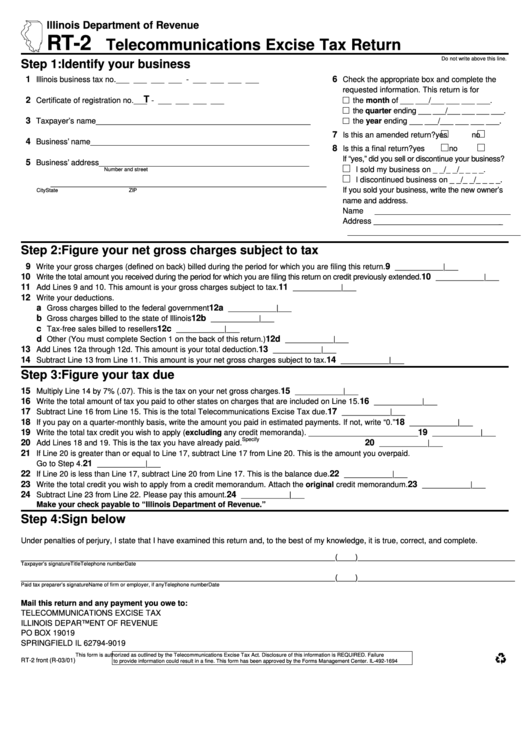

Form Rt-2 - Telecommunications Excise Tax Return

ADVERTISEMENT

Illinois Department of Revenue

RT-2

Telecommunications Excise Tax Return

Do not write above this line.

Step 1: Identify your business

1

6

Illinois business tax no.

___ ___ ___ ___ - ___ ___ ___ ___

Check the appropriate box and complete the

requested information. This return is for

T

2

Certificate of registration no. ___ - ___ ___ ___ ___

the month of ___ ___/___ ___ ___ ___.

the quarter ending ___ ___/___ ___ ___ ___.

3

Taxpayer’s name

_________________________________________________

the year ending ___ ___/___ ___ ___ ___.

7

Is this an amended return?

yes

no

4

Business’ name

__________________________________________________

8

Is this a final return?

yes

no

If “yes,” did you sell or discontinue your business?

5

Business’ address

________________________________________________

I sold my business on _ _/_ _/_ _ _ _.

Number and street

I discontinued business on _ _/_ _/_ _ _ _.

_______________________________________________________________

If you sold your business, write the new owner’s

City

State

ZIP

name and address.

Name

_______________________________

Address ______________________________

______________________________________________________

Step 2: Figure your net gross charges subject to tax

9

9

Write your gross charges (defined on back) billed during the period for which you are filing this return.

___________|___

10

10

Write the total amount you received during the period for which you are filing this return on credit previously extended.

___________|___

11

11

Add Lines 9 and 10. This amount is your gross charges subject to tax.

___________|___

12

Write your deductions.

a

12a

Gross charges billed to the federal government

___________|___

b

12b

Gross charges billed to the state of Illinois

___________|___

c

12c

Tax-free sales billed to resellers

___________|___

d

12d

Other (You must complete Section 1 on the back of this return.)

___________|___

13

13

Add Lines 12a through 12d. This amount is your total deduction.

___________|___

14

14

Subtract Line 13 from Line 11. This amount is your net gross charges subject to tax.

___________|___

Step 3: Figure your tax due

15

15

Multiply Line 14 by 7% (.07). This is the tax on your net gross charges.

___________|___

16

16

Write the total amount of tax you paid to other states on charges that are included on Line 15.

___________|___

17

17

Subtract Line 16 from Line 15. This is the total Telecommunications Excise Tax due.

___________|___

18

18

If you pay on a quarter-monthly basis, write the amount you paid in estimated payments. If not, write “0.”

___________|___

19

19

Write the total tax credit you wish to apply (excluding any credit memoranda). _________________________

___________|___

Specify

20

20

Add Lines 18 and 19. This is the tax you have already paid.

___________|___

21

If Line 20 is greater than or equal to Line 17, subtract Line 17 from Line 20. This is the amount you overpaid.

21

Go to Step 4.

___________|___

22

22

If Line 20 is less than Line 17, subtract Line 20 from Line 17. This is the balance due.

___________|___

23

23

Write the total credit you wish to apply from a credit memorandum. Attach the original credit memorandum.

___________|___

24

24

Subtract Line 23 from Line 22. Please pay this amount.

___________|___

Make your check payable to “Illinois Department of Revenue.”

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

________________________________________________________________________(____)____________________________________

Taxpayer’s signature

Title

Telephone number

Date

________________________________________________________________________(____)____________________________________

Paid tax preparer’s signature

Name of firm or employer, if any

Telephone number

Date

Mail this return and any payment you owe to:

TELECOMMUNICATIONS EXCISE TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

This form is authorized as outlined by the Telecommunications Excise Tax Act. Disclosure of this information is REQUIRED. Failure

RT-2 front (R-03/01)

to provide information could result in a fine. This form has been approved by the Forms Management Center. IL-492-1694

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1