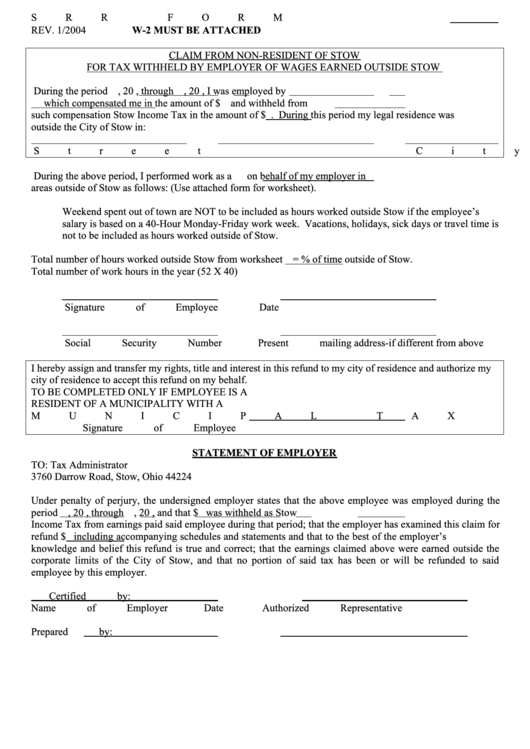

Srr Form - Claim From Non-Resident Of Stow For Tax Withheld By Employer Of Wages Earned Outside Stow - State Of Ohio

ADVERTISEMENT

20

SRR FORM

REV. 1/2004

W-2 MUST BE ATTACHED

CLAIM FROM NON-RESIDENT OF STOW

FOR TAX WITHHELD BY EMPLOYER OF WAGES EARNED OUTSIDE STOW

During the period

, 20

, through

, 20

, I was employed by

which compensated me in the amount of $

and withheld from

such compensation Stow Income Tax in the amount of $

. During this period my legal residence was

outside the City of Stow in:

Street

City, Village, Township

State

During the above period, I performed work as a

on behalf of my employer in

areas outside of Stow as follows: (Use attached form for worksheet).

Weekend spent out of town are NOT to be included as hours worked outside Stow if the employee’s

salary is based on a 40-Hour Monday-Friday work week. Vacations, holidays, sick days or travel time is

not to be included as hours worked outside of Stow.

Total number of hours worked outside Stow from worksheet

= % of time outside of Stow.

Total number of work hours in the year (52 X 40)

Signature of Employee

Date

Social Security Number

Present mailing address-if different from above

I hereby assign and transfer my rights, title and interest in this refund to my city of residence and authorize my

city of residence to accept this refund on my behalf.

TO BE COMPLETED ONLY IF EMPLOYEE IS A

RESIDENT OF A MUNICIPALITY WITH A

MUNICIPAL TAX

Signature of Employee

STATEMENT OF EMPLOYER

TO: Tax Administrator

3760 Darrow Road, Stow, Ohio 44224

Under penalty of perjury, the undersigned employer states that the above employee was employed during the

period

, 20

, through

, 20

, and that $

was withheld as Stow

Income Tax from earnings paid said employee during that period; that the employer has examined this claim for

refund $

including accompanying schedules and statements and that to the best of the employer’s

knowledge and belief this refund is true and correct; that the earnings claimed above were earned outside the

corporate limits of the City of Stow, and that no portion of said tax has been or will be refunded to said

employee by this employer.

Certified by:

Name of Employer

Date

Authorized Representative

Prepared by:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2