Estimated Tax Worksheet, Form P-1040es - Estimated Tax Declaration-Voucher For The Year 2015

ADVERTISEMENT

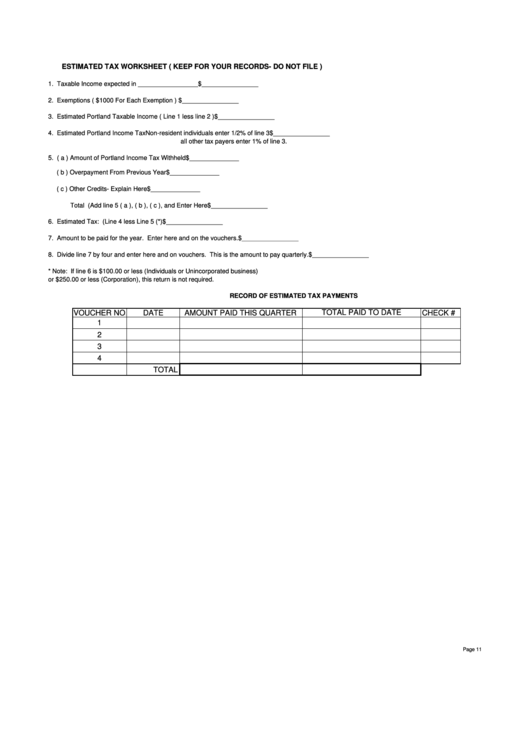

ESTIMATED TAX WORKSHEET ( KEEP FOR YOUR RECORDS- DO NOT FILE )

1. Taxable Income expected in _________________

$________________

2. Exemptions ( $1000 For Each Exemption )

$________________

3. Estimated Portland Taxable Income ( Line 1 less line 2 )

$________________

4. Estimated Portland Income Tax

Non-resident individuals enter 1/2% of line 3

$________________

all other tax payers enter 1% of line 3.

5. ( a ) Amount of Portland Income Tax Withheld

$______________

( b ) Overpayment From Previous Year

$______________

( c ) Other Credits- Explain Here

$______________

Total (Add line 5 ( a ), ( b ), ( c ), and Enter Here

$________________

6. Estimated Tax: (Line 4 less Line 5 (*)

$________________

7. Amount to be paid for the year. Enter here and on the vouchers.

$________________

8. Divide line 7 by four and enter here and on vouchers. This is the amount to pay quarterly.

$________________

* Note: If line 6 is $100.00 or less (Individuals or Unincorporated business)

or $250.00 or less (Corporation), this return is not required.

RECORD OF ESTIMATED TAX PAYMENTS

TOTAL PAID TO DATE

VOUCHER NO.

DATE

AMOUNT PAID THIS QUARTER

CHECK #

1

2

3

4

TOTAL

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2