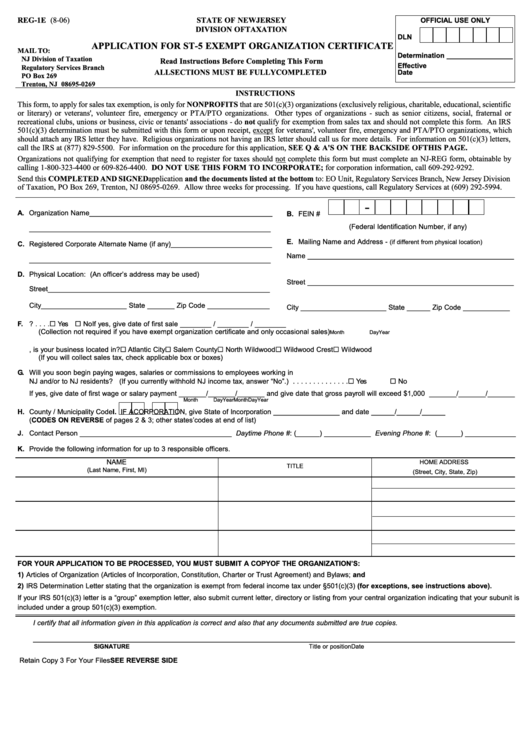

REG-1E (8-06)

STATE OF NEW JERSEY

OFFICIAL USE ONLY

DIVISION OF TAXATION

DLN

APPLICATION FOR ST-5 EXEMPT ORGANIZATION CERTIFICATE

MAIL TO:

Determination _________________

NJ Division of Taxation

Read Instructions Before Completing This Form

Effective

Regulatory Services Branch

ALL SECTIONS MUST BE FULLY COMPLETED

Date ......... ___________________

PO Box 269

Trenton, NJ 08695-0269

INSTRUCTIONS

This form, to apply for sales tax exemption, is only for NONPROFITS that are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific

or literary) or veterans', volunteer fire, emergency or PTA/PTO organizations. Other types of organizations - such as senior citizens, social, fraternal or

recreational clubs, unions or business, civic or tenants' associations - do not qualify for exemption from sales tax and should not complete this form. An IRS

501(c)(3) determination must be submitted with this form or upon receipt, except for veterans', volunteer fire, emergency and PTA/PTO organizations, which

should attach any IRS letter they have. Religious organizations not having an IRS letter should call us for more details. For information on 501(c)(3) letters,

call the IRS at (877) 829-5500. For information on the procedure for this application, SEE Q & A'S ON THE BACKSIDE OF THIS PAGE.

Organizations not qualifying for exemption that need to register for taxes should not complete this form but must complete an NJ-REG form, obtainable by

calling 1-800-323-4400 or 609-826-4400. DO NOT USE THIS FORM TO INCORPORATE; for corporation information, call 609-292-9292.

Send this COMPLETED AND SIGNED application and the documents listed at the bottom to: EO Unit, Regulatory Services Branch, New Jersey Division

of Taxation, PO Box 269, Trenton, NJ 08695-0269. Allow three weeks for processing. If you have questions, call Regulatory Services at (609) 292-5994.

-

A. Organization Name_______________________________________________

B. FEIN #

(Federal Identification Number, if any)

______________________________________________________________

E. Mailing Name and Address -

(if different from physical location)

C. Registered Corporate Alternate Name (if any)__________________________

Name _____________________________________________________

______________________________________________________________

D. Physical Location: (An officer’s address may be used)

Street _____________________________________________________

Street_________________________________________________________

City______________________ State _______ Zip Code ________________

City ______________________ State ______ Zip Code ____________

F. 1. Will you collect New Jersey Sales Tax? . . . .

Yes

No

If yes, give date of first sale ________ / ________ / ________

(Collection not required if you have exempt organization certificate and only occasional sales)

Month

Day

Year

2. If yes, is your business located in?

Atlantic City

Salem County

North Wildwood

Wildwood Crest

Wildwood

(If you will collect sales tax, check applicable box or boxes)

G. Will you soon begin paying wages, salaries or commissions to employees working in

NJ and/or to NJ residents? (If you currently withhold NJ income tax, answer “No”.) . . . . . . . . . . . . . .

Yes

No

If yes, give date of first wage or salary payment _______/_______/_______ and give date that gross payroll will exceed $1,000 _______/_______/_______

Month

Day

Year

Month

Day

Year

H. County / Municipality Code

I. IF A CORPORATION, give State of Incorporation _________________ and date ______/______/______

(CODES ON REVERSE of pages 2 & 3; other states’ codes at end of list)

J. Contact Person _______________________________________ Daytime Phone #: (______) ____________ Evening Phone #: (______) _____________

K. Provide the following information for up to 3 responsible officers.

NAME

HOME ADDRESS

TITLE

(Last Name, First, MI)

(Street, City, State, Zip)

FOR YOUR APPLICATION TO BE PROCESSED, YOU MUST SUBMIT A COPY OF THE ORGANIZATION’S:

1) Articles of Organization (Articles of Incorporation, Constitution, Charter or Trust Agreement) and Bylaws; and

2) IRS Determination Letter stating that the organization is exempt from federal income tax under §501(c)(3) (for exceptions, see instructions above).

If your IRS 501(c)(3) letter is a “group” exemption letter, also submit current letter, directory or listing from your central organization indicating that your subunit is

included under a group 501(c)(3) exemption.

I certify that all information given in this application is correct and also that any documents submitted are true copies.

______________________________________________________________________________________________________________

SIGNATURE

Title or position

Date

Retain Copy 3 For Your Files

SEE REVERSE SIDE

1

1