Annual Statement Of Gross Receipts Form - 2002

ADVERTISEMENT

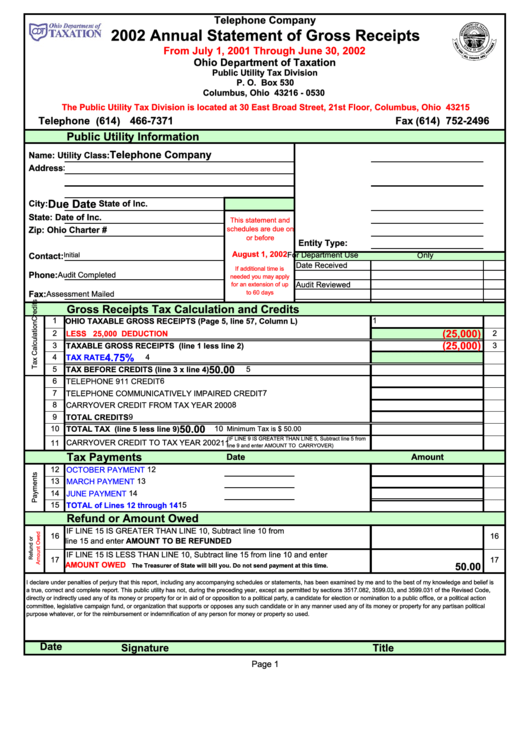

Telephone Company

2002 Annual Statement of Gross Receipts

From July 1, 2001 Through June 30, 2002

Ohio Department of Taxation

Public Utility Tax Division

P. O. Box 530

Columbus, Ohio 43216 - 0530

The Public Utility Tax Division is located at 30 East Broad Street, 21st Floor, Columbus, Ohio 43215

Telephone (614) 466-7371

Fax (614) 752-2496

Public Utility Information

Telephone Company

Name:

Utility Class:

Address:

FEIN:

Due Date

City:

State of Inc.

State:

Date of Inc.

This statement and

Zip:

schedules are due on

Ohio Charter #

or before

Entity Type:

August 1, 2002

For Department Use Only

Contact:

Initial

Date Received

If additional time is

Phone:

Audit Completed

needed you may apply

Audit Reviewed

for an extension of up

to 60 days

Fax:

Assessment Mailed

Gross Receipts Tax Calculation and Credits

1

OHIO TAXABLE GROSS RECEIPTS (Page 5, line 57, Column L)

1

(25,000)

2

2

LESS 25,000 DEDUCTION

(25,000)

3

3

TAXABLE GROSS RECEIPTS (line 1 less line 2)

4.75%

4

4

TAX RATE

50.00

5

5

TAX BEFORE CREDITS (line 3 x line 4)

6

6

TELEPHONE 911 CREDIT

7

7

TELEPHONE COMMUNICATIVELY IMPAIRED CREDIT

8

CARRYOVER CREDIT FROM TAX YEAR 2000

8

9

9

TOTAL CREDITS

50.00

10 TOTAL TAX (line 5 less line 9)

10

Minimum Tax is $ 50.00

(IF LINE 9 IS GREATER THAN LINE 5, Subtract line 5 from

11 CARRYOVER CREDIT TO TAX YEAR 2002

11

line 9 and enter AMOUNT TO CARRYOVER)

Tax Payments

Date

Amount

12

12

OCTOBER PAYMENT

13

MARCH PAYMENT

13

14

14

JUNE PAYMENT

15

15

TOTAL of Lines 12 through 14

Refund or Amount Owed

IF LINE 15 IS GREATER THAN LINE 10, Subtract line 10 from

16

16

line 15 and enter AMOUNT TO BE REFUNDED

IF LINE 15 IS LESS THAN LINE 10, Subtract line 15 from line 10 and enter

17

17

AMOUNT OWED

50.00

The Treasurer of State will bill you. Do not send payment at this time.

I declare under penalties of perjury that this report, including any accompanying schedules or statements, has been examined by me and to the best of my knowledge and belief is

a true, correct and complete report. This public utility has not, during the preceding year, except as permitted by sections 3517.082, 3599.03, and 3599.031 of the Revised Code,

directly or indirectly used any of its money or property for or in aid of or opposition to a political party, a candidate for election or nomination to a public office, or a political action

committee, legislative campaign fund, or organization that supports or opposes any such candidate or in any manner used any of its money or property for any partisan political

purpose whatever, or for the reimbursement or indemnification of any person for money or property so used.

Date

Signature

Title

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5