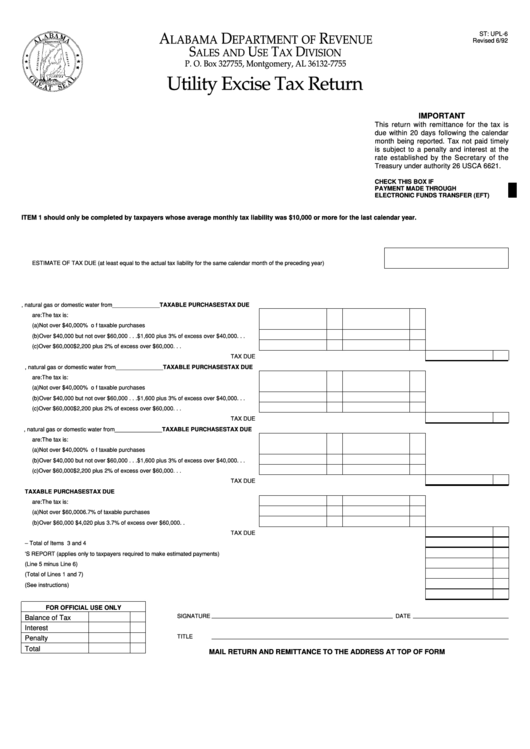

Form Upl-6 - Utility Excise Tax Return

ADVERTISEMENT

A

D

R

ST: UPL-6

LABAMA

EPARTMENT OF

EVENUE

Revised 6/92

S

U

T

D

ALES AND

SE

AX

IVISION

P. O. Box 327755, Montgomery, AL 36132-7755

Utility Excise Tax Return

IMPORTANT

This return with remittance for the tax is

due within 20 days following the calendar

month being reported. Tax not paid timely

is subject to a penalty and interest at the

rate established by the Secretary of the

Treasury under authority 26 USCA 6621.

CHECK THIS BOX IF

PAYMENT MADE THROUGH

ELECTRONIC FUNDS TRANSFER (EFT)

ITEM 1 should only be completed by taxpayers whose average monthly tax liability was $10,000 or more for the last calendar year.

1. ESTIMATE FOR CURRENT MONTH OF __________________________________________________________________ 19 ________

ESTIMATE OF TAX DUE (at least equal to the actual tax liability for the same calendar month of the preceding year) . . . . . . . . . . . . . . . . .

2. REPORT FOR PRECEDING MONTH OF __________________________________________________________________ 19 ________

3A. If taxable purchases of electricity, natural gas or domestic water from _______________

TAXABLE PURCHASES

TAX DUE

are:

The tax is:

(a) Not over $40,000 . . . . . . . . . . . . . . . . . 4% of taxable purchases . . . . . . . . . . . . . . .

(b) Over $40,000 but not over $60,000 . . . $1,600 plus 3% of excess over $40,000 . . .

(c) Over $60,000 . . . . . . . . . . . . . . . . . . . . $2,200 plus 2% of excess over $60,000 . . .

TAX DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. If taxable purchases of electricity, natural gas or domestic water from _______________

TAXABLE PURCHASES

TAX DUE

are:

The tax is:

(a) Not over $40,000 . . . . . . . . . . . . . . . . . 4% of taxable purchases . . . . . . . . . . . . . . .

(b) Over $40,000 but not over $60,000 . . . $1,600 plus 3% of excess over $40,000 . . .

(c) Over $60,000 . . . . . . . . . . . . . . . . . . . . $2,200 plus 2% of excess over $60,000 . . .

TAX DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C. If taxable purchases of electricity, natural gas or domestic water from _______________

TAXABLE PURCHASES

TAX DUE

are:

The tax is:

(a) Not over $40,000 . . . . . . . . . . . . . . . . . 4% of taxable purchases . . . . . . . . . . . . . . .

(b) Over $40,000 but not over $60,000 . . . $1,600 plus 3% of excess over $40,000 . . .

(c) Over $60,000 . . . . . . . . . . . . . . . . . . . . $2,200 plus 2% of excess over $60,000 . . .

TAX DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. If taxable purchases of telegraph and telephone services from _____________________

TAXABLE PURCHASES

TAX DUE

are:

The tax is:

(a) Not over $60,000 . . . . . . . . . . . . . . . . . 6.7% of taxable purchases. . . . . . . . . . . . . .

(b) Over $60,000 . . . . . . . . . . . . . . . . . . . . $4,020 plus 3.7% of excess over $60,000 . .

TAX DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. TOTAL TAX DUE – Total of Items 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. LESS PAYMENT OF ESTIMATE MADE ON PREVIOUS MONTH’S REPORT (applies only to taxpayers required to make estimated payments) . . . . . . . . .

7. BALANCE DUE (Line 5 minus Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. TOTAL TAX DUE (Total of Lines 1 and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. ADD PENALTY AND INTEREST IF NOT PAID BY DUE DATE (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. TOTAL AMOUNT REMITTED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR OFFICIAL USE ONLY

SIGNATURE

DATE

Balance of Tax

Interest

TITLE

Penalty

Total

MAIL RETURN AND REMITTANCE TO THE ADDRESS AT TOP OF FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1