R865-19S-43. Sales to or by Religious and Charitable Institutions Pursuant to Utah Code §59-12-104.

A.

In order to qualify for an exemption from sales tax as a religious or charitable institution, an organization must be recognized by the

Internal Revenue Service as exempt from tax under Section 501(c)(3) of the Internal Revenue Code.

B.

Religious and charitable institutions must collect sales tax on any sales income arising from unrelated trades or businesses and

report that sales tax to the Tax Commission unless the sales are otherwise exempted by law.

1.

The definition of the phrase "unrelated trades or businesses" shall be the definition of that phrase in 26 U.S.C.A. Section 513

(West Supp. 1993), which is adopted and incorporated by reference.

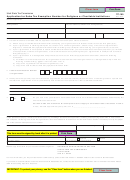

C. Every institution claiming exemption from sales tax under this rule must submit form TC-160, Application for Sales Tax Exemption

Number for Religious or Charitable Institutions, along with any other information that form requires, to the Tax Commission for its

determination. Vendors making sales to institutions exempt from sales tax are subject to the requirements of Rule R865-19S-23.

Internal Revenue Code (IRC) Section 501(c)(3)

Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific,

testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no

part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part

of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is

carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in subsection (h)), and which

does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in

opposition to) any candidate for public office.

IRS 501(c)(3) Determination Letter Exceptions

Internal Revenue Code (IRC) Section 508(c)(1), Special Rules with Respect to Section 501(c)(3) Organizations, exempts the following

organizations from obtaining a 501(c)(3) determination letter:

• churches, their integrated auxiliaries, and conventions or associations of churches, or

• any organization which is not a private foundation (as defined in section 509(a)) and the gross receipts of which in each taxable

year are normally not more than $5,000.

Organizations meeting this exemption, that do not have an IRS determination letter, must attach other documentation such as Articles

of Incorporation, Articles of Organization, bylaws or other evidence to verify they are exempt from tax under IRC Section 501(c)(3).

1

1 2

2