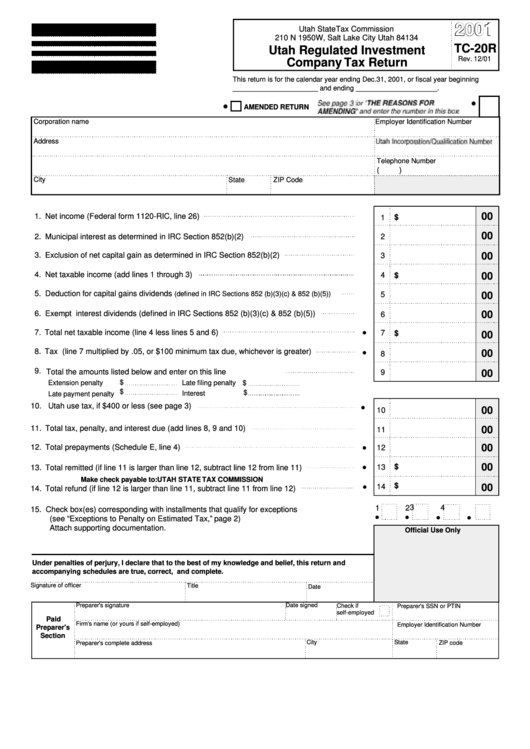

Form Tc-20r - Utah Regulated Investment Company Tax Return - 2001

ADVERTISEMENT

2001

Utah State Tax Commission

210 N 1950 W, Salt Lake City Utah 84134

TC-20R

Utah Regulated Investment

Rev. 12/01

Company Tax Return

This return is for the calendar year ending Dec. 31, 2001, or fiscal year beginning

______________________ and ending _____________________.

AMENDED RETURN

Corporation name

Employer Identification Number

Address

Telephone Number

(

)

City

State

ZIP Code

00

1. Net income (Federal form 1120-RIC, line 26)

$

1

00

2. Municipal interest as determined in IRC Section 852(b)(2)

2

3. Exclusion of net capital gain as determined in IRC Section 852(b)(2)

00

3

4. Net taxable income (add lines 1 through 3)

4

$

00

5. Deduction for capital gains dividends

(defined in IRC Sections 852 (b)(3)(c) & 852 (b)(5))

5

00

6. Exempt interest dividends (defined in IRC Sections 852 (b)(3)(c) & 852 (b)(5))

00

6

7. Total net taxable income (line 4 less lines 5 and 6)

7

$

00

8. Tax (line 7 multiplied by .05, or $100 minimum tax due, whichever is greater)

00

8

9.

Total the amounts listed below and enter on this line

9

00

$

Extension penalty

Late filing penalty

$

$

$

Interest

Late payment penalty

10.

Utah use tax, if $400 or less (see page 3)

00

10

11. Total tax, penalty, and interest due (add lines 8, 9 and 10)

00

11

12. Total prepayments (Schedule E, line 4)

00

12

00

13

$

13. Total remitted (if line 11 is larger than line 12, subtract line 12 from line 11)

Make check payable to: UTAH STATE TAX COMMISSION

$

14

00

14. Total refund (if line 12 is larger than line 11, subtract line 11 from line 12)

3

4

1

2

15. Check box(es) corresponding with installments that qualify for exceptions

(see “Exceptions to Penalty on Estimated Tax,” page 2)

Attach supporting documentation.

Official Use Only

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and

accompanying schedules are true, correct, and complete.

Signature of officer

Title

Date

Date signed

Preparer's signature

Check if

Preparer's SSN or PTIN

self-employed

Paid

Firm's name (or yours if self-employed)

Employer Identification Number

Preparer's

Section

City

State

Preparer's complete address

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2