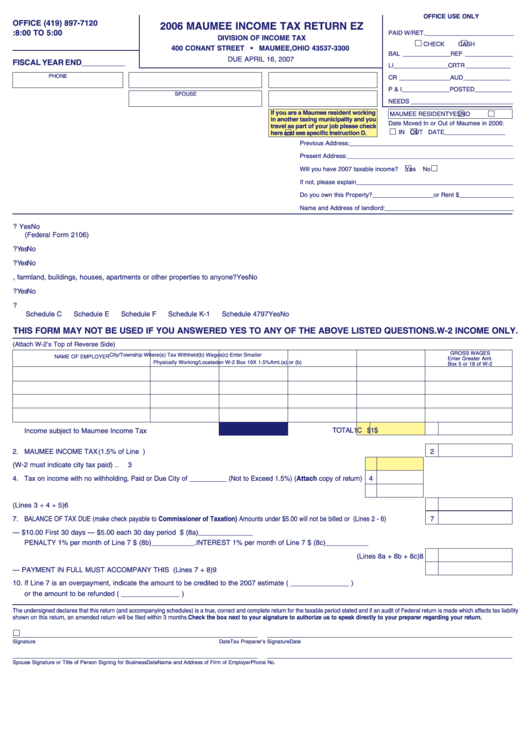

Maumee Income Tax Return Ez Division Of Income Tax Form - 2006

ADVERTISEMENT

OFFICE USE ONLY

OFFICE (419) 897-7120

2006 MAUMEE INCOME TAX RETURN EZ

MON. THRU FRI.: 8:00 TO 5:00

PAID W/RET.__________________________

DIVISION OF INCOME TAX

CHECK

CASH

400 CONANT STREET • MAUMEE, OHIO 43537-3300

BAL ______________REF ______________

DUE APRIL 16, 2007

FISCAL YEAR END __________

LI ________________CRTR _____________

PHONE NUMBER

S.S. NO. or E.I.D. NO.

OCCUPATION

CR _______________AUD ______________

P & I ______________POSTED___________

SPOUSE S.S. NO.

OCCUPATION

NEEDS ______________________________

If you are a Maumee resident working

MAUMEE RESIDENT

YES

NO

in another taxing municipality and you

Date Moved In or Out of Maumee in 2006:

travel as part of your job please check

IN

OUT DATE___________________

here

and see specific Instruction D.

Previous Address: ________________________________________________

Present Address:_________________________________________________

Will you have 2007 taxable income?

Yes

No

If not, please explain ______________________________________________

Do you own this Property?__________________or Rent $________________

Name and Address of landlord:______________________________________

1. Did you claim a deduction for un-reimbursed employee business expenses?

Yes

No

(Federal Form 2106)

2. Did you own or operate a business?

Yes

No

3. Were you a partner or shareholder in a business?

Yes

No

4. Did you rent land, farmland, buildings, houses, apartments or other properties to anyone?

Yes

No

5. Did you receive a Federal Form 1099-Misc?

Yes

No

6. Did you file any of the following forms with your Federal return?

Schedule C

Schedule E

Schedule F

Schedule K-1

Schedule 4797

Yes

No

THIS FORM MAY NOT BE USED IF YOU ANSWERED YES TO ANY OF THE ABOVE LISTED QUESTIONS. W-2 INCOME ONLY.

1. Compensation from Wages (Attach W-2’s Top of Reverse Side)

GROSS WAGES

City/Township Where

(a) Tax Withheld

(b) Wages

(c) Enter Smaller

NAME OF EMPLOYER

Enter Greater Amt.

Physically Working/Located

on W-2 Box 19

X 1.5%

Amt. (a) or (b)

Box 5 or 18 of W-2

TOTAL 1C $

1

$

Income subject to Maumee Income Tax

2. MAUMEE INCOME TAX (1.5% of Line 1. This line must be completed whether or not you work or pay taxes to the City of Maumee)

2

3. Total withholding credits per Column 1c above (W-2 must indicate city tax paid)................................................

3

4. Tax on income with no withholding, Paid or Due City of __________ (Not to Exceed 1.5%) (Attach copy of return)

4

5. Estimated tax payments and prior year overpayments.........................................................................................

5

6. TOTAL CREDITS ......................................................................................................................................................(Lines 3 + 4 + 5)

6

7. BALANCE OF TAX DUE (make check payable to Commissioner of Taxation) Amounts under $5.00 will not be billed or refunded.........(Lines 2 - 6)

7

8. LATE FILING FEE — $10.00 First 30 days — $5.00 each 30 day period thereafter ....................................$ (8a)______________

PENALTY 1% per month of Line 7 $ (8b)___________. INTEREST 1% per month of Line 7 $ (8c)___________

(Lines 8a + 8b + 8c)

8

9. TOTAL AMOUNT DUE — PAYMENT IN FULL MUST ACCOMPANY THIS RETURN ...................................................(Lines 7 + 8)

9

10. If Line 7 is an overpayment, indicate the amount to be credited to the 2007 estimate ( _______________ )

or the amount to be refunded ( _______________ )

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and if an audit of Federal return is made which affects tax liability

shown on this return, an amended return will be filed within 3 months. Check the box next to your signature to authorize us to speak directly to your preparer regarding your return.

Signature

Date

Tax Preparer’s Signature

Date

Spouse Signature or Title of Person Signing for Business

Date

Name and Address of Firm of Employer

Phone No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1