Reciprocity Contractors 2014 Filing Of Gross Receipts Form - City Of Alexandria

ADVERTISEMENT

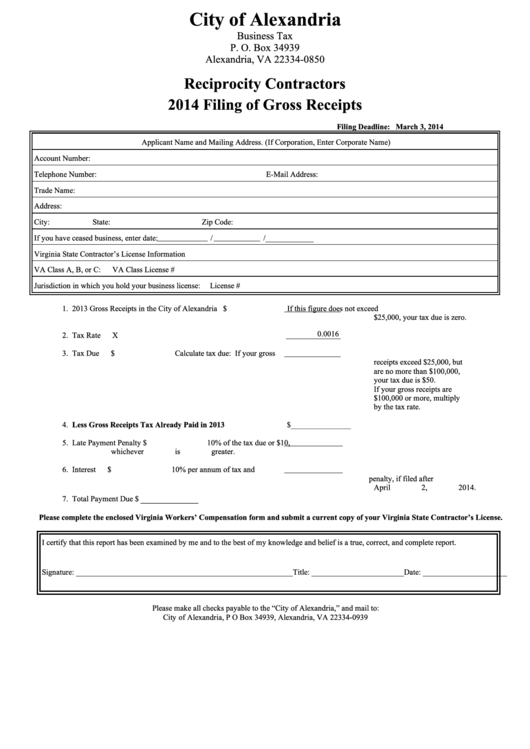

City of Alexandria

Business Tax

P. O. Box 34939

Alexandria, VA 22334-0850

Reciprocity Contractors

2014 Filing of Gross Receipts

Filing Deadline: March 3, 2014

Applicant Name and Mailing Address. (If Corporation, Enter Corporate Name)

Account Number:

Telephone Number:

E-Mail Address:

Trade Name:

Address:

City:

State:

Zip Code:

If you have ceased business, enter date:

/

/____________

Virginia State Contractor’s License Information

VA Class A, B, or C:

VA Class License #

Jurisdiction in which you hold your business license:

License #

1. 2013 Gross Receipts in the City of Alexandria

$

If this figure does not exceed

$25,000, your tax due is zero.

0.0016

2. Tax Rate

X

3. Tax Due

$

Calculate tax due: If your gross

receipts exceed $25,000, but

are no more than $100,000,

your tax due is $50.

If your gross receipts are

$100,000 or more, multiply

by the tax rate.

4. Less Gross Receipts Tax Already Paid in 2013

$_______________

5. Late Payment Penalty

$

10% of the tax due or $10,

whichever is greater.

6. Interest

$

10% per annum of tax and

penalty, if filed after

April 2, 2014.

___________

7. Total Payment Due

$

Please complete the enclosed Virginia Workers’ Compensation form and submit a current copy of your Virginia State Contractor’s License.

I certify that this report has been examined by me and to the best of my knowledge and belief is a true, correct, and complete report.

Signature: ______________________________________________________Title: _______________________Date: _____________________

Please make all checks payable to the “City of Alexandria,” and mail to:

City of Alexandria, P O Box 34939, Alexandria, VA 22334-0939

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2