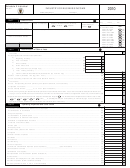

Schedule K Individual - Industry Or Business Income - Government Of Puerto Rico - 2011

ADVERTISEMENT

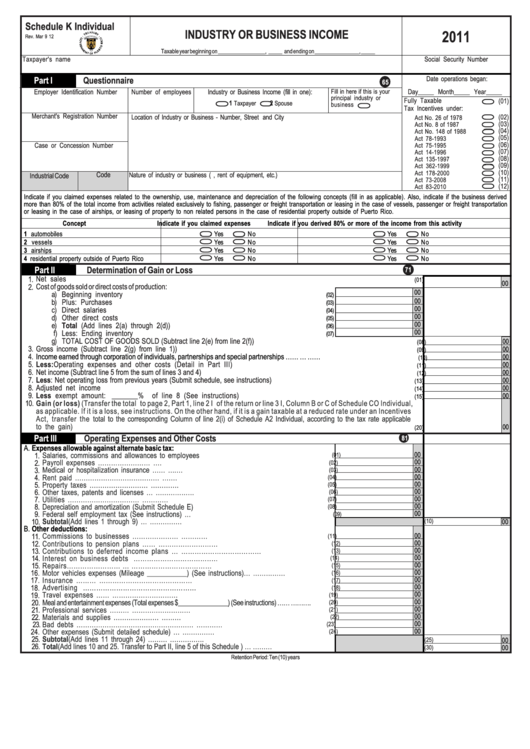

Schedule K Individual

INDUSTRY OR BUSINESS INCOME

2011

Rev. Mar 9 12

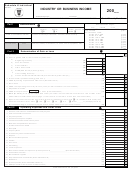

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Questionnaire

Date operations began:

65

Fill in here if this is your

Day_____ Month_____ Year_____

Employer Identification Number

Number of employees

Industry or Business Income (fill in one):

principal industry or

Fully Taxable

(01)

1

2

Taxpayer

Spouse

business

Tax Incentives under:

Merchant's Registration Number

(02)

Location of Industry or Business - Number, Street and City

Act No. 26 of 1978

(03)

Act No. 8 of 1987

(04)

Act No. 148 of 1988

(05)

Act 78-1993

(06)

Case or Concession Number

Act 75-1995

(07)

Act 14-1996

(08)

Act 135-1997

(09)

Act 362-1999

(10)

Act 178-2000

Code

Nature of industry or business (i.e. hotel, rent of equipment, etc.)

Industrial Code

(11)

Act 73-2008

(12)

Act 83-2010

Indicate if you claimed expenses related to the ownership, use, maintenance and depreciation of the following concepts (fill in as applicable). Also, indicate if the business derived

more than 80% of the total income from activities related exclusively to fishing, passenger or freight transportation or leasing in the case of vessels, passenger or freight transportation

or leasing in the case of airships, or leasing of property to non related persons in the case of residential property outside of Puerto Rico.

Concept

Indicate if you claimed expenses

Indicate if you derived 80% or more of the income from this activity

1 automobiles

Yes

No

Yes

No

Yes

No

Yes

No

2 vessels

3 airships

Yes

No

Yes

No

4 residential property outside of Puerto Rico

Yes

No

Yes

No

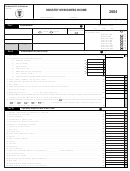

Part II

Determination of Gain or Loss

71

1.

Net sales ...........................................................................................................................................................................

(01)

00

2.

Cost of goods sold or direct costs of production:

00

a)

Beginning inventory ......................................................................................................

(02)

00

b)

Plus: Purchases ..........................................................................................................

(03)

c)

00

Direct salaries ..............................................................................................................

(04)

d)

00

Other direct costs .........................................................................................................

(05)

00

e)

Total (Add lines 2(a) through 2(d))...................................................................................

(06)

00

f)

Less: Ending inventory .................................................................................................

(07)

g)

TOTAL COST OF GOODS SOLD (Subtract line 2(e) from line 2(f)) ....................................................................................

00

(08)

3.

Gross income (Subtract line 2(g) from line 1)) .............................................................................................................................

00

(09)

4.

Income earned through corporation of individuals, partnerships and special partnerships ……..............................................…....……

00

(10)

5.

Less: Operating expenses and other costs (Detail in Part III) .....................................................................................

00

(11)

6.

Net income (Subtract line 5 from the sum of lines 3 and 4) .................................................................................................................

00

(12)

7.

Less: Net operating loss from previous years (Submit schedule, see instructions) ..........................................................................

00

(13)

8.

Adjusted net income .............................................................................................................................................................

00

(14)

9.

Less exempt amount: _______%

of line 8 (See instructions) ..................................................................................

00

(15)

10.

Gain (or loss) (Transfer the total to page 2, Part 1, line 2 I of the return or line 3 I, Column B or C of Schedule CO Individual,

as applicable. If it is a loss, see instructions. On the other hand, if it is a gain taxable at a reduced rate under an Incentives

Act, transfer the total to the corresponding Column of line 2(i) of Schedule A2 Individual, according to the tax rate applicable

to the gain)

..................................................................................................................................................................................

00

(20)

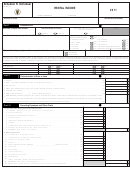

Part III

Operating Expenses and Other Costs

81

A. Expenses allowable against alternate basic tax:

00

1.

Salaries, commissions and allowances to employees .................................................................

(01)

2.

Payroll expenses ……………………..................................................................................….

00

(02)

3.

Medical or hospitalization insurance ……............................................................................….…

00

(03)

4.

Rent paid …………………………………............................................................................…….

00

(04)

5.

Property taxes ………………………...........................................................................………….

00

(05)

6.

Other taxes, patents and licenses …......................................................................………………

00

(06)

7.

Utilities ……………………………................................................................................…………

00

(07)

8.

Depreciation and amortization (Submit Schedule E) .....................................................................

00

(08)

9.

Federal self employment tax (See instructions) ….......................................................................

00

(09)

10.

Subtotal (Add lines 1 through 9) …............................................................................……………

(10)

00

B. Other deductions:

11.

Commissions to businesses …………………..........................................................…………

00

(11)

Contributions to pension plans ……....................................................………………………

00

12.

(12)

Contributions to deferred income plans …..............................………………………………

00

13.

(13)

Interest on business debts ..................................................……………………………..…

00

14.

(14)

Repairs…………………….........................…............................………………………………

00

15.

(15)

Motor vehicles expenses (Mileage ___________) (See instructions)….....................……………

00

16.

(16)

Insurance ………...............................................................……………………………………

00

17.

(17)

Advertising ............................................................……………………………………………

00

18.

(18)

00

19.

Travel expenses …….........................................................................…………………………

(19)

00

20.

Meal and entertainment expenses (Total expenses $_______________) (See instructions) ……........……….

(20)

00

21.

Professional services ……….....................................................................………………………

(21)

00

22.

Materials and supplies …………………...........................................................................………

(22)

00

23.

Bad debts ………………………………………………....................................................…………

(23)

24.

Other expenses (Submit detailed schedule) …............................................................……………

00

(24)

25.

Subtotal (Add lines 11 through 24) ………................................................................…………….

(25)

00

26.

Total (Add lines 10 and 25. Transfer to Part II, line 5 of this Schedule ) …............................………

(30)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1