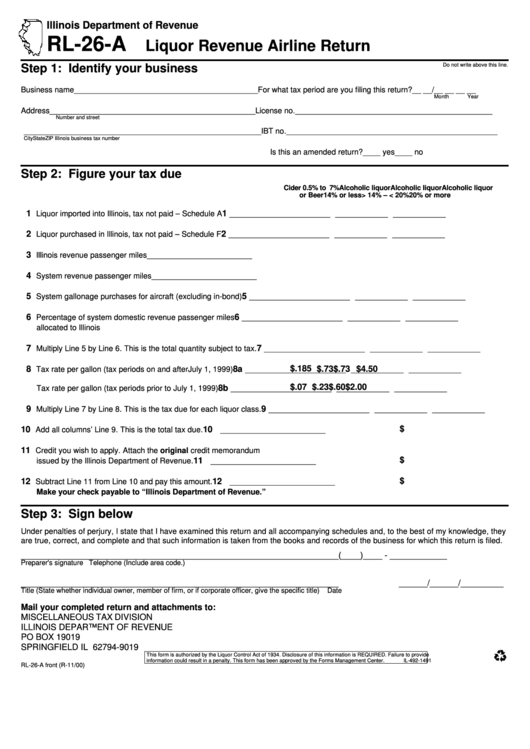

Form Rl-26-A - Liquor Revenue Airline Return - 2000

ADVERTISEMENT

Illinois Department of Revenue

RL-26-A

Liquor Revenue Airline Return

Do not write above this line.

Step 1: Identify your business

Business name __________________________________________

For what tax period are you filing this return? __ __/__ __ __ __

Month

Year

Address _______________________________________________

License no. _____________________________________________

Number and street

______________________________________________________

IBT no. ________________________________________________

City

State

ZIP

Illinois business tax number

Is this an amended return?

____ yes

____ no

Step 2: Figure your tax due

Cider 0.5% to 7% Alcoholic liquor Alcoholic liquor Alcoholic liquor

or Beer

14% or less

> 14% – < 20%

20% or more

1

1

Liquor imported into Illinois, tax not paid – Schedule A

___________ ____________ ____________ ____________

2

2

Liquor purchased in Illinois, tax not paid – Schedule F

___________ ____________ ____________ ____________

3

Illinois revenue passenger miles

________________________

4

System revenue passenger miles ________________________

5

5

System gallonage purchases for aircraft (excluding in-bond)

___________ ____________ ____________ ____________

6

6

Percentage of system domestic revenue passenger miles

___________ ____________ ____________ ____________

allocated to Illinois

7

7

Multiply Line 5 by Line 6. This is the total quantity subject to tax.

___________ ____________ ____________ ____________

$

.185 $

.73 $

.73 $

4.50

8

8a

Tax rate per gallon (tax periods on and after July 1, 1999)

___________ ____________ ____________ ____________

$

.07 $

.23 $

.60 $

2.00

8b

Tax rate per gallon (tax periods prior to July 1, 1999)

___________ ____________ ____________ ____________

9

9

Multiply Line 7 by Line 8. This is the tax due for each liquor class.

___________ ____________ ____________ ____________

$

10

10

Add all columns’ Line 9. This is the total tax due.

________________________

11

Credit you wish to apply. Attach the original credit memorandum

$

11

issued by the Illinois Department of Revenue.

________________________

$

12

12

Subtract Line 11 from Line 10 and pay this amount.

________________________

Make your check payable to “Illinois Department of Revenue.”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and all accompanying schedules and, to the best of my knowledge, they

are true, correct, and complete and that such information is taken from the books and records of the business for which this return is filed.

___________________________________________________________________

(____)____ - ____________

Preparer's signature

Telephone (Include area code.)

___________________________________________________________________

______/______/_________

Title (State whether individual owner, member of firm, or if corporate officer, give the specific title)

Date

Mail your completed return and attachments to:

MISCELLANEOUS TAX DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

This form is authorized by the Liquor Control Act of 1934. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1491

RL-26-A front (R-11/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1