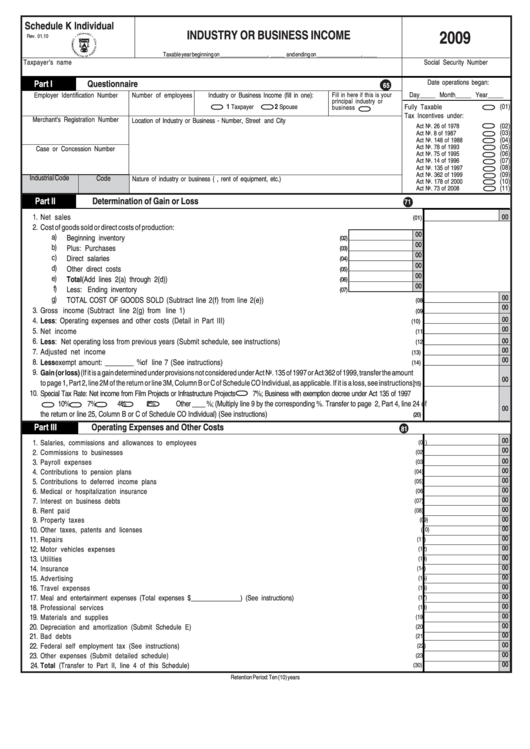

Schedule K Individual - Industry Or Business Income - 2009

ADVERTISEMENT

Schedule K Individual

2009

INDUSTRY OR BUSINESS INCOME

Rev. 01.10

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Questionnaire

Date operations began:

65

Employer Identification Number

Number of employees

Industry or Business Income (fill in one):

Fill in here if this is your

Day_____ Month_____ Year_____

principal industry or

1

Taxpayer

2

Spouse

Fully Taxable

(01)

business

Tax Incentives under:

Merchant's Registration Number

Location of Industry or Business - Number, Street and City

(02)

Act No. 26 of 1978

(03)

Act No. 8 of 1987

(04)

Act No. 148 of 1988

(05)

Act No. 78 of 1993

Case or Concession Number

(06)

Act No. 75 of 1995

(07)

Act No. 14 of 1996

(08)

Act No. 135 of 1997

(09)

Act No. 362 of 1999

Industrial Code

Code

Nature of industry or business (i.e. hotel, rent of equipment, etc.)

(10)

Act No. 178 of 2000

(11)

Act No. 73 of 2008

Part II

Determination of Gain or Loss

71

1.

Net sales .........................................................................................................................................................................

00

(01)

2.

Cost of goods sold or direct costs of production:

00

a)

Beginning inventory ...................................................................................................................

(02)

00

b)

Plus: Purchases .......................................................................................................................

(03)

00

c)

Direct salaries ...........................................................................................................................

(04)

00

d)

Other direct costs ......................................................................................................................

(05)

00

e)

Total (Add lines 2(a) through 2(d)) ..............................................................................................

(06)

00

f)

Less: Ending inventory .............................................................................................................

(07)

00

g)

TOTAL COST OF GOODS SOLD (Subtract line 2(f) from line 2(e)) ............................................................................

(08)

00

3.

Gross income (Subtract line 2(g) from line 1) .....................................................................................................................

(09)

00

4.

Less: Operating expenses and other costs (Detail in Part III) ..................................................................................................

(10)

00

5.

Net income .....................................................................................................................................................................

(11)

6.

00

Less: Net operating loss from previous years (Submit schedule, see instructions) .....................................................................

(12)

00

7.

Adjusted net income .........................................................................................................................................................

(13)

00

8.

%

Less exempt amount: ________

of line 7 (See instructions) ................................................................................................

(14)

9.

Gain (or loss) (If it is a gain determined under provisions not considered under Act No. 135 of 1997 or Act 362 of 1999, transfer the amount

00

to page 1, Part 2, line 2M of the return or line 3M, Column B or C of Schedule CO Individual, as applicable. If it is a loss, see instructions)

(15)

10.

Special Tax Rate: Net income from Film Projects or Infrastructure Projects

7%; Business with exemption decree under Act 135 of 1997

10%

7%

4%

2%

Other ____ %; (Multiply line 9 by the corresponding %. Transfer to page 2, Part 4, line 24 of

00

the return or line 25, Column B or C of Schedule CO Individual) (See instructions) ......................................................................................

(20)

Part III

Operating Expenses and Other Costs

81

00

1.

Salaries, commissions and allowances to employees .................................................................................................................

(01)

00

2.

Commissions to businesses ....................................................................................................................................................

(02)

00

3.

Payroll expenses ..................................................................................................................................................................

(03)

00

4.

Contributions to pension plans .................................................................................................................................................

(04)

00

5.

Contributions to deferred income plans ......................................................................................................................................

(05)

00

6.

Medical or hospitalization insurance .........................................................................................................................................

(06)

00

7.

Interest on business debts ......................................................................................................................................................

(07)

00

8.

Rent paid .............................................................................................................................................................................

(08)

00

9.

Property taxes ......................................................................................................................................................................

(09)

00

10.

Other taxes, patents and licenses ............................................................................................................................................

(10)

00

11.

Repairs ...............................................................................................................................................................................

(11)

00

12.

Motor vehicles expenses .......................................................................................................................................................

(12)

00

13.

Utilities ................................................................................................................................................................................

(13)

00

14.

Insurance .............................................................................................................................................................................

(14)

00

15.

Advertising ...........................................................................................................................................................................

(15)

00

16.

Travel expenses ...................................................................................................................................................................

(16)

00

17.

Meal and entertainment expenses (Total expenses $_______________) (See instructions) ...............................................................

(17)

00

18.

Professional services ............................................................................................................................................................

(18)

00

19.

Materials and supplies ...........................................................................................................................................................

(19)

00

20.

Depreciation and amortization (Submit Schedule E) .....................................................................................................................

(20)

00

21.

Bad debts ............................................................................................................................................................................

(21)

00

22.

Federal self employment tax (See instructions) ..........................................................................................................................

(22)

00

23.

Other expenses (Submit detailed schedule) ...............................................................................................................................

(23)

00

24.

Total (Transfer to Part II, line 4 of this Schedule) ........................................................................................................................

(30)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1