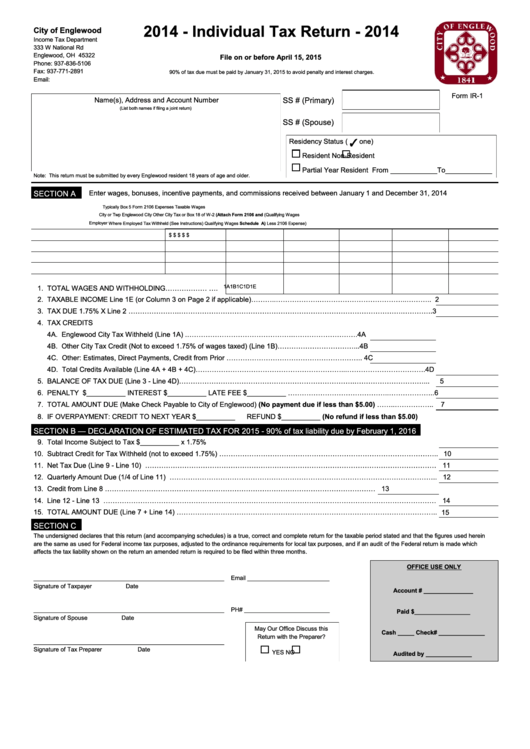

Form Ir-1 - Individual Tax Return - 2014

ADVERTISEMENT

2014 - Individual Tax Return - 2014

City of Englewood

Income Tax Department

333 W National Rd

Englewood, OH 45322

File on or before April 15, 2015

Phone:

937-836-5106

Fax:

937-771-2891

90% of tax due must be paid by January 31, 2015 to avoid penalty and interest charges.

Email:

tax@englewood.oh.us

Form IR-1

Name(s), Address and Account Number

SS # (Primary)

(List both names if filing a joint return)

SS # (Spouse)

Residency Status (

one)

Resident

Non-Resident

Partial Year Resident From ____________To____________

Note: This return must be submitted by every Englewood resident 18 years of age and older.

SECTION A

Enter wages, bonuses, incentive payments, and commissions received between January 1 and December 31, 2014

Typically Box 5

Form 2106 Expenses

Taxable Wages

City or Twp

Englewood City

Other City Tax

or Box 18 of W-2

(Attach Form 2106 and

(Qualifying Wages

Employer

Where Employed

Tax Withheld

(See Instructions)

Qualifying Wages

Schedule A)

Less 2106 Expense)

$

$

$

$

$

1A

1B

1C

1D

1E

1. TOTAL WAGES AND WITHHOLDING………………....….

2. TAXABLE INCOME Line 1E (or Column 3 on Page 2 if applicable)………..……………….………………………………..………..

2

3. TAX DUE 1.75% X Line 2 ………………….…………………………………………………………………………………….…………. 3

4. TAX CREDITS

4A. Englewood City Tax Withheld (Line 1A) .……………………………………….……………………….

4A

4B. Other City Tax Credit (Not to exceed 1.75% of wages taxed) (Line 1B)……………………………...

4B

4C. Other: Estimates, Direct Payments, Credit from Prior …………………………………………………..

4C

4D. Total Credits Available (Line 4A + 4B + 4C)………………………………………………………...…………………………….

4D

5. BALANCE OF TAX DUE (Line 3 - Line 4D)………………………………………………………………….…………………………...

5

6. PENALTY $__________ INTEREST $__________ LATE FEE $__________ ……………………………………..……………….. 6

7. TOTAL AMOUNT DUE (Make Check Payable to City of Englewood) (No payment due if less than $5.00) ……..……………..

7

8. IF OVERPAYMENT: CREDIT TO NEXT YEAR $__________

REFUND $__________ (No refund if less than $5.00)

SECTION B — DECLARATION OF ESTIMATED TAX FOR 2015 - 90% of tax liability due by February 1, 2016

9. Total Income Subject to Tax $__________ x 1.75%........................................................................................................................ 9

10. Subtract Credit for Tax Withheld (not to exceed 1.75%) ………………………………………………………………………………….. 10

11. Net Tax Due (Line 9 - Line 10) ……………………………………………………………………………………………………………… 11

12. Quarterly Amount Due (1/4 of Line 11) …………………………………………………………………………………………………….. 12

13. Credit from Line 8 ……………………………………………………………………………………………………… 13

14. Line 12 - Line 13 ……………………………………………………………………………………………………………………………… 14

15. TOTAL AMOUNT DUE (Line 7 + Line 14) …………………………………………………………………………………………………..

15

SECTION C

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein

are the same as used for Federal income tax purposes, adjusted to the ordinance requirements for local tax purposes, and if an audit of the Federal return is made which

affects the tax liability shown on the return an amended return is required to be filed within three months.

OFFICE USE ONLY

__________________________________________________________

Email _________________________

Signature of Taxpayer

Date

Account # _______________

__________________________________________________________

PH# __________________________

Paid $_________________

Signature of Spouse

Date

May Our Office Discuss this

Cash _____ Check# ______________

Return with the Preparer?

__________________________________________________________

Signature of Tax Preparer

Date

YES

NO

Audited by ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2