Form Reg-8 - Application For Farmer Tax Exemption Permit

ADVERTISEMENT

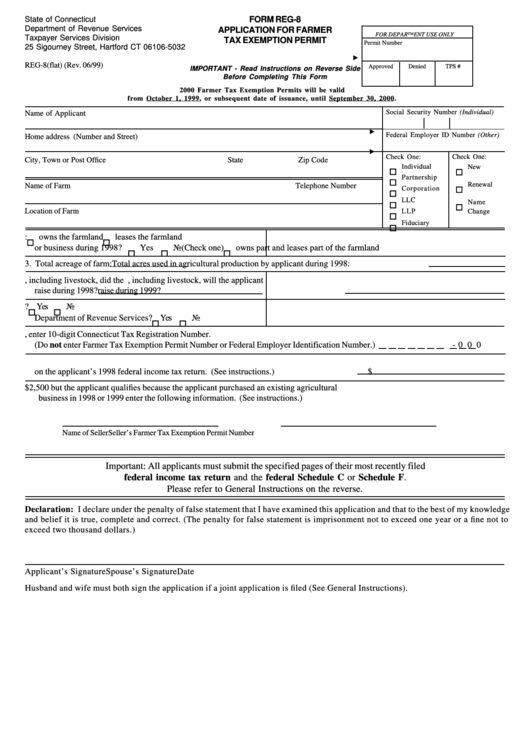

State of Connecticut

FORM REG-8

Department of Revenue Services

APPLICATION FOR FARMER

FOR DEPARTMENT USE ONLY

Taxpayer Services Division

TAX EXEMPTION PERMIT

Permit Number

25 Sigourney Street, Hartford CT 06106-5032

REG-8(flat) (Rev. 06/99)

Approved

Denied

TPS #

IMPORTANT - Read Instructions on Reverse Side

Before Completing This Form

2000 Farmer Tax Exemption Permits will be valid

from October 1, 1999, or subsequent date of issuance, until September 30, 2000.

Social Security Number (Individual)

Name of Applicant

Federal Employer ID Number (Other)

Home address (Number and Street)

Check One:

Check One:

City, Town or Post Office

State

Zip Code

Individual

New

Partnership

Renewal

Name of Farm

Telephone Number

Corporation

LLC

Name

Location of Farm

LLP

Change

Fiduciary

1. Was the applicant engaged in agricultural production as a trade

2. Applicant:

owns the farmland

leases the farmland

or business during 1998?

Yes

No

(Check one)

owns part and leases part of the farmland

3. Total acreage of farm:

Total acres used in agricultural production by applicant during 1998:

4. What farm products, including livestock, did the applicant

5. What farm products, including livestock, will the applicant

raise during 1998?

raise during 1999?

6. Has the applicant been issued a Sales and Use Tax permit by the

7. Does the applicant have employees?

Yes

No

Department of Revenue Services?

Yes

No

8. If yes to 6 or 7, enter 10-digit Connecticut Tax Registration Number.

(Do not enter Farmer Tax Exemption Permit Number or Federal Employer Identification Number.)

- 0 0 0

9. State the amount of gross income derived solely from agricultural production as reported

on the applicant’s 1998 federal income tax return. (See instructions.)

$

10. If the amount entered on Line 9 is less than $2,500 but the applicant qualifies because the applicant purchased an existing agricultural

business in 1998 or 1999 enter the following information. (See instructions.)

Name of Seller

Seller’s Farmer Tax Exemption Permit Number

Important: All applicants must submit the specified pages of their most recently filed

federal income tax return and the federal Schedule C or Schedule F.

Please refer to General Instructions on the reverse.

Declaration: I declare under the penalty of false statement that I have examined this application and that to the best of my knowledge

and belief it is true, complete and correct. (The penalty for false statement is imprisonment not to exceed one year or a fine not to

exceed two thousand dollars.)

Applicant’s Signature

Spouse’s Signature

Date

Husband and wife must both sign the application if a joint application is filed (See General Instructions).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2