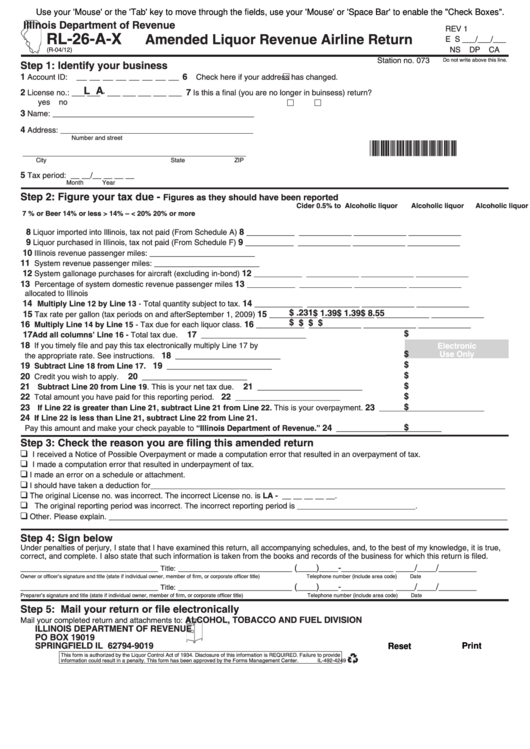

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

REV 1

RL-26-A-X

Amended Liquor Revenue Airline Return

E S ___/___/___

NS DP CA

(R-04/12)

Station no. 073

Do not write above this line.

Step 1: Identify your business

1

6

Account ID:__ __ __ __ __ __ __ __

Check here if your address has changed.

L A

2

7

License no.: ___ ___ - ___ ___ ___ ___ ___

Is this a final (you are no longer in buinsess) return?

yes no

3

Name: ______________________________________________

4

Address: ____________________________________________

Number and street

*034911110*

___________________________________________________

City State ZIP

5

Tax period: __ __/__ __ __ __

Month Year

Step 2: Figure your tax due -

Figures as they should have been reported

Cider 0.5% to

Alcoholic liquor

Alcoholic liquor

Alcoholic liquor

7 % or Beer

14% or less

> 14% – < 20%

20% or more

8

8

Liquor imported into Illinois, tax not paid (From Schedule A)

___________ ____________ ____________ ____________

9

9

Liquor purchased in Illinois, tax not paid (From Schedule F)

___________ ____________ ____________ ____________

1 0

Illinois revenue passenger miles: ________________________

11

System revenue passenger miles: ________________________

1 2

12

System gallonage purchases for aircraft (excluding in-bond)

___________ ____________ ____________ ____________

13

13

Percentage of system domestic revenue passenger miles

___________ ____________ ____________ ____________

allocated to Illinois

1 4

14

Multiply Line 12 by Line 13 - Total quantity subject to tax.

___________ ____________ ____________ ____________

$

.231 $

1.39 $

1.39 $

8.55

15

15

Tax rate per gallon (tax periods on and after September 1, 2009)

___________ ____________ ____________ ____________

$

$

$

$

16

16

Multiply Line 14 by Line 15 - Tax due for each liquor class.

___________ ____________ ____________ ____________

$

17

17

Add all columns’ Line 16 - Total tax due.

________________________

18

If you timely file and pay this tax electronically multiply Line 17 by

Electronic

$

Use Only

18

the appropriate rate. See instructions.

________________________

$

19

19

Subtract Line 18 from Line 17.

________________________

$

20

20

Credit you wish to apply.

________________________

$

21

21

Subtract Line 20 from Line 19. This is your net tax due.

________________________

$

22

22

Total amount you have paid for this reporting period.

________________________

23

23

$

If Line 22 is greater than Line 21, subtract Line 21 from Line 22. This is your overpayment.

________________________

24

If Line 22 is less than Line 21, subtract Line 22 from Line 21.

$

24

Pay this amount and make your check payable to “Illinois Department of Revenue.”

________________________

Step 3: Check the reason you are filing this amended return

❑

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

❑

I made a computation error that resulted in underpayment of tax.

❑

I made an error on a schedule or attachment.

❑

I should have taken a deduction for_________________________________________________________________________________

❑

The original License no. was incorrect. The incorrect License no. is LA - __ __ __ __ __.

❑

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

❑

Other. Please explain. ___________________________________________________________________________________________

_____________________________________________________________________________________________________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return, all accompanying schedules, and, to the best of my knowledge, it is true,

correct, and complete. I also state that such information is taken from the books and records of the business for which this return is filed.

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Owner or officer’s signature and title (state if individual owner, member of firm, or corporate officer title) Telephone number (include area code) Date

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Preparer’s signature and title (state if individual owner, member of firm, or corporate officer title) Telephone number (include area code) Date

Step 5: Mail your return or file electronically

ALCOHOL, TOBACCO AND FUEL DIVISION

Mail your completed return and attachments to:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

Reset

Print

This form is authorized by the Liquor Control Act of 1934. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4249

1

1