such purposes. Deductions taken on this line must be fully

supported by dray tickets, bills of lading or similar document. Flat percentage deduction will be disallowed.

Line 5. Sales of Gasoline and Motor Fuels: Enter the sales of gasoline and motor fuels. Not applicable to Food and Drug Sales.

Line 6. Sales to Government Agencies: Enter only sales made directly to and paid for by the United States Government, State of

Louisiana, or its local political subdivisions and agencies.

Line 7. USDA Food Stamps or WIC Vouchers: Not applicable to General Sales Tax Returns.

Line 8, 9, and 10. Other Deductions: Enter on these lines other deductions as allowed by law for which a space is not specifically

provided for elsewhere on this form. Please include a description and reference the law or regulation in support of the deduction

taken.

Line 14. Purchases Subject to Use Tax: Enter on this line the purchase price of goods, merchandise, and equipment used or

consumed in your business upon which Jefferson Parish Sales Tax has not been paid. Goods and merchandise purchased for resale

and subsequently taken from stock and used or consumed by you rather than resold must be included.

Line 16. Tax Calculation: Calculate by multiplying amount on Line 15 by rate for tax column.

Line 17. Excess Tax Collected: Enter here the amount of tax collected in excess of Line 16.

Line 19. Vendor's Compensation: Enter 1% of Line 18, provided payment is made on or before the 20th day following the period

covered by this return. Vendor's Compensation is disallowed on delinquent returns.

Line 21. Penalty: Enter 5% per month of line 20, not to exceed 25%, for each 30 days, or fraction thereof, if the return is filed on or

st

after the 21

day of the month following the month in which the return is filed. For example, a return filed for the month of

February would be subject to a 5% penalty on or after the 21st day of March, a 10% penalty on or after the 21st of April, a 15%

penalty on or after the 21st day of May, etc., not to exceed 25%.

Line 22. Interest: Interest is due on the unpaid balance when payment has not been made on or before the 20th day following the

period covered by the return. Interest accrues on a daily basis from the first of the month following the period covered by the return

at an annual percentage rate of 12%. Use the following formula to calculate your interest when payment is not made on or before

the 20th of the month following the return period.

Amount of Tax Due $_________________________________ X Days Late ________________ * 12% / 365

Line 24. Tax Debit or Credit (Authorized Memo Must be Attached): Enter here any debit/credit amount requested and approved by

this office. An authorized memo from this office must support any credit amount listed.

Line 26. Total to be Remitted: Enter the total amount you are remitting and send remittance in the form of a Cashier's Check,

Personal Check, or Money Order. Please do not send cash through the mail. You may also file online by following the links at

Timely filing when the 20th calendar day falls on Saturday, Sunday, or legal holiday: Unless otherwise specifically provided, when

th

the 20

calendar day falls on a Saturday, Sunday, or legal holiday, the report or return shall be considered timely if it is filed on the

next business day.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1